What a time to be a trader. I can’t count how many calls and texts I have received from people worried about my trading because the market is down substantially. They all get answered the same way, that you can make money when stocks go up and also when they go down. Add to that that even when the markets are down there are always stocks and sectors that have retaliative strength. The key to the last few weeks was just having a few names to focus on and spending the rest of your time looking at key levels of sectors for once things settle down.

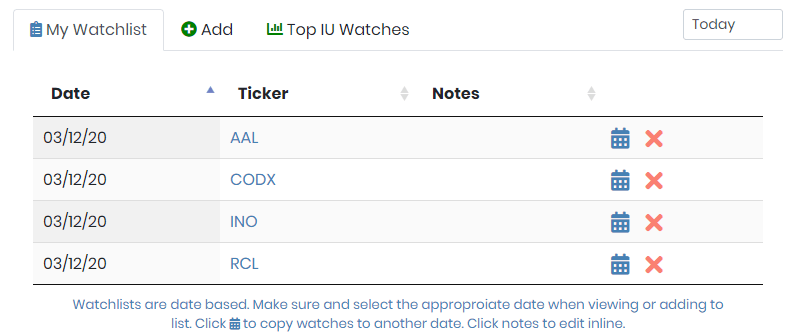

To aid in keeping all of your notes and game plans organized we have added a new watch list tool for our members. You can add tickers posted in the chat or add any tickers you like. You can also sort tickers by dates you select so they won’t clog your watch list until their earnings date or a date that should make them move.

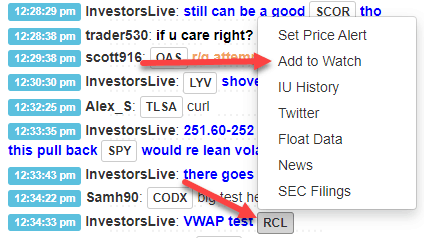

First grab the ticker by clicking on it.

This shows all of tickers for that day.

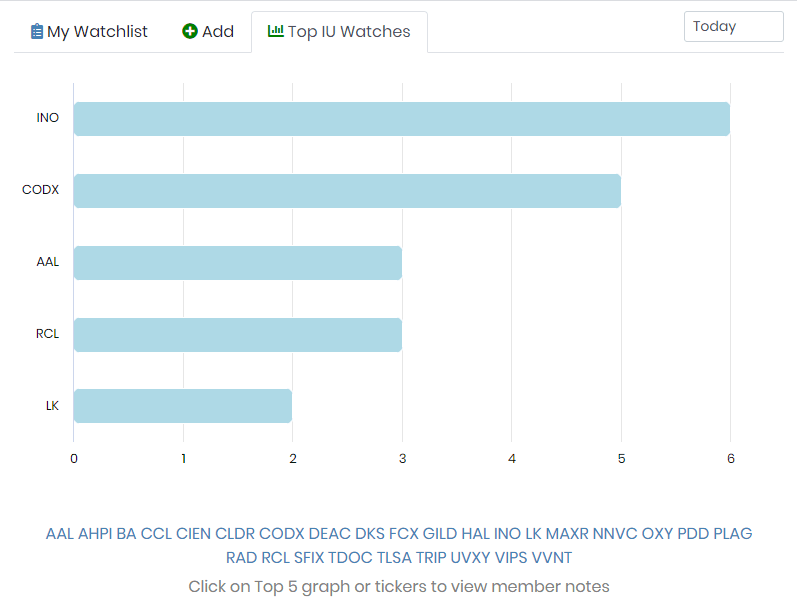

You can also see what the top watches are for other members.

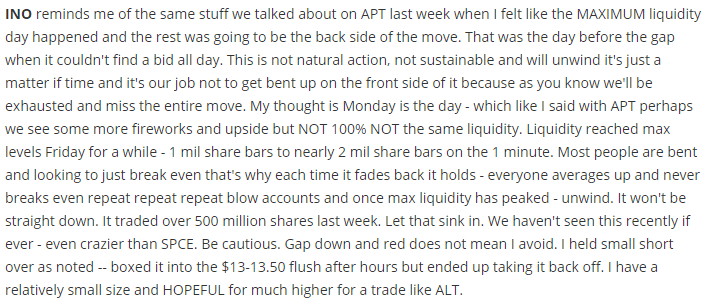

INO Failed Follow Through

INO has been a great trading vehicle the last few weeks. Nate had it on the scan on Sunday night and then started in short when he saw the momentum fail twice.

