Learning how to short sell stocks is a great way to take advantage of both sides of the market (bullish and bearish movements). If you only place long trades, you will analyze every chart with a long-bias and limit your opportunities. When you add short selling to your toolkit, you become a more well-rounded trader who can analyze charts and take action on both long or short setups. This expands your trading opportunities and allows you to participate in different types of market action.

Short selling can be a profitable strategy, but it also comes with additional risk. When you take a long position, the most you can lose is 100% of your money. When you take a short position, your potential risk is infinite. A stock can run from $5 to $10 to $20, etc, meaning you can lose over 100% of your initial investment. Basic trading rules (such as cutting losses early) can protect you from these risks, however there are a few other things to consider.

1. Timing and Squeezes

A lot of the points we are about to discuss revolve around one main concept – short squeezes. A short squeeze occurs when a stock artificially increases in price due to shorts covering their positions. Covering a position in a stock is basically the same as buying it (from a supply and demand perspective). This is considered “artificial” because these aren’t genuine buyers who expect the stock to go up – they are simply short sellers cutting losses. Regardless, they have the same effect on the market.

When planning a short position, timing is crucial.

Shorts may have the right thesis on a stock, but if their timing is off, they will pay the price. For example, a stock may run up 50% on phony news. It wouldn’t be unfair to assume that the move was unjustified, which may lead shorts to start piling in. But what happens if the stock keeps going up to 60%…70%…80%? Naturally, shorts will start to cover their positions, ironically, making the stock go up even further.

The main takeaway here – don’t get trigger happy with your shorts. Be patient and make sure to time it properly – especially on low float stocks.

2. Float & Volume

A stock’s “float” is the number of freely traded shares on the market. Think of a stock as a pie, where the number of shares (the float) are the slices. This “pie” can be cut into 10 pieces or 10 million pieces. This ties back to the concept of supply and demand.

If a pie has 10 million slices and 1000 people want to buy a slice, everyone can be accommodated with very little competition between buyers. If a pie has 10 slices and 1000 people want to buy a piece, the bidding war begins, and the prices of the pie are likely to skyrocket. In both cases, 1000 people want a slice of pie, but when supply is limited, prices become more volatile. (Note: this volatility can also favor the downside when sellers overpower buyers)

Moving away from the analogy — stocks with lower floats (supply) are susceptible to higher volatility on relatively lower levels of volume (demand). This becomes particularly important for short sellers because higher volatility can lead a stock into a short squeeze.

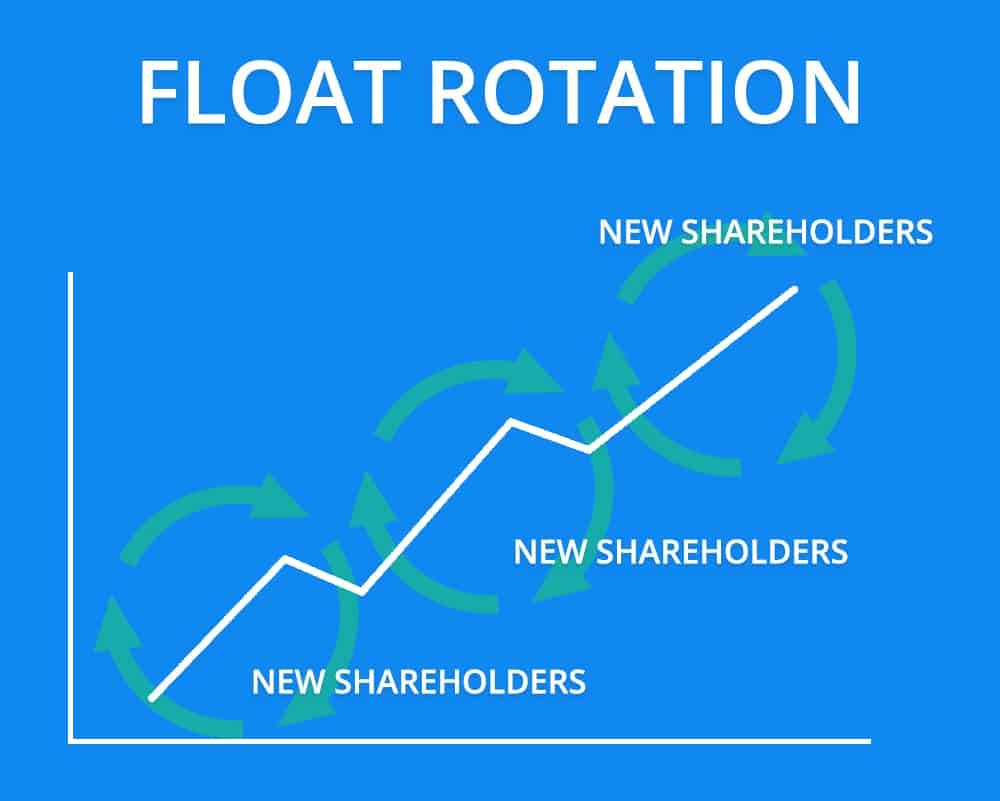

Float Rotation

“Float rotation” is another thing to be aware of when trading low float stocks. Float rotation occurs when a stock’s volume is a multiple of it’s float. For example, if a stock has a 5 million share float and trades 10 million shares of volume on the day, the float has been “rotated “twice.

