These are some of the most fun days in the market. There have only been a handful of them in the last six months and they really give some amazing opportunities to ANYONE who prepares for it. The last few gap down days were when SPY was at the lows. We saw red candle after red candle and finally the panic set in it gapped down a few hundred points and the wash out came in. Typically this happens within the first one or two minutes for optimal entry.

The way I typically trade these days is by picking stocks I wouldn’t mind “getting stuck in” if I am early, wrong etc. I always give myself more fire power to add on gap downs like this and typically stay out of the trade until market open. The goal for me is to take advantage of the market orders on open and any more washout as a result of it.

Today we were super prepared and the only thing I did wrong was I didn’t buy enough 🙂

My whole thought today was that this whole oil Doha meeting stuff was NEVER expected to have a freeze. That was the excuse people gave as to “why oil ran” and when there was no idea, media ate that up. “NO DEAL!!” so bad!! etc … But it wasn’t EXPECTED. So to that, it smelled like opportunity. Gap it down !! In fact I thought it may go green as I wrote – and it nearly did !

Here’s a recap from today and how I trade washouts.

Enjoy the video!

I’ve included the morning chat logs today so you can see the plan prior to market open to see why/how I prepared the way I did which are posted at the bottom.

Below are some entries and charts of the trades we did today:

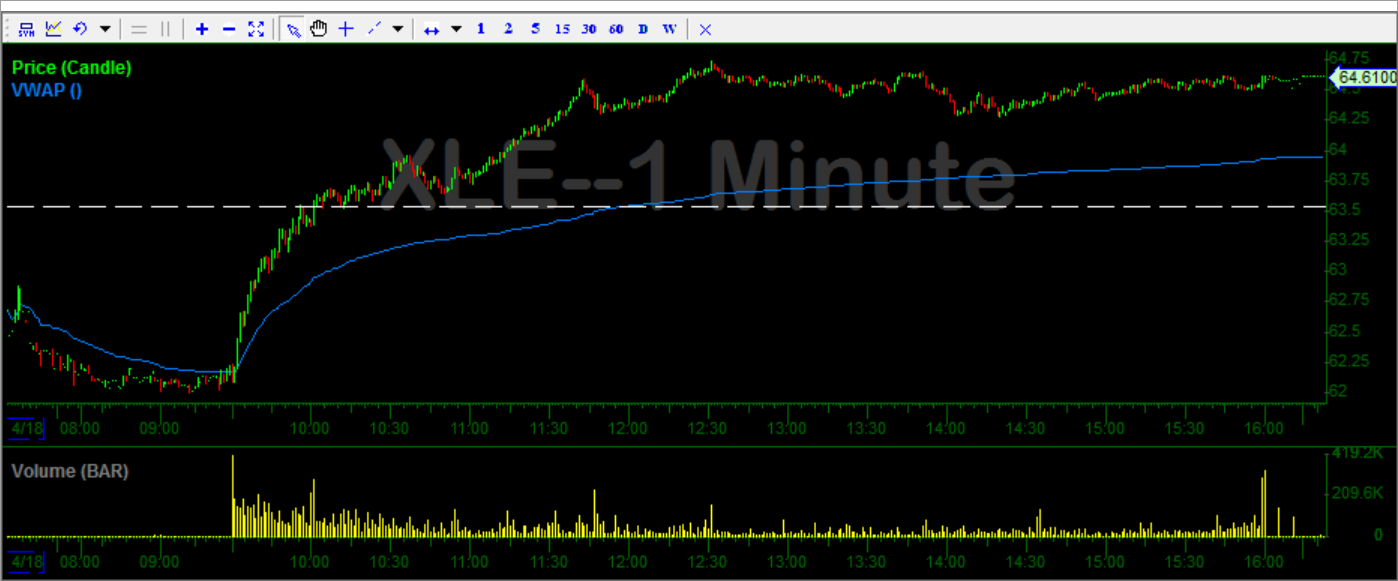

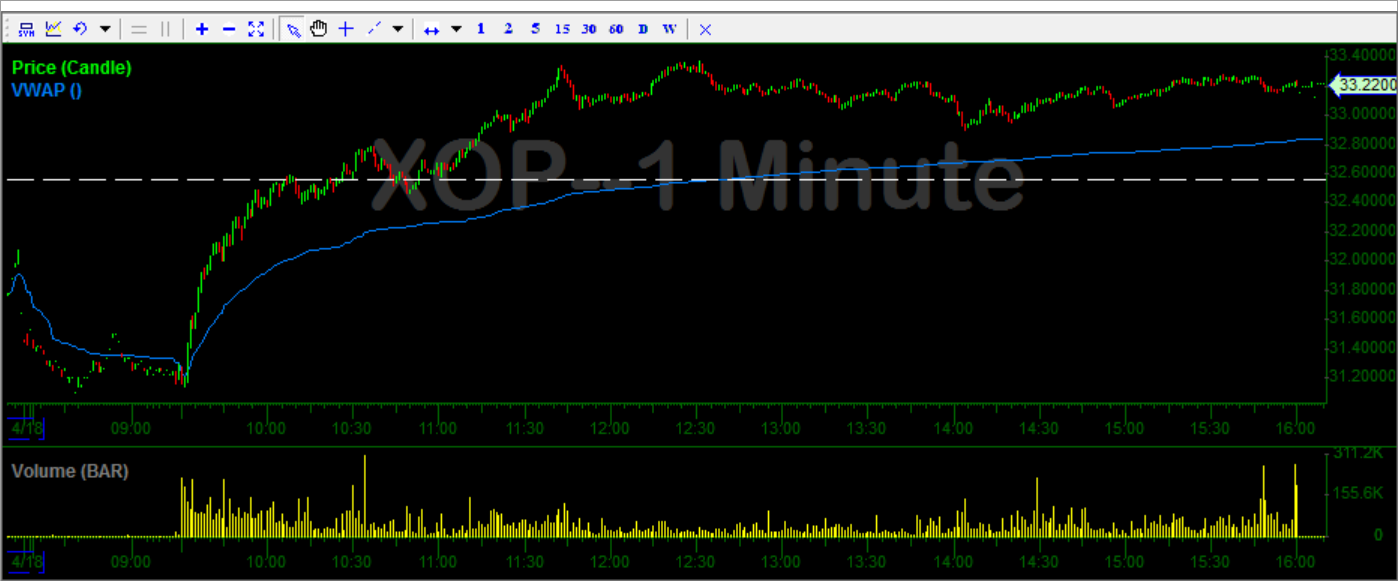

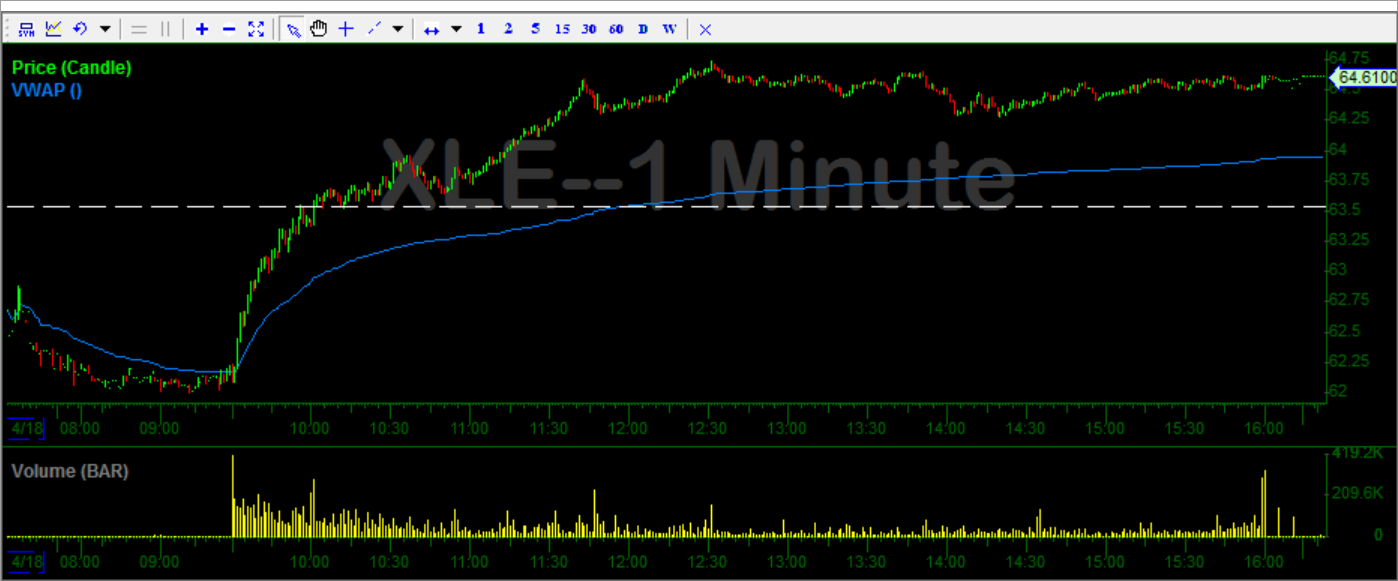

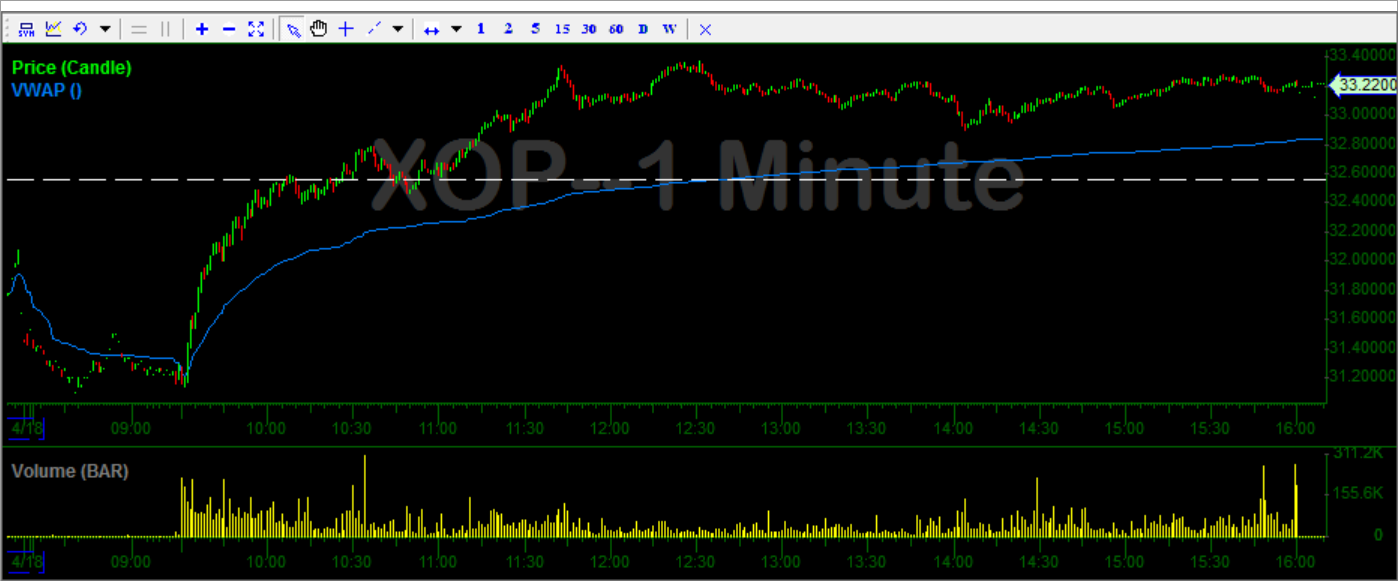

Whenever trading energy names I always watch USO XLE and XOP

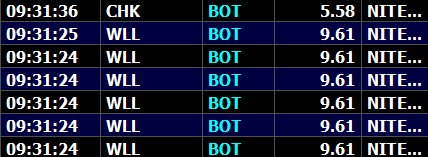

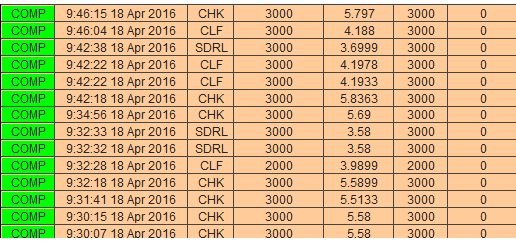

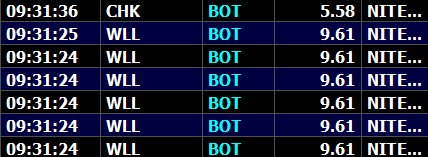

Here are the morning washout snags WLL bottom ended up being $9.60 I just took the offer – this is one of those times it’s quick reaction that matters – PAY THE ECN fee don’t be cheap !

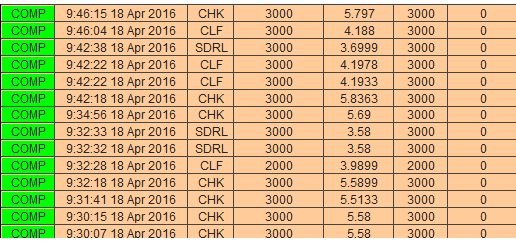

CLF was probably the best trade idea of the day given that NUGT involves more risk than most should be taking and CPXX well that was picture perfect but the help of some heavily followed bio guys had some negative view points that took it down so although it was perfect, it definitely was unnatural but I won’t complain!

CLF I had overnight from last week. I’d been buying dips for a few days, sold most before the close, and added in this morning. I scaled up throughout the day, sold a bunch $4.45-4.46 into close and holding rest over. We’ll see how it goes.

