I asked on Twitter what people wanted me to blog about. I decided to choose 3 topics and expand on them as much as I could without boring anyone.

I’m not the best writer so please forgive any grammatical mistakes.

Enjoy!

First of all the most important thing about swing shorts is TIMING. You can’t just short a “piece of shit” stock at any price and say “Its trash I’m just going to swing it until it drops!” … couple problems with that statement.

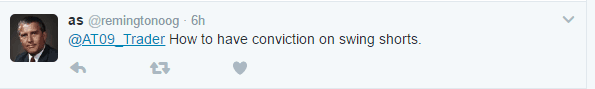

#1 Take a look at SINO chart from a few days ago. Company is total shit. BUT what happens when you start short 5k short @ 3.5 and add 5k @ 4 because “it’ll come back down eventually” .. Now you’re stuck with 10k @ $3.75 avg just a $37,500 position. For whatever reason what happens when the stock becomes crowded and is trading at $4.50-$5 range you’re down $10k. If your account isn’t big enough to sustain or you keep add add adding to losers on margin you’ll find yourself blowing up in a day.

#2 Most people don’t have the ability to hold a stock short for an extended period of time. You can’t just short something and hold forever. If that was the case, I would be on my yacht in the Cayman Islands by now. Most of the time you can only hold for 3 days or so depending on your broker. So what happens when something like ETRM comes along? Squeezes for 4 days before starting to pull back. If you just hold and pray you are BOUND to lose or blow up.

So now back to the question. TIMING IS KEY on swinging stocks short. IF you start a swing before the backside is in YOU BETTER have a plan in mind or at least have some padding to be able to add when the time does come.

I was short SINO the day it squeezed. When the market closed that day I was red on my position. BUT I took a step back. I had not totally exhausted myself. I had a plan in mind and was ready and willing to cut or add depending on what the stock did the next morning. Doing some basic chart research I found that these shippers never sustained a day 2 move after the big initial squeeze was over. Long story short, the day after the squeeze there was a big stuff at the open at $5.50s (keep in mind the daily chart on 11/23/16 shows resistance at $5.45) and continued fade. Momentum was gone. So I was 10000% comfortable holding size short OVERNIGHT because the hype was over. My thought process was… “now longs are under water, and there is no reason for this to keep going. So let me hold for a few days and try to see if it’ll slowly fade while no one was talking about it”. To my surprise we had a $3.18 offering on it today.

IMO you should NEVER be swinging a short on the FRONTSIDE unless you’re prepared for a big rip at the open or ready to take your loss. Once SINO broke $4.50 there was no shot it would be coming back up for air. Knowing that, I had the conviction to hold it short overnight for the possible offering which we got.

Sizing is very very very tough. Something I think many pros even struggle with. If you are just “sizing” into everything just because you want to make more money you are doing it WRONG. Sizing is a privilege IMO. You should ONLY be sizing into setups where you are over 80% confident. For me recently its been setups like DRYS and SINO, but I’ll use a different example for this.

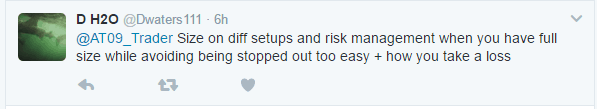

ZAIS

As you can tell from the daily chart the stock has a habit of squeezing and not being able to sustain a day 2 move. Knowing that I took a small 2/5 position on it with the anticipation of adding size into the failed follow through momentum the next day. I did not want to exhaust myself and go full size day one. That’s just stupid, especially when were in a market environment where trash is just flying sky high for no reason. So according to my plan I added size short today in hopes that it silently unwinds and has a possible offering in the coming days.

I still have issues when it comes to stopping out on trash stocks. But slowly I’ve been trying to adjust and adapt. There are a couple ways to go about size.

