When I first started trading I wanted to be in everything. I wanted to make money on every stock that was moving. Even if it was $100 at a time. I thought the only way to make real money was to basically trade everything and hope that It added up into a big day. Something that really opened my eyes was when people like Eric//Phil would only focus on ONE stock during the day. They would be laser focused and bring the farm when their specific setup was there. Basically they key is YOU DO NOT HAVE TO BE IN EVERY STOCK THATS MOVING EVERY DAY. Focus on the stock that fits your niche criteria and put all your attention and size in that rather than be in 3 stocks at the same time because then your attention is split 3 ways on 3 different plays. Its hard to focus. For me, I am RARELY ever in 2 stocks at the same time. I like staring at the tape to get a read of the way the stock is trading. If I’m looking at multiple stocks at the same time its nearly impossible to fully understand the way the stock is trading. Before I enter a trade I always do some quick due diligence//fundamental analysis on a stock to see if they have//need money, if they raised money recently through an offering, cash on hand. If they company is “shit” the next step is looking at the float size which is important. Anything under < 5M float is considered “low float” for me and should be traded with caution. Next step is to chart out key resistance points on the daily chart and MAKE A PLAN for attack. Fundamentals and Technicals are key. You MUST have an understanding of BOTH when it comes to trading.

I don’t listen to music trading when the market first opens. From 8:00am-11:30am its straight business and silence for me. I DO NOT want anything to distract me from trading the open. No CNBC, no music no nothing just straight FOCUS to make sure I get the best entries and execute my plan. When the lull comes around, and I’m peeling off profitable trades // not entering new ones I start to play music. Nothing better than nailing a trade and playing some good music to continue hyping you up after a nice win.

I don’t like shorting pre market. Plain and simple. If I short pre market it means I’m getting FOMO and thats already the first sign that something is bound to go wrong. Yes, there are plenty times where small caps are trading millions of shares pre market and it is easy to get in and get out. BUT I’ve learned through trial and error that its just better to WAIT for the open, wait for MORE VOLUME to get a much better feel for the trend of the stock. There have been plenty times where a stock is up a bunch pre market, but when 9:30am hits it just tanks on air due to an ATM being hit or something along those lines. My advice is AVOID FOMO AVOID PRE MARKET TRADING. People trade less size during pre market anyway due to it being more thin. Why not just wait till the market is open and use REAL size rather than piking around for a couple hundred dollars pre market.

As many of you know I talk about it in my webinars too but from time to time but I have trouble staying asleep. Getting enough sleep is always important no matter what business you are in. I like sleeping early because just incase I keep waking up I have plenty of time to try going back to bed. Trading is a business. If you sleep at 2am every night and wake up at 9am every morning, yes you are getting 7 hours of sleep BUT you are already at a disadvantage because people have been awake and forming a plan since 7am pre market. I am always logged in and starting to watch at 7am EVERY.SINGLE.MORNING. I love what I do, its my passion and I can’t get enough of it. Its very important for me to be the best version of myself when it comes to trading and if that means I have to sleep at 10pm every night to make sure I get enough sleep // get to the desk early you better believe thats what I’m going to keep doing daily.

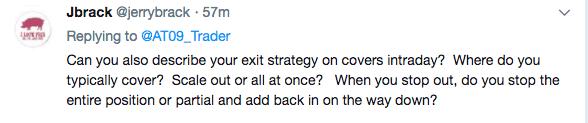

For example: Say I have a $5.25 average short on a stock and the HOD is $5.50 and my plan is to stop on a NHOD breakout I won’t stop out at exactly $5.50 because EVERYONE is doing that. I would rather wait and see if that move is going to stuff everyone or if its a legit breakout I don’t mind paying 10 cents higher ($5.60s) for an exit. To me its worth it to pay up a little more and see whats going to happen rather than panic cover (like every else) into the obvious HOD break. When i do stop out it is NEVER all at once. Everyone has their own method to their madness but what works for me is I always take off HALF first into those $5.60s if I’m wrong and if it does end up stuffing / failing there I’ll add it back, if not I take the rest off. I’m not waiting on the bids to exit. If Im wrong the damage is already done and I want out FAST. Saving a few cents adding liquidity isn’t gonna change anything in the grand scheme of it all. I rather be out FAST and back to focusing on how I’m going to make a new plan of attack when the stock finally reverses.

**If I didn’t answer your question this time be sure to send it in again for next weeks blog**

Investors Underground [Discounted Memberships]: https://investorsunderground.com/s/XmXLj

We put all the FREE WEBINARS Dante & I have done so far on one page for everyone. Enjoy! investorsunderground.com/s/3EOJG

Recent Blogs + FREE Webinars:

My Investors Underground Interview

Setting Stops & Trade Management

Conviction + Sizing + Why 90% Of Traders Fail