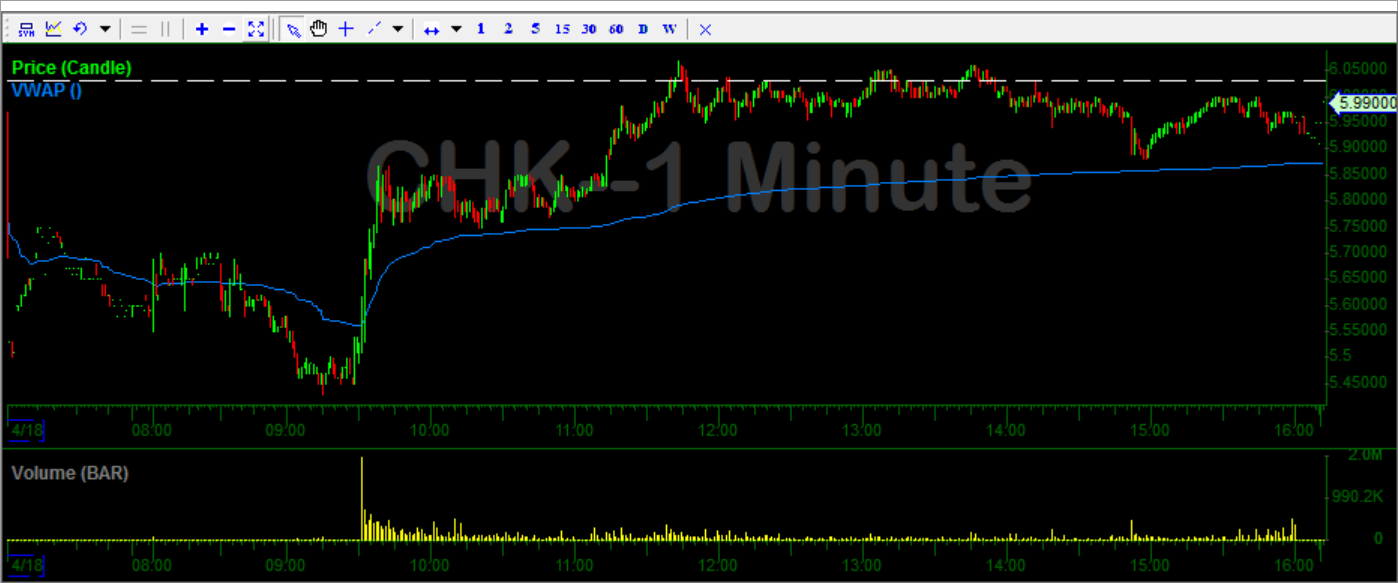

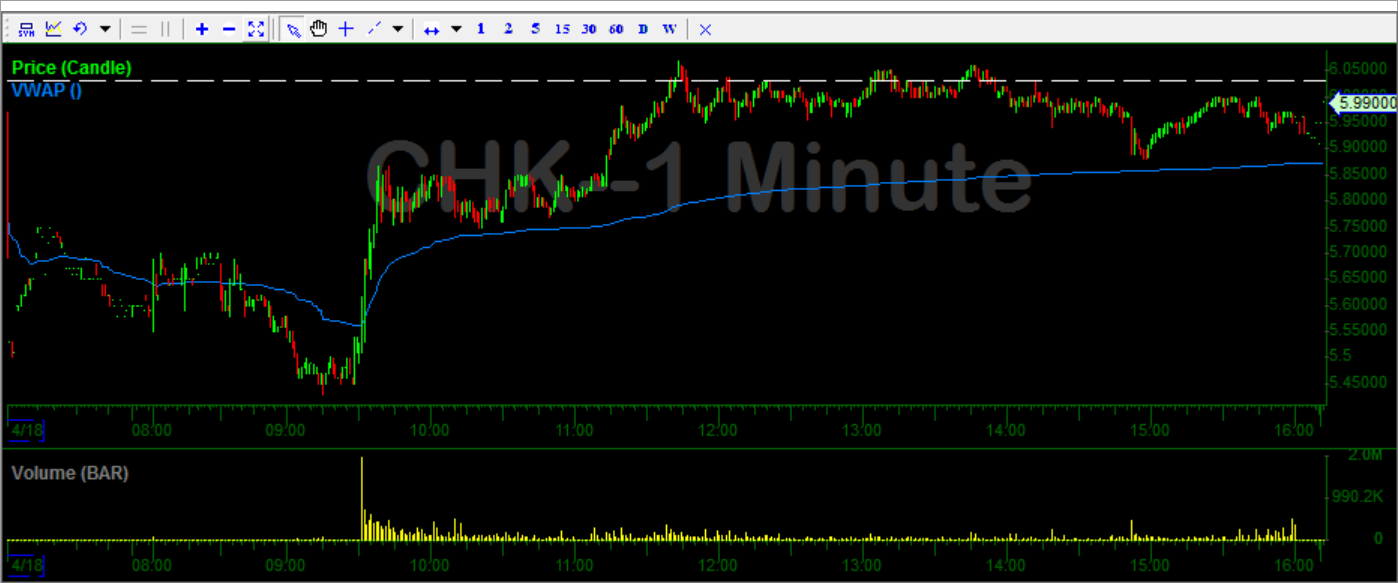

CHK perfect fade right into the open volume candle and straight up. If you weren’t fortunate enough to snag the wash out – where was the next ABCD set up and risk that you see? Leave a comment in the comment section!

SDRL I’ve been trading washouts the past few days and been holding over. I had $3.50 entry from last week had a bunch added added and sold more than 3/4s of it Friday into close given the Doha news expected Sunday. So I did start “down” compared to Friday on this but given the entry no big deal and this opportunity was an absolute gift.