Think of float rotation as a “refresh” of shareholders. As new shareholders take on positions, the stock’s trading behavior changes. This is best viewed with an example.

- Short seller A shorts 1000 shares of $XYZ at $5 and gets squeezed out at $7

- Short Seller B shorts 1000 shares of $XYZ at $7 and gets squeezed out at $9

- Short Seller C shorts 1000 shares of $XYZ at $9 and gets squeezed out at $11

As new shareholders enter the stock, it’s almost as if the stock resets and gets new life.

This is also effective for chipping away at the shares of traders who took larger positions. As a stock ramps and dips, it will shake out weaker hands (on the long side), meaning traders who are sized in will have less of an impact on the stock (as they will be selling their shares to new holders). These new holders buy up the dips, meaning the dips become traps for short sellers who think the stock is about to reverse. As the float continues to rotate, the stock can run farther than most expect.

This can be compared to the difference between a standard race and a relay race. In a standard race, one runner runs the whole way. In a relay race, runners run shorter distances and “pass the baton” onto the next runner who continues the sprint. While a single runner may not be able to complete a 100-mile race, a group of runners certainly can.

3. Crowded Trades

Before entering a short trade, you should think about how “crowded” it is. How many other short sellers have the exact same trade ideas as you? When too many early shorts enter a trade, the results can be catastrophic.

All of these short positions will need to be covered, meaning the stock is filled with future buyers. If the group’s short thesis was wrong or the timing was off, everyone will start covering and squeeze each other out of the trade.

4. Current Market Trends

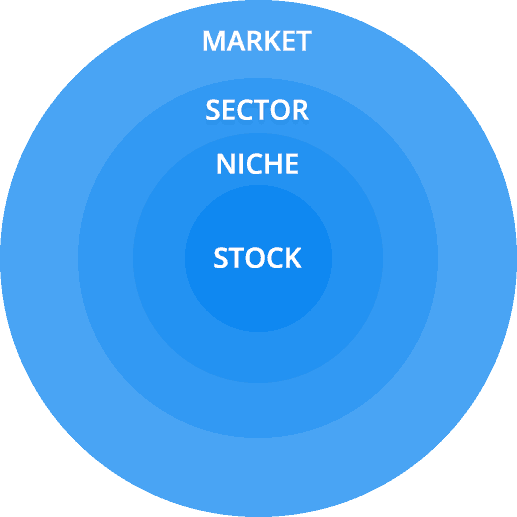

Individual stocks are influenced by external factors such as market conditions, sector strength, and other trends. It’s important to pay attention to these trends because they will affect the outcomes of your trades. For example, if the S&P500 is rallying, you may not want to short top S&P stocks like AAPL, MSFT, and AMZN – you would be fighting the market trend. This is an example of a “broader” market trend. There are also smaller trends within these markets.

Towards the end of 2017, blockchain stocks were the hot new thing. Companies who simply mentioned the word “blockchain” in a press release would skyrocket. For example, a company named “Long Island Iced Tea Corp” (LTEA) changed their name to “Long Blockchain Corp” (LBCC) and decided to shift their focus from beverages to blockchain technology. The stock proceeded to run nearly 300% in a single day. Rational? No. But, this was the theme at the time, as blockchain stocks like RIOT, XNET, DPW, and a handful of others were experiencing similar move. LTEA’s press release may have gone unnoticed in other market conditions, but due to the hype around blockchain technology at the time, it went parabolic.

If you shorted LTEA (now LBCC) into the open, you would have been squeezed, regardless of the legitimacy of your thesis. Diligent short sellers should be aware of trends like these and plan their entries accordingly.

5. Strength Relative to VWAP

When planning intraday short trades, it’s important to account for a stock’s relative strength. Relative strength can be measured in a few ways, but the easiest method is to see where a stock is trading relative to VWAP (volume weighted average price).

A stock trading above VWAP could be considered strong, whereas a stock trading below VWAP could be considered weak. The last thing you want to do is short a strong stock with full conviction. This isn’t to say you should never short a stock above VWAP, but if you are going to short it, recognize that you are fighting the trend, and trade accordingly.

