This week was a little tougher than normal. It was hard to prep plans for trades in pre-market as it seemed to take 15 to 30 minutes after the open for names to firm up in any direction. Having a list of names and their key levels helped to react faster once they hit those levels so you could zero in on the trade.

Blog sale this week is an annual IU membership with 2 bonus months of membership. http://investorsunderground.com/s/Zp2Cz/

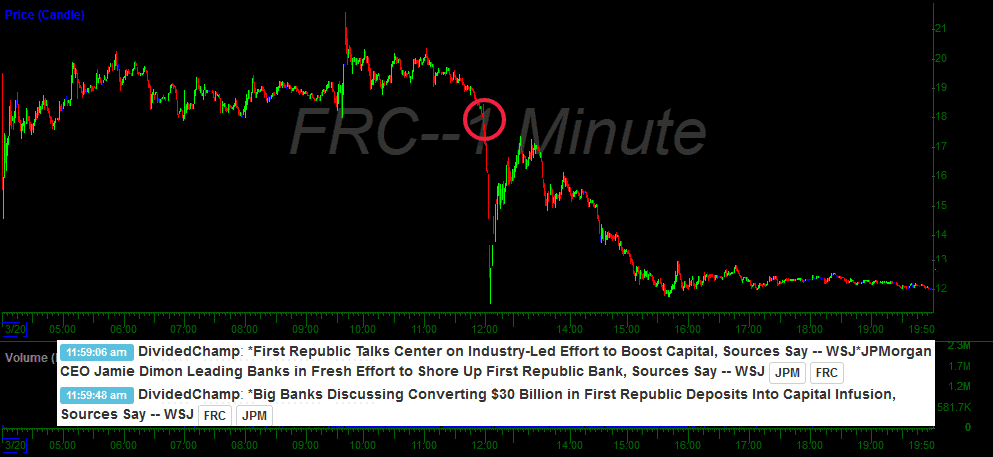

FRC Dump

This has been a great trading vehicle that last few weeks. Decent range each day with opportunity on both sides.

CISO Key Level

This is what I was talking about in regards to key levels. This had exhausted out at the same level the day before.

GME Exhaustion

Same idea as the CISO trade. Let it exhaust out and then join the fade.

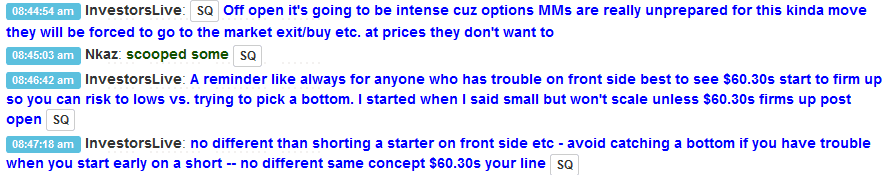

SQ Long

Just like we keep on eye on key levels not to firm up when trading short, we are wanting them to firm up for this long trade.

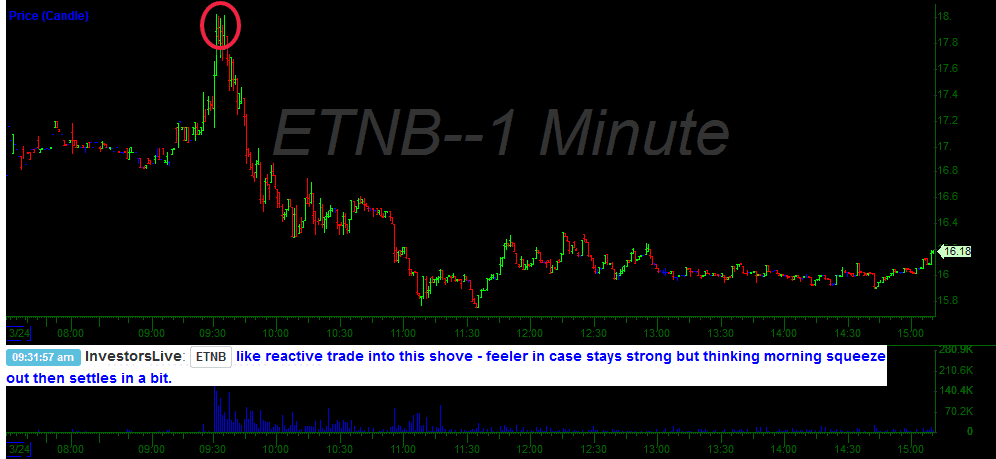

ETNB Reactive

This is an example of waiting a bit after the open to react to a move. Starting in just a few minutes early likely would have stopped you out.

Have a great weekend.

0 Comments