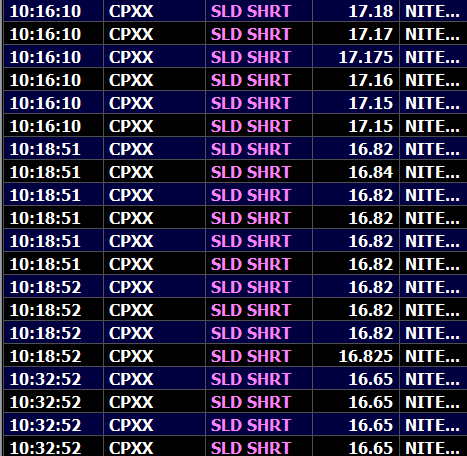

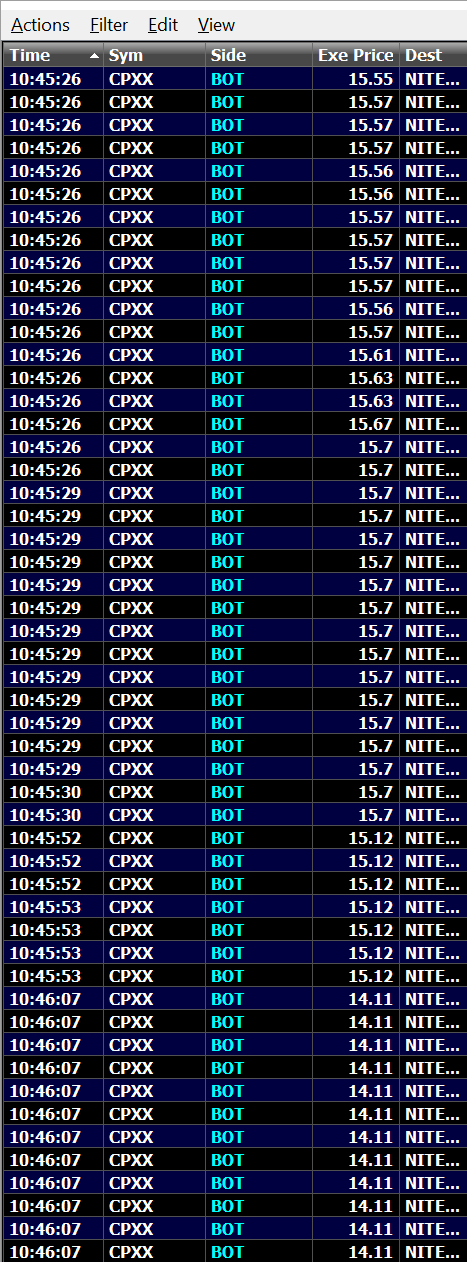

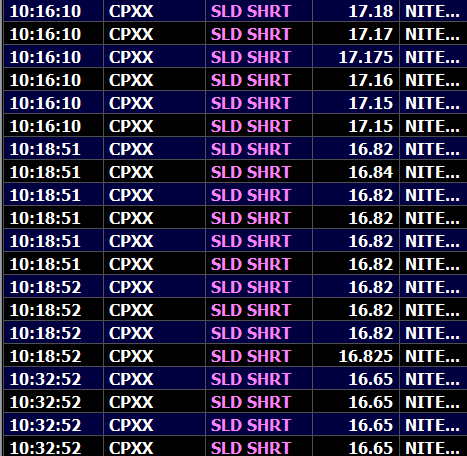

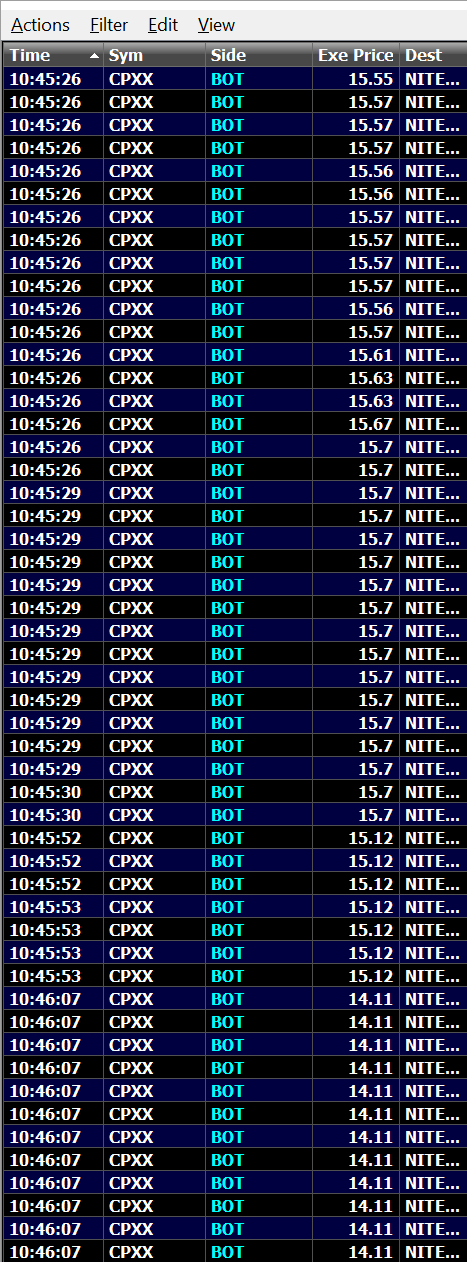

CPXX as explained on the video – wrong at first but did the right thing. Nothing wrong with trading in the first few minutes off emotion but it’s a scalp and if it doesn’t do as expected or starts to collect and head higher GET OUT and hope for higher – that’s exactly what we did!

I waited for it to blow off into the $17s $17.30-.40 and the volume bar then got short and added to winner – you can see my scale and short here:

As you can see I downsized a BIT too early but I never get angry about it as I may have been “too patient” and covered at the same spot anyway.