If a stock is trading above VWAP, you’re better off scalping trades and waiting for confirmation of a breakdown. Short into pops and take profits into pullbacks. Don’t hold out for the “big move” or you may find yourself squeezed out of a position.

Once a stock is trading below VWAP, you can be more patient with the trade and let it play out using set risk levels.

6. Underlying Catalysts

Momentum traders are primarily focused on price action (technical analysis), but understanding the reason a stock is moving can help you gauge the legitimacy of the move.

For example, if a small cap company runs 30% on the announcement of a $100 million deal with Amazon, the move may be justified. You may expect the stock to run for a few days. Contrarily, if a small cap company runs 30% after announcing their product was added to the Amazon marketplace, the move may be over-exaggerated. In this case, you may expect the stock to return to a reasonable price range in a shorter period of time.

Of course, the market isn’t always rational so you shouldn’t get carried away with this type of analysis, however it can be helpful to understand why a stock is behaving the way it is.

7. Upcoming Catalysts

If you are going to hold a short position for a longer period of time, you should be aware of upcoming catalysts as well. Upcoming catalysts may include earnings, FDA decisions, takeout rumors, reasons for a potential halt, etc. One press release can cause a seemingly weak stock to gap up – a nightmare for short sellers.

Of course, you should be this diligent with all of your longer term trades, however it’s especially important when holding a short position where you have theoretically infinite risk and the potential for margin calls.

8. Frontside vs. Backside

As repeated throughout this article, timing is everything when it comes to short selling. When a stock goes parabolic, it can be tempting to short into the initial move. It may seem ridiculous for a stock to run 50-100% on seemingly nonsensical news. Moves like this have “SHORT!” written all over them.

Stocks that experience these unjustified movements will often retreat back to a reasonable price range, but you shouldn’t underestimate how high they can go first. Take a stock like RIOT as an example. The stock ran from ~$4 to ~$46 (frontside of the move) when blockchain stocks were hot. This move probably seemed irrational at $8…then $15…..then $25….etc. If you were short at $8 and stuck to your guns, you would have blown up your trading account. Stocks like these can run higher than expected and it’s easy for early shorts to get run over.

RIOT eventually retreated back to ~$10 (backside of the move) after volume faded and hype died down, leaving plenty of short opportunities. It’s easy to feel like you are missing out on a great entry if you wait to short a stock but you are actually protecting yourself. The backside of the move will provide plenty of opportunities to short with set risk.

Notice how the frontside of the move is characterized by high volume and large candles. As the volume fades, the stock makes a few recovery attempts before fizzling back to it’s original breakout point.

9. Is It Shortable?

Once you’ve found a good short setup, you need to make sure you can actually short the stock with your broker. You can’t short every stock, especially if you are using a discount broker.

Check to see if your broker has shares to short BEFORE planning the trade. If the shares are “easy-to-borrow”, you’re in the clear. If the shares are “hard-to-borrow” there will be an additional cost associated with shorting the stock. Once again, it’s best to figure this out before the market even opens. If your broker doesn’t have shares, you will be unable to short the stock. The last thing you want to do is stalk a ticker all day waiting for the perfect entry only to find out you can’t borrow any shares.

Discount brokers like ETRADE and TD Ameritrade cater more towards long traders and will have a limited short inventory. Certain brokers, like Centerpoint Securities and SpeedTrader have more extensive short lists. If short selling becomes a bigger part of your trading strategy, you will want to make sure you have a broker that can accommodate your style.

Fees

There are some additional trading fees associated with short selling. When you place a long trade, you simply pay a commission for the trade (and routing fees, when applicable).

When you place a short trade, you may pay locate fees and interest on hard-to-borrow stocks.

What can you do about these additional fees? Absolutely nothing.

Fees and commissions are just the cost of doing business as a trader. These fees should never make or break a trade. If they do, the issue is probably with the trade itself.

More on Short Selling

For more information on short selling, check out this segment from our free trading course.

Absolutely great lesson. Full of detailed, applicable details for the momentum (price action) trader. I finally get how Float and VWAP play a role.. Never heard anyone explain back and front of the move. Nate, you good!!!!

Awesome guide for traders, worth reading it actually I believed if we managed this above mentions keys then we would be profitable..

Thanks! Amazing info, easy to understand.

Great post, very detailed, and an all around good read. Thanks for the tips.

Great information worth the read, well explained and easy to understand,thank you.

goooood stuff

Nate: you are awesome! Love the way you explain all the topics in a very friendly yet professional way….can’t wait for new posts like this: cheers man.

Nate and IU team you Thank you for this lesson

Very well explained

Thanks guys great explanation for new comers

Great article, thanks for posting.

👍👍

Thank you

Can never get enough of of the basics no matter how long you been in this game. tks Nate

About the fees absolutely noting, true! Except recently CenterPoint has added up to 30% discount on locates, depending how big your capital is.