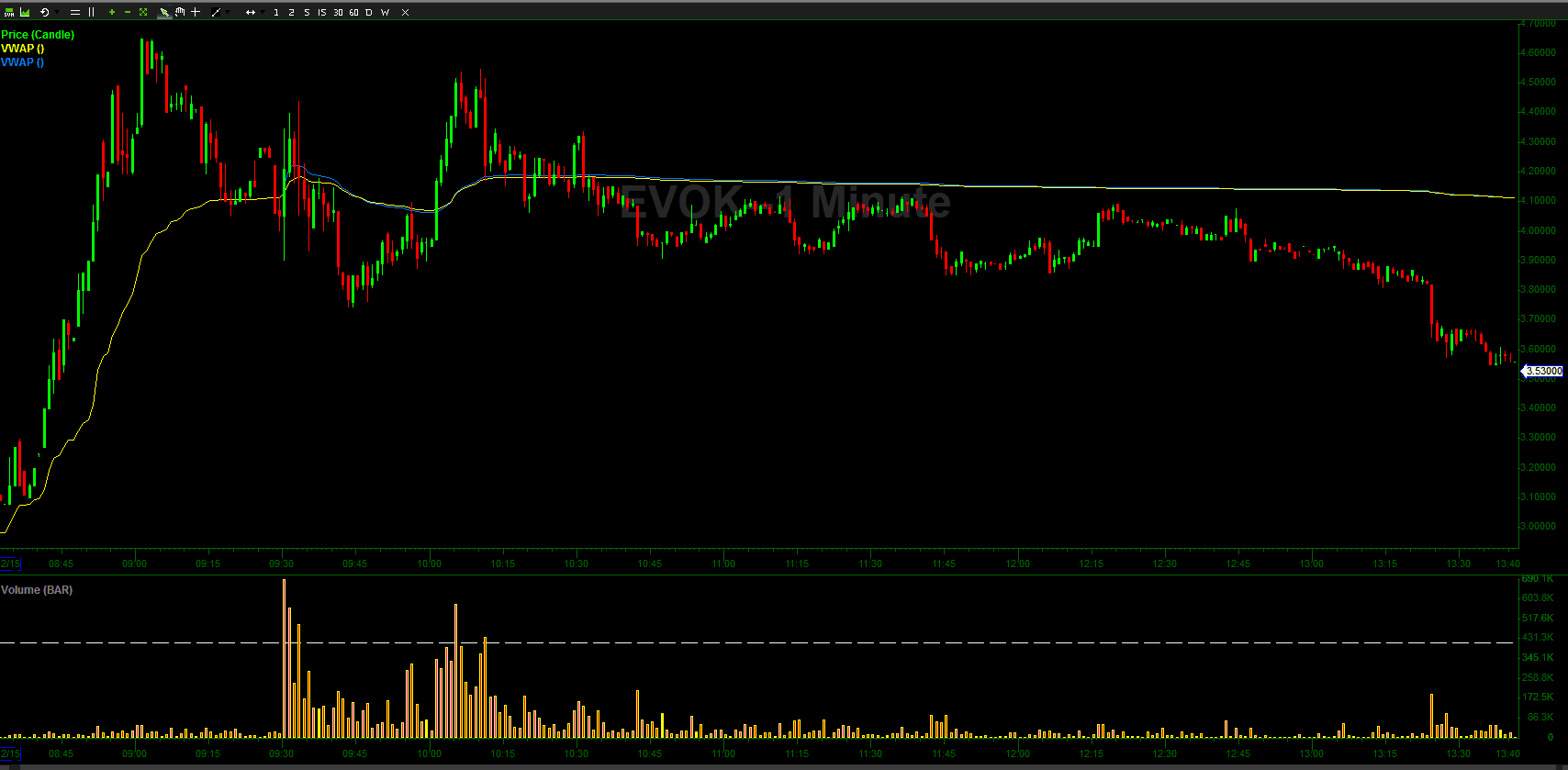

#1 Going Short: If you want to short something and you have the utmost conviction that the stock is trash and will come down. You should wait until the stock is under VWAP and confirms it before you start to hammer size in. By doing this you limit your risk much more because once the momentum has shifted, and the stock is under VWAP you have your “backside edge” in the short. Take a look at EVOK. What happened around 10:30? Push through VWAP. Fail. After that ever single pop got stuffed into until the ultimate unwind started to happen. If you just WAIT until the backside is confirmed by using VWAP you can really hammer size and watch your profits add up.