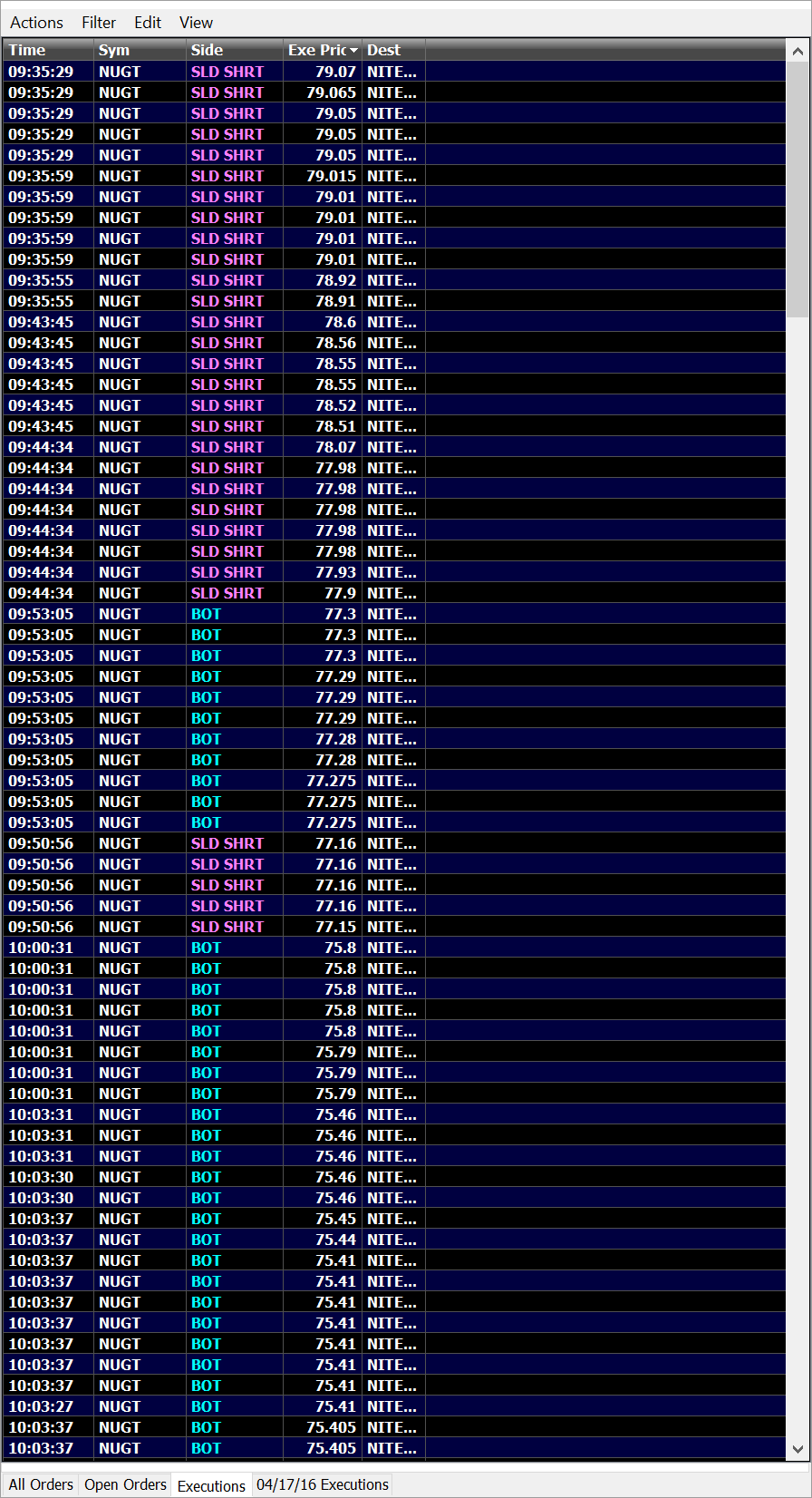

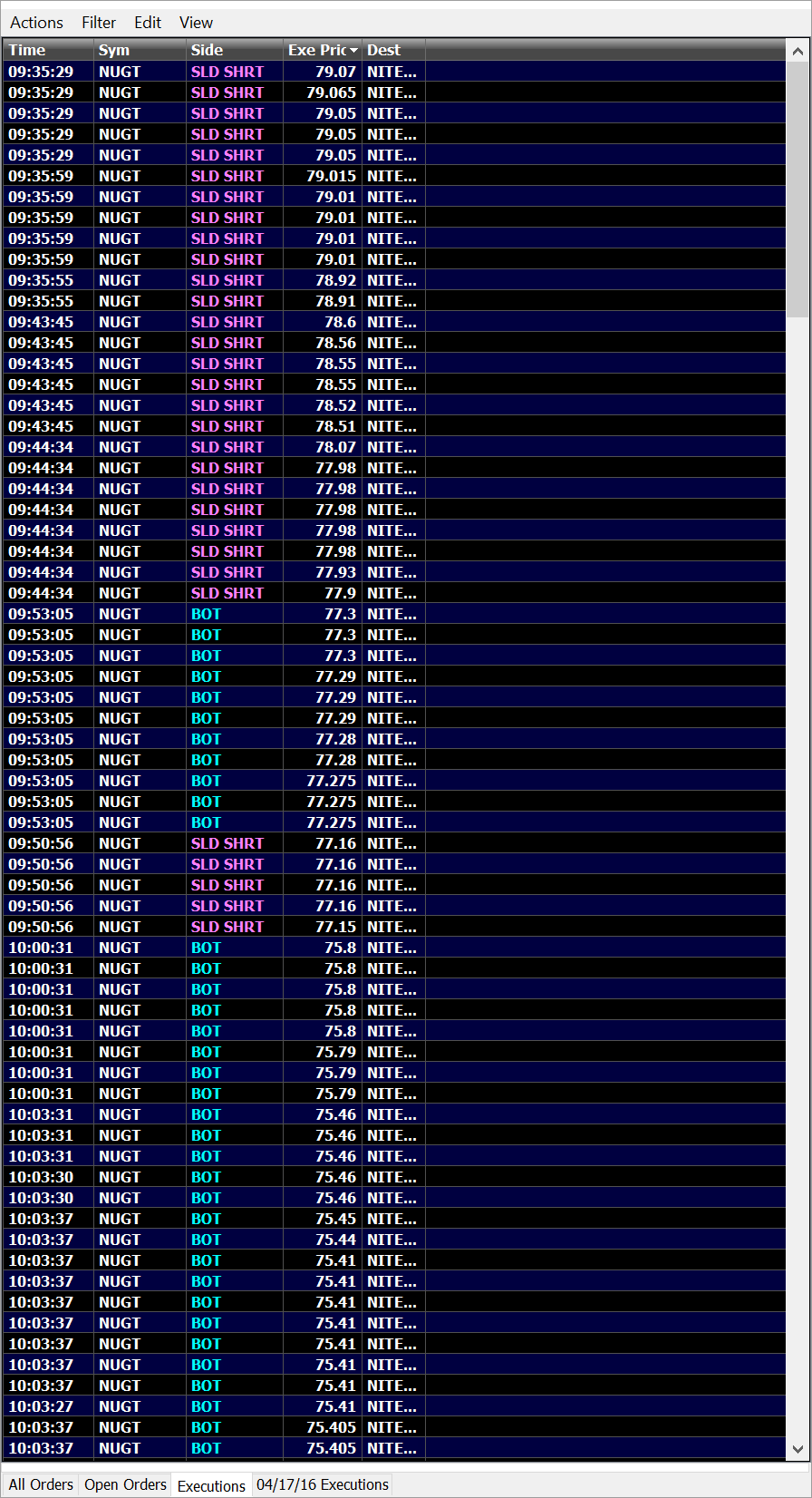

NUGT ended up being my main gainer with an entry then the scale which you can see below:

What is important to note here is the scale – entry to start then add, add, and slammed in when it was about to wash (or at least I thought it was going to). I was extremely happy with my covers on NUGT. I’m best out of the gate on NUGT but I absolutely have the most difficulty with it after 10:30AM and during lull when I try to anticipate direction. The best way to trade this ETF for ME is either 1) Join trend 2) out of the gate 3) into the last 30-40 minutes

AVOID OTHERWISE if you see me trading it any other time, please PM me and slap me !!