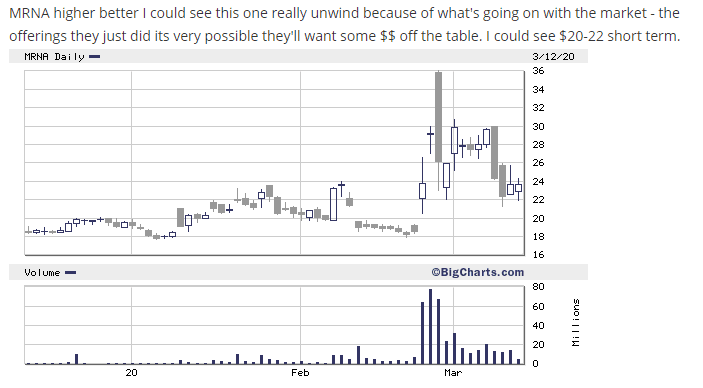

MRNA Scan and Trade

Part of building your scans is to make your plans based on what others would probably do. You look for levels where longs would start to ditch positions or where shorts may start to panic cover. No different for MRNA on Tuesday.

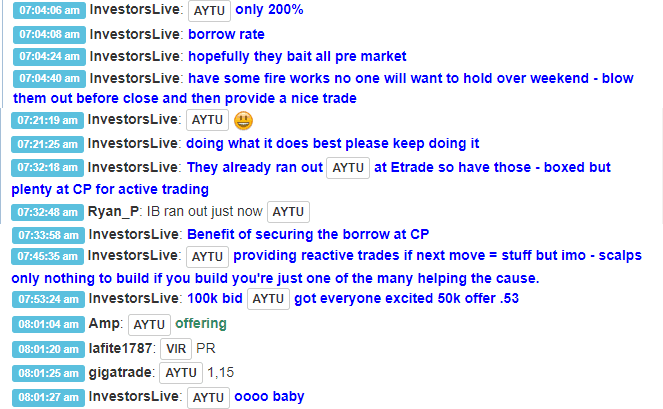

AYTU Bait

When you start to notice things lining up that seem less than natural you should pay attention. The stocks ramps up causing panic covers and then they drop an offering. Amazing.

SPY Trade

Kind of the same as above. When you start thinking about the emotional response of the public it lets you make a plan. That and about a trillion in fed repos.

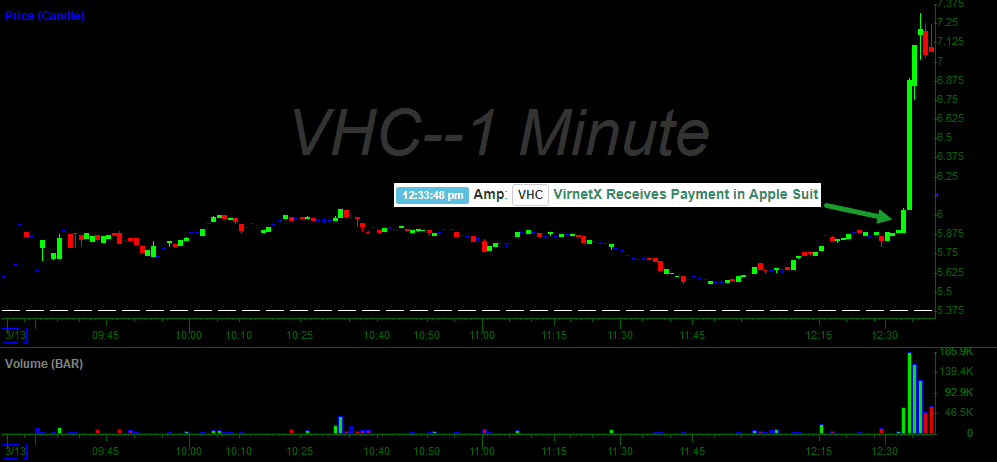

VHC News

On Friday, @Amp_Trades was first with the news on VHC getting payment for the Apple suit. Early enough for members to jump in before the big candles start ripping.

Have a great weekend. If you have any questions or are thinking about getting started with IU, shoot me an email. [email protected]

0 Comments