The longer you trade, the more you realize the importance of trading psychology. You can take courses, study charts, and analyze patterns, but there will always be a gap between trading theory and execution.

The field of trading psychology encompasses a wide-range of topics, but they are all focused on one key objective: optimizing the trader. Organization plays a major role in this optimization process. A successful trader knows what to focus on, what to avoid, and why. This purposeful approach to trading helps to eliminate some of the randomness involved in trading.

Today, we are going to discuss one simple switch you can make to become more organized and stay out of trouble.

Nate’s Trader Talk

Categorizing Your Trades

What makes a good trade?

Traders obsess over this question, but there’s no right answer.

There is no secret formula nor is there an answer that will apply to every trader. Every trader will have their own unique approach to trading, and what works well for one trader may be catastrophic for another.

Furthermore, a good trade is not necessarily defined by the outcome. Poorly planned trades may be rewarded and well-strategized trades may result in losses.

While there are many components that comprise a good trade, we’ll be focusing on just one today: categorization.

Categorization is the process of thoroughly defining your trade setups so you can place logical, purposeful trades. Your trade categories will guide your trading behavior. You will know what to focus on and, more importantly, what to AVOID.

The Importance of Categories

In the past, we’ve talked about the importance of finding your trading edge. We further expanded on this idea by discussing the importance of becoming a specialist instead of a jack of all trades.

To summarize, the best traders don’t trade everything. They find their niches and maximize the profitability of every opportunity that falls within the scope of their trading strategy. In other words, these traders only trade within their pre-defined categories.

Categorization helps traders focus on the opportunities that will make them the most money. It also keeps traders in line by forcing them to become more deliberate with their trading activities.

This type of strategic hyper-focus is an indicator of success in all fields.

- Warren Buffet is a value investor. He doesn’t focus on day trading, momentum, or growth investing.

- Chris Sacca is an angel investor who specializes in tech companies. He invests in a specific type of company and avoids the rest.

- Tom Brady is a successful quarterback. He doesn’t train for other positions or other sports.

The leaders in every field are focused on their categories and you should be too.

What is a Trade Category?

A trade category is a set of criteria for a trade, generally a specific chart pattern or setup. Categories vary by trader, and your personal trade categories should be the ones that deliver the best results for YOU.

Your categories need to be well-defined so they can guide your trading behavior and deliver the results you desire. A broad category like “stock breakouts” is unlikely to provide the guidance you need.

Here are two of my top categories:

Weak Open Red/Green (Long)

High-volume stocks that open red to a morning sell-off, put in a short-term bottom, and reverse towards the previous day’s close for a “red/green” breakout.

Failed Follow Through Momentum (Short)

High-volume stocks that reject a key breakout/resistance level and show signs of an intraday trend reversal.

Because these setups are well-defined, they can be used as filters for every trade that shows up on my radar. It’s pretty clear whether or not a trade meets these criteria, so by focusing on categorization, I can confidently enter positions in trades that MEET the criteria and AVOID positions in trades that do NOT.

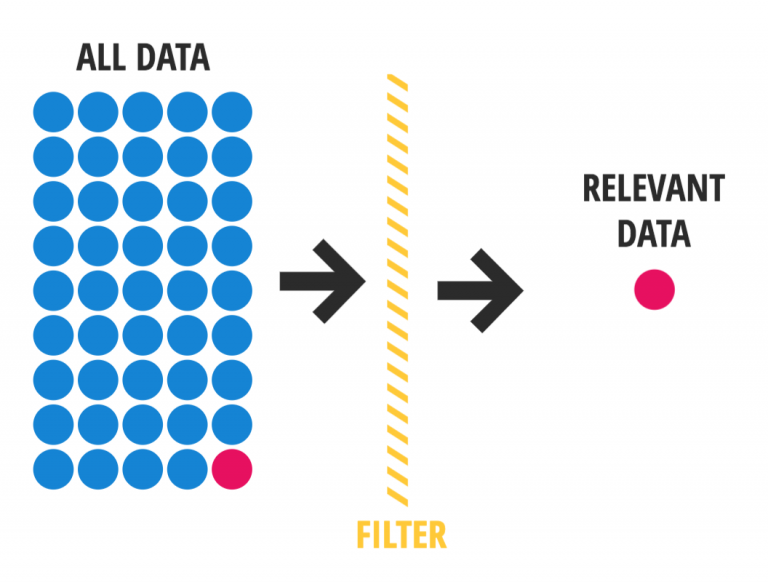

There’s so much data flowing in the markets and, without the proper filters, it’s easy to experience information overload. Categorization helps you filter out irrelevant data so you can focus on the trades that will yield the best results.