08:09:05 am InvestorsLive: CHK hoping they give us a 1-2 candle gift

08:27:52 am InvestorsLive: in a market like this I look for the big gap downers that are excessive vs. peers

08:27:59 am InvestorsLive: then ideally we get 1-2 candles in the first few minutes to react to

08:28:04 am InvestorsLive: and either scalp quickly or let them work

08:28:27 am InvestorsLive: SM WLL DNR ESV CHK CLF SDRL types and many more will scan here shortly

08:28:51 am InvestorsLive: going to watch failed follow through on CPXX – nice big gap

08:30:48 am InvestorsLive: Key today is not being too biased in any one direction – reactive trades out of the gate for sure but look at big picture

08:30:59 am InvestorsLive: let things come to you

08:31:04 am InvestorsLive: Theranos CEO on CNBC

08:34:04 am nblancha: CYTX IMMU RXDX all health, all gap up of 10%+, all up on news. Could potentially set up for the failed follow through later in the day

08:35:36 am InvestorsLive: OTIV worth eye on dips today, news a minute ago

08:35:55 am InvestorsLive: chart break $1.05-1.10 area

08:36:42 am InvestorsLive: Crude ramp

08:36:45 am Eurocayman: Crude nice off that 38.50 support

08:37:46 am n2growth: Crude front mo rolled over to June today FYI

08:37:49 am elielitvin: DSCO is now WINT, fyi

08:43:43 am Mikez: ^n2groth, that was yesterday fwiw

08:44:04 am InvestorsLive: dang nice gap on ORPN

08:45:00 am InvestorsLive: MDVN worth an eye for $55 push then fizzle

08:45:06 am InvestorsLive: CPXX higher the better

08:45:25 am InvestorsLive: CHK SDRL WLL MRO focus spots for me prob w/ same game plan as mentioned

08:45:57 am InvestorsLive: PTCT any big washes as well

08:48:29 am elielitvin: GBSN wait up… sub 4

08:48:39 am elkwood66: beauty on the ss swing

08:57:27 am InvestorsLive: have your plans out of the gate find the names you like most for potential washes – reactive trades on oil/gas is what I am looking for

08:57:33 am Umar: CHMA & CLMT 54 and 48% down

08:57:48 am InvestorsLive: if you’re nto familiar with what that is, it’s ok — relax, focus and be patient for trades later on after the settle and set up

08:58:35 am InvestorsLive: also remember things do NOT have to bounce so if you nail a wash and rebounds don’t turn a nice scalp into a full day hold/loser

09:01:39 am joshclick: RPRX floating back up

09:02:31 am d4ytrad3: Kandi Technologies Reports the JV Company’s EV Models Receive Tax Exemption Approval

09:07:49 am InvestorsLive: SKLN nice gapper so far

09:10:04 am InvestorsLive: Cramer says ESV is most important

09:10:12 am InvestorsLive: that $9.25 #

09:12:33 am Laura: pre losers: CHMA CLMT BCEI DNR UWTI GUSH PPP EMES GASL CRC REXX CHK OAS WLL UCO VNR

09:13:02 am InvestorsLive: CPXX reactive trade into a para for me

09:13:08 am InvestorsLive: then looking for back side to add

09:15:24 am d4ytrad3: AMDA *DJ Amedica Signs Exclusive Chinese Silicon Nitride Distribution Agreement(Dow Jones 04/18 09:15:04)

09:16:07 am Emil: main CPXX RPRX PTCT ideally will have a squeeze out of the gate

09:16:38 am Emil: AEZS will watch weak open r/g type of move for more upside

09:16:59 am InvestorsLive: DDD STX on watch from scan as well but going to be busy w/ the oil/gas mentioned out of gate

09:17:04 am InvestorsLive: will re visit those once things settle

09:17:43 am InvestorsLive: RPRX small recovery so far ideally has a morning ramp/squeeze out for more opportunity on downside, likely won’t touch since all the rest are going

09:18:49 am CarpeGallus: EGN O&G name tends to fade hard. will look for a pop to 37.50’s o/u for an ss mkt provided

09:21:24 am Muddy: pre so far… FCSC RXDX DRIP LOXO ORPN RPRX BIOC GASX MNOV ERY CLRB BTX NUGT NXTD SKLN CANN ARGS CPXX

09:22:00 am InvestorsLive: AMDA that was fast

09:24:24 am InvestorsLive: ESV perk

09:27:58 am InvestorsLive: Entry in everything guys be patient and let the trades come to you – lots of action this AM

09:28:07 am InvestorsLive: ESV running away from me but I’ll wait

09:28:56 am Knowgood: PTCT dip

09:29:37 am InvestorsLive: SKLN HODs

09:31:03 am InvestorsLive: started CPXX

09:31:06 am InvestorsLive: per plan

09:31:42 am Emil: TRXC slap

09:31:44 am InvestorsLive: started CHK

09:31:49 am InvestorsLive: NUGT slap

09:32:00 am OddStockTrader: scooped more SKLN long

09:32:08 am SatoshiTrader: FIT green

09:32:44 am cornel28: long CHK

09:32:56 am Muddy: RXDX fade

09:33:01 am Yelk: long ORPN .80s starter willing to let it dip more towards red

09:33:05 am InvestorsLive: SDRL WLL as well per plans

09:33:34 am joshclick: RPRX para

09:33:50 am InvestorsLive: WLL bingo

09:33:51 am InvestorsLive: nice

09:33:57 am Muddy: RXDX under 9

09:34:05 am Yelk: ss RPRX .71

09:34:35 am InvestorsLive: CHK nice rip

09:34:39 am Muddy: AMDA big

09:35:32 am OddStockTrader: CANN push

09:35:37 am InvestorsLive: starting NUGT ss into pops and add if red

09:35:49 am InvestorsLive: CPXX – 15.20 is area I am watching for any adds until then staying careful

09:36:08 am Muddy: RXDX lod

09:36:09 am Deezy: ESS NLOD

09:36:12 am InvestorsLive: remember – nice nails on these take some profits along way guys

09:36:45 am InvestorsLive: ESV HODs

09:36:47 am Muddy: ORPN near red

09:36:56 am InvestorsLive: CLF near r/g

09:37:17 am InvestorsLive: SDRL some push

09:37:26 am Savino: Long SDRL… strated

09:37:30 am OddStockTrader: bailed SKLN

09:37:31 am Savino: started

09:37:37 am InvestorsLive: ESV GODs

09:37:39 am InvestorsLive: HODs *

09:37:40 am elielitvin: ss PTCT 8.25

09:37:42 am InvestorsLive: CLF on r/g

09:38:05 am bbstock: SDRL long 3.62

09:38:47 am Muddy: SKLN red

09:38:49 am InvestorsLive: TWTR LODs

09:38:53 am ThePacer: ARIA move off lows

09:39:17 am Muddy: MNOV trying 10 cross

09:39:33 am Muddy: AMDA drop

09:39:38 am OddStockTrader: TRTC thr .50s

09:39:53 am InvestorsLive: 2/3s wash out snags left — locked some in very nice guys CHK WLL ESV SDRL CLF etc

09:39:54 am cornel28: sold CHK

09:40:01 am InvestorsLive: CPXX cov will re visit

09:40:19 am InvestorsLive: WLL thru $10

09:40:42 am Arsenal: FCX rip

09:41:00 am Emil: started AMDA s/s

09:41:09 am InvestorsLive: Gold spot slam

09:41:36 am Yelk: add size ORPN long, stop .79 on size

09:41:44 am elielitvin: cov PTCT 8.15-.17

09:42:15 am InvestorsLive: CLF !