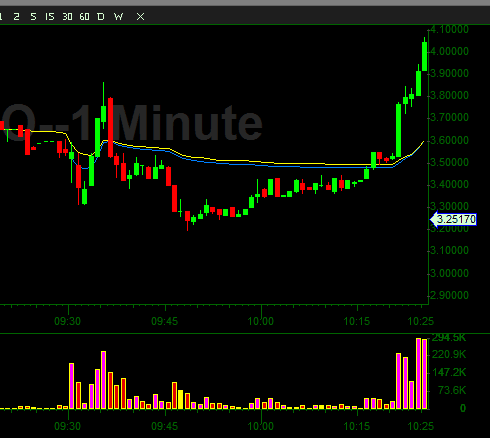

FLIPSIDE: Look at this SINO chart. Broke VWAP and faded, UNTIL volume started to pour in and there was a new high on the day. It’s much easier said than done, but if you’re not stopping out into that new high that’s poor risk management. What I’ve been doing lately is no matter what setting a hard stop on HALF my size at NHOD and the evaluating what happens next. Either I take the rest off 10 cents higher or I just re add back if the stuff move is confirmed.

Honestly I think it’s because newer traders are just too prideful and stubborn to stop out when wrong. Most traders fail because their losers are much bigger than their winners. The key to success in this game is being able to have bigger winners than losers AND finding consistency. Making $250 a day for 5 days straight and losing only a few times = +60k a year. But thinking short term making $250 is nothing. NEWER TRADERS NEED TO REALIZE BASE HITS ADD UP. (Take a look at https://twitter.com/inefficientmrkt if you want to see how much base hits add up)

Also another thing I think is a problem is a lot of newer traders are falling for FURU marketing. I WAS ONE OF THEM. I saw the Instagram posts of the cars and cash and I wanted that lifestyle too. But now I see what’s really going on. YOU ARE PAYING THE FURU’S TO LIVE THE LIFESTYLE THAT YOU WANT. There are so many bullshit chat rooms and newsletters that pump LOW VOLUME GARBAGE and when all the volume comes in they start unloading.

Unfortunately the only way you leave these services is when you lose all your money. I’ve said it a million times. IF YOU WANT TO BE THE BEST YOU HAVE TO SURROUND YOURSELF WITH THE BEST! If I didn’t find Investors Underground I can guarantee I wouldn’t be where I am today. I LEARNED to trade. I didn’t learn to be a sheep chasing my FURU and trying to grab fills at the same price as him. I always say there is no harm in joining for a month and seeing if IU is the right fit for you. Regardless, you must surround yourself with like minded traders to REALLY find long term success in this game.

Special Sale going on: investorsunderground.com/s/mrR5n

Great Blog post. A lot to learn from here.

Thank you so much🙏. But u now, i have another problem… I trade with small size… very small, and cannot increase trading size

Great post man, exactly the advice i needed after today, thx!

Agree, great post.

TripleV was here learning. Thank you, AT09!

First great post…..Fairly new to trading and agree a lot of FURU out there. Currently subscribe to IU and like what I see so far 2 months in. Have not held anything overnight yet long or short, seems there is more opportunity to profit but would like to learn more about it. Anything on the subject you would recommend to learn from as a new trader ? Thanks keep posting!

Great content AT09. Thanks a lot

Great Post!!

thank you AT09 I really enjoyed reading this and thank you for being so honest

Yeah, the paradox of surrounding oneself with successful consistent traders, is that thier time ain’t exactly easy to get. Furu Chump sheepism is out there. I like IU, a lot, and find that rarely do I get accountability, or my questions answered for legit authentic detail oriented specific to set ups (r/g, g/p, risk/reward, multiple time frame set ups, exit strategy , when it’s ok to chase, etc.) I get a vibe I’m kinda following the leader too much, being a sheep, by studying to master and execute on text book trading set ups..do I don’t know if I’m just a sheep?