Creating Categories and Applying Them to Your Trading

If you’ve been trading for awhile, you have a lot of the data you need to start creating your categories. If you’re new to trading, you’ll start to collect this data as you trade (or paper trade) more.

Analyze your existing trades and see where you excel and where you underperform. You can start building your categories using these insights.

Take the time to think of the most relevant indicators of a good trade. Here are a few factors you may consider:

- Equity Type

- Equity Price Range

- Timeframe

- Time of Day

- Chart Patterns

- Catalysts

- Fundamental Indicators

- Technical Indicators

- Risk Tolerance

- Volatility/Range

- Volume

- Trend

- Long/Short

- Profit Targets

You may not get it right the first time, so it’s important to refine your categories as new data flows in. For example, assume you analyzed your trades and realized that your best trades are “intraday ABCD long setups.”

As you continued to trade, you may find even more criteria that differentiate winning trades from losing trades in this category. For example, you may find that this setup works best on lower priced stocks, stocks with healthy daily charts, and stocks with higher relative volume. These insights would help you narrow your category and better filter further trades.

The #1 Rule of Categories

Once you’ve defined your categories, you need to allow them to guide your trading. Every trade should fall under a pre-defined category.

Before entering any trade, ask, “which category does this fall into?” If you don’t have an answer, you don’t have a trade.

That’s actually one of the best parts about trading categories. Not only do they help you maximize your highest probability opportunities, but they help you AVOID trades you have no business being in.

The Heavy Price of Ignoring Your Categories

I started creating trade categories out of necessity. Much like many trading rules, you may not think you need them…. until you do.

You may not think you need a max dollar stop loss until your stomach churns as you stare at a loss that is 2-3x your risk threshold. You may not think you need a plan for profit taking until you turn your biggest winner of the year into a losing trade. Likewise, you may not think you need to categorize your trades until you find yourself stuck in a losing position with no recollection of why you entered the trade in the first place.

I experienced this firsthand towards the end of 2018. I was trying to scale up my trading and I found myself stuck in a precarious situation because I ignored the rule of categorization.

In October of 2018, the ticker $PTI started to breakout on pre-market news. Some of the best traders I knew felt the move was unjustified and started shorting it. I wanted to take advantage of the momentum and, influenced by FOMO, I disregarded my rules and took a short position.

Long story short, what started out as a hopeful pre-market scalp trade ended up as a $200,000 loss – in a single day.

The next day, I came to the market with a vengeance, ready to make back the money I had lost the previous day. The market was hot and I found the perfect stock to help me avenge the nasty loss.

YECO was breaking out and I was building my long position. By mid-morning I had already made back a quarter of the previous day’s loss. Normally, I would lock in some of these gains, but I was on a mission to wipe out the previous loss with an equivalent winning trade. The stock failed its mid-day breakout but I wasn’t ready to call it quits. I figured I could hold the position overnight and avenge my loss the next day – and that’s exactly what I did. Unfortunately, justice wasn’t served, and I found myself staring at another $50,000 loss as the stock gapped down.

The PTI FOMO-trade triggered a sequence of events that led to $250,000 in trading losses. That’s how dangerous trading can be when you ignore your core strategy and go rogue. Sure, you may get rewarded for reckless behavior from time-to-time, but ultimately it will catch up to you.

You’re not immune – I guarantee it.

Create your trade categories. Refine your trade categories. And, most importantly, RESPECT your trade categories.

Thank you.

as far as wisdom goes the advice is worth in GOLD!

Thanks for this information, look forward to meeting you.

Randy Acevedo

Awesome, thanks!

Thanks Nate

Golden advice… thanks for taking the time to post it…

Great words! Thanks for sharing your experience.

Very Correct. Revenge Trading is Dangerous. Your experience you shared (trade categories) in this post is worth reading for all kind of traders. I haves seen even experienced traders make the same mistake somewhere someday!

Thank you for sharing your two strategies.

Tnx Great info.