09:42:43 am Muddy: AMDA lod

09:42:46 am aspenc: ARIA straight up with market

09:42:57 am heniuro: RXDX thru hod

09:43:11 am Muddy: huge pop^

09:43:11 am Emil: covered 1/2 AMDA

09:43:22 am InvestorsLive: NUGT another pull

09:43:53 am Savino: SOld 2/3 SDRL …will re add on dip , if any

09:44:13 am InvestorsLive: sold more SDRL CHK WLL

09:44:19 am Muddy: MNOV 10 fail

09:44:20 am InvestorsLive: gonig to re add on dips

09:44:23 am InvestorsLive: NUGT RED !

09:44:29 am Muddy: CPXX 16

09:45:32 am Emil: out AMDA more 1/3 left

09:45:36 am InvestorsLive: SKLN going to watch dips use .22 guide after the big gap can use profits to let antoehr trade work

09:46:45 am InvestorsLive: CLF relative strength so far

09:47:14 am Muddy: GBSN some bounce

09:48:37 am InvestorsLive: MRO straight up

09:50:10 am InvestorsLive: PTCT already back on $8

09:50:28 am Muddy: SGSVF over 1

09:50:40 am InvestorsLive: NUGT More slam

09:50:53 am Muddy: GBSN green

09:51:36 am InvestorsLive: sized way down on all the oil and gas rebounds

09:51:41 am InvestorsLive: partial left looking for any good scoops

09:52:26 am nic3trade: CHMA nlod

09:52:38 am CarpeGallus: EGN started ss room to 38

09:52:43 am InvestorsLive: 16.25 seller so far CPXX watchin around $16 later on – not interest into front side

09:52:56 am Yelk: stopped ORPN long .80 -.05 revisit if they scoop later

09:53:21 am Muddy: GBSN fighting green hold

09:53:54 am Muddy: LABU r/g

09:54:38 am Muddy: GBSN fail green

09:55:54 am SocietyRock: MDVN pushing

09:55:57 am bbstock: SDRL nHOD ed to green posible

09:55:58 am InvestorsLive: covered 1/2 NUGT

09:56:00 am InvestorsLive: SDRL thru HODs

09:56:05 am InvestorsLive: TWTR watch dips now 17.40 risk

09:56:33 am nic3trade: CMMA lod, 4 test

09:57:00 am nic3trade: CHMA

09:57:03 am elielitvin: ss starter RPRX 2.70

09:57:16 am InvestorsLive: ESV

09:59:19 am elielitvin: add ss 2.66 RPRX

09:59:25 am InvestorsLive: NUGT LODs

10:00:25 am Muddy: CPXX more 52s

10:00:31 am elielitvin: cov RPRX 2.65

10:00:36 am InvestorsLive: coveed bit more NUGT 1/3 left

10:01:16 am InvestorsLive: CLF fresh highs

10:01:38 am Nonstopshop: C r/g 45 test

10:01:46 am CarpeGallus: Stopped EGN

10:02:08 am Muddy: ARGS more off pre

10:02:09 am InvestorsLive: CPXX nice

10:02:31 am Yelk: PGNX 5 break multi month resist, has run before watching dips if follow through

10:02:31 am QTrader111: VALE r/g

10:02:38 am Nonstopshop: SPY ramp

10:02:46 am InvestorsLive: Gold spot striaght down

10:03:19 am InvestorsLive: SDRL nearing r/g

10:03:41 am InvestorsLive: covered rest of NUGT

10:03:54 am InvestorsLive: +4-4.50

10:03:54 am bbstock: SDRL out +.17

10:04:16 am taipeirob: why oil bounced hard

10:04:17 am OddStockTrader: long STEM

10:04:39 am lx21: Worked down size on my RPRX short position pretty far. I’m not looking to hold another day unless support cracks today.

10:04:46 am QTrader111: CHK perk

10:05:31 am Muddy: UNXL pops

10:07:08 am Jwezz: HLF testing lows

10:07:58 am heniuro: DDD losing g/r

10:09:13 am InvestorsLive: USO on 10

10:09:50 am Muddy: RXDX under 9 again

10:10:09 am InvestorsLive: PTCT nice rally off dips

10:11:08 am tunko: CPXX nhod

10:11:53 am InvestorsLive: going to be patient now and let WLL CLF ESV SDRL CHK trend w/o any size on — going to watch for opportunity on cracks – nice job guys !

10:12:19 am swimswim: PTCT news was out

pre-market

10:12:42 am cdr2006: long small SKLN .21

10:12:44 am Savino: Scoop some TWTR off dips

10:12:50 am Savino: long**

10:14:44 am InvestorsLive: like the relative strength on CLF

10:14:53 am InvestorsLive: NUGT nice reversal off covers

10:15:30 am ThePacer: CPXX faster

10:15:36 am InvestorsLive: TRTC squeezing a bit more today

10:15:44 am Muddy: UNXL more

10:15:59 am InvestorsLive: STX trend formed today worth a watch on dips

10:16:18 am InvestorsLive: started ss CPXX feeler

10:17:08 am InvestorsLive: cover CPXX along way, still on front side – nice little stuff there .20-.30s but has a lot of power and if dips get soaked can keep going

10:17:26 am InvestorsLive: $16.50 over/under only spot I’d be patient

10:18:47 am InvestorsLive: SKLN they supported again off dips- agian not a trtade for anyone only if u have padding

10:18:48 am InvestorsLive: from earlier

10:20:37 am Muddy: ARGS 52s

10:20:41 am InvestorsLive: Gold spot pulling back down

10:20:49 am InvestorsLive: NUGT Nice failed follow thru – missed it that round

10:21:03 am InvestorsLive: will watch all pops NUGT for s/s as long as Gold spot doesn’t base at 1234

10:22:58 am InvestorsLive: CPXX – 16.80s I’d say at this point is a key level based on the absorb – so be sure you’ve paid yourself some but 16.80s = big level for over/under

10:23:04 am InvestorsLive: Gold, no interest in NUGT right now

10:23:42 am OddStockTrader: STEM nhod

10:24:32 am InvestorsLive: STEM is a super slug but def a watch if it moves has a big baggy base that will love to get excited about it

10:24:38 am InvestorsLive: WLL Fresh highs

10:25:53 am chasesmooz: CMRX looks like it wants to go parabolic

10:26:56 am Yelk: PGNX more hods

10:27:08 am heniuro: RPRX back above

VWAP

10:27:17 am Muddy: LABU 5% on the r/g, CANN steady so far

10:27:53 am InvestorsLive: CHK setting up nicely again

10:28:11 am orlandog1: PTCT hod

10:28:20 am kiwuuu: PTCT Squuueeze

10:28:50 am OddStockTrader: CANN impressive

10:29:17 am InvestorsLive: PTCT nice game plan Friday, for dip buys for squeeze back – careful on short side very well may see r/g if trend can hold

10:29:22 am InvestorsLive: nothing to chase idea was into dips/washouts off open

10:29:31 am InvestorsLive: CPXX reclaim – be aware if you didn’t take profits

10:30:24 am Muddy: RXDX lod

10:30:51 am Muddy: CANN walkup 1.80

10:31:52 am InvestorsLive: CHK perk

10:32:36 am InvestorsLive: working into CHK dips .. SDRL would love to scoop for r/g and $4 mag – all dips if oil/energy agrees

10:32:48 am InvestorsLive: I have a core still on all of these – just took off day trades when mentioned

10:33:17 am InvestorsLive: CPXX failed follow thru so far

10:33:22 am d4ytrad3: NUGT / Gold nice continuation bounce back to green

10:33:48 am InvestorsLive: CPXX still above VWAP – so stick w/ rules we cover on webinar

10:35:16 am B1rko: RXDX nlod

10:36:15 am d4ytrad3: RPRX failed followthrough break

10:36:32 am InvestorsLive: STEM .290

10:38:35 am InvestorsLive: VCEL some push – was the old ASTM that used to run with STEM potential sympathy I have zero interest in long vol too low but just in case it gets going will watch back side

10:39:12 am Muddy: ORPN red

10:39:49 am TWB52: RPRX snap

10:40:27 am Muddy: ENDP bit more

10:41:34 am InvestorsLive: ENDP damnit, every day I miss it lol – going to get long here on dips using VWAP as a guide

10:42:03 am InvestorsLive: started ENDP – looking for .50 wash dips and VWAP guide then if I get to 1/2 size will use .50s over/under

10:42:59 am nic3trade: ss STX

10:43:43 am InvestorsLive: yep STX ^ eye from scan on pops

10:44:06 am InvestorsLive: CPXX there’s $1 fader so far

10:44:23 am OddStockTrader: FELP nhod

10:44:26 am d4ytrad3: ss WLL

10:44:48 am d4ytrad3: FREE some vol

10:45:27 am Nonstopshop: CPXX 15s

10:45:32 am InvestorsLive: cover 1/2 CPXX

10:45:32 am xiaoyi11788: cpxx wow

10:45:34 am heniuro: $CPXX NCI/Stanford Ph2 AML trial just suspended pending IRB review

10:45:35 am GaryC: FREE moving because a know trade said he bought

10:45:49 am InvestorsLive: CPXX !!!!!

10:45:56 am OddStockTrader: FORD former runner, light vol at the moment

10:46:06 am xiaoyi11788: cpxx free fall

10:46:10 am InvestorsLive: ALLC OVERED

10:46:12 am InvestorsLive: BOOOOM

10:46:13 am Emil: holy moly CPXX

10:46:17 am InvestorsLive: going to takea lap around my house brb

10:46:36 am InvestorsLive: omg covered far too many far too soon

10:46:49 am Emil: god damn

10:46:49 am Arsenal: covered ALL 16.13

10:46:54 am OddStockTrader: likely halts

10:46:55 am Nocturnal: More bleed CPXX is there news?

10:46:57 am Muddy: sorry not yet

10:46:57 am Danetyler: wowww

10:47:05 am heniuro: yes CPXX neg

10:47:06 am stapes1: CPXX

10:47:06 am Savino: ok… thats was a gift !!!!!

10:47:11 am Nonstopshop: halt

10:47:14 am Muddy: theres halt

10:47:21 am OddStockTrader: wow

10:47:23 am Emil: $CPXX NCI/Stanford Ph2 AML trial just suspended pending IRB review

10:47:27 am gigantebaba: Celator Pharma CPX-351 Study Suspended Participant Recruitment

10:47:30 am Muddy: unreal wow

10:47:39 am Arsenal: AND halt

10:47:42 am Nonstopshop: Great work guys!

10:47:44 am Nocturnal: PTCT’s turn now

10:49:30 am tbohen: wow lost a couple hundred being early on a starter on CPXX that hurts now!

10:49:36 am InvestorsLive: grats guys – crazy morning nice work

10:49:38 am apitrading: BPTH vol

10:50:04 am adamj: nice alert Heniuro on CPXX!

10:50:18 am Muddy: UNXL hod

10:50:23 am xiaoyi11788: cpxx’s rip pull rip pull action got me covered bunch too.. timing is the key!

10:51:15 am nic3trade: STX Nice below vwap

10:51:26 am Savino: SDRL pulling…

10:52:12 am ThePacer: open CPXX

10:53:55 am OddStockTrader: not many likey got short CPXX, can do an easy 16 push

10:53:58 am cw29545: long CPXX

10:54:37 am Savino: SS STX 25.99

10:55:03 am Nocturnal: halt CPXX again

10:55:33 am d4ytrad3: CHMA sucked huge shorts 3.90-4 off that 100k bid, held so far

10:55:45 am Savino: staying out of CPXX for nw…. yo yo action halt crazy for me

10:55:50 am InvestorsLive: CLF HODs

10:56:15 am Muddy: LABU again

10:56:52 am Muddy: LMCK no bottom yet

10:59:21 am nic3trade: ss PTCT 8.29

10:59:34 am InvestorsLive: ENDP HODs

11:02:30 am Savino: added more on TWTR //last of it…

11:04:10 am Savino: STX nice acton

11:04:16 am Savino: aatiion**

11:04:35 am InvestorsLive: SKLN failed trend

11:05:33 am Gahan: RLYP r/g

11:06:24 am c137: ss NUGT

11:07:36 am OddStockTrader: GRNH fast thru .07

11:07:43 am InvestorsLive: WLL bit more !

11:08:20 am Emil: watching LULU for lower highs and back side

11:08:28 am B1rko: BOFI nhod

11:08:51 am InvestorsLive: ENDP eyeing dips

11:08:54 am Iglue: SKYS hodn

11:09:09 am InvestorsLive: CHK if it goes – its going to be fast like WLL on the break towards $6

11:11:27 am c137: covered NUGT

11:11:54 am Savino: COvered 2/3 STX +.45 leaving the rest for a possible g/r move

11:11:55 am Kojiman: WATT keeps grinding up past 11’s

11:14:01 am Knowgood: CHK going

11:15:01 am InvestorsLive: CHK

11:15:29 am InvestorsLive: awesome preparation today guys – feel free to reach out if any questions any trouble out of the gate … here to help while I’m just sitting on hands

Thanks for a great recap!

Nate, Do u use any criteria/parameter to differentiate b/w short covering and real buying pressure when you go long on early morning washout?

All about the daily chart, volume and price action.

it would be great to see a run through of what you do after market hours… going over your trades, logging them, journal if you use one, exel spreadsheet entries,…thanks

I go for a walk, work out and relax and then scan later on. No reason to journal for me I know when I loneed or short and why. At the end of the day my scan at night and morning prepares me I make the trades with a plan I don’t need to go back and review what the plan was I do that while trading real time.

Tradervue is great for stats though you can learn a lot.

what tool do you use to go through stocks and pick them out depending on your criteria that your looking for?

Finviz dumpers that I go over on Tandem