We’re back with another lesson in our free beginners video course. The reception to this course has been great. We encourage everyone to provide feedback by leaving a comment on this post or on the YouTube videos. Let us know what you want to learn about next.

In case you missed the previous lessons, you can find them here:

- Lesson 1 of 8: Intro to Day Trading

- Lesson 2 of 8: Intro to Technical Analysis

- Lesson 3 of 8: Intro to Long Setups

- Lesson 4 of 8: Intro to Short Selling

- Lesson 5 of 8: Intro to Trading Computers

- Lesson 6 of 8: Intro to Stock Brokers

This week we are going to be talking about scanning for stocks. Scanning for stocks is what allows you to find ideal trading candidates within the overwhelmingly large pool of stocks available to trade.

If you are not already trading with us in the chat room, we highly recommend doing so!

Let’s get to it.

Scanning for Stocks Video Course

Topics Covered in the Video:

Introduction to Scanning

Scanning for stocks is one of the most important responsibilities of a day trader. Think of this process as filtering out all of the noise from the markets so that you can focus on the stocks that actually provide good trading opportunities. There are a variety of different types of scans you can run, but the end goal is the same. Most traders will run a scan the night before the next trading day in order to build their watch lists. Active day traders will continuously scan the market during the day to find even more trading setups. In this segment of the video, we discuss the importance of scanning and how you should approach it.

Scanning Criteria

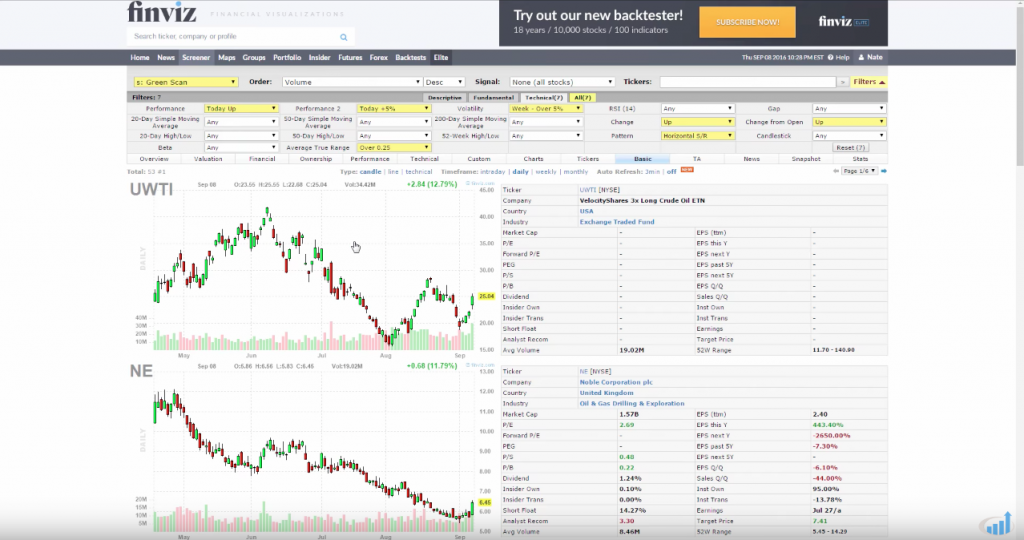

A scan is only as good as the criteria it uses to filter stocks. Fine tuning the criteria you use to find stocks to trade can take time but the results are well worth it. There is no perfect set of criteria when it comes to stock scans. The goal is to find trading setups that align with your trading strategy. In this segment of the video course, we discuss a few of the things we look for when we scan for stocks.

Free Stock Scanning Tools

There are a bunch of different scanning tools that you can use. Every trader will have a different preference. Most brokers will provide scanning tools within their trading software. If you are looking for a free scanner, FinViz is a great option. We use FinViz at Investors Underground to create our nightly scans. In this segment of the video, we go over some of the scanning criteria we use to find stocks to trade every day.

Types of Scanners

As mentioned earlier, you can scan for stocks before or during the trading day. While FinViz may work well for preparing watch lists, it won’t be your most efficient option for real-time market scanning. In this segment of the video course, we go over some of the other types of scanners you can use during the day, including live market scanners, news scanners, and even chat rooms.

Using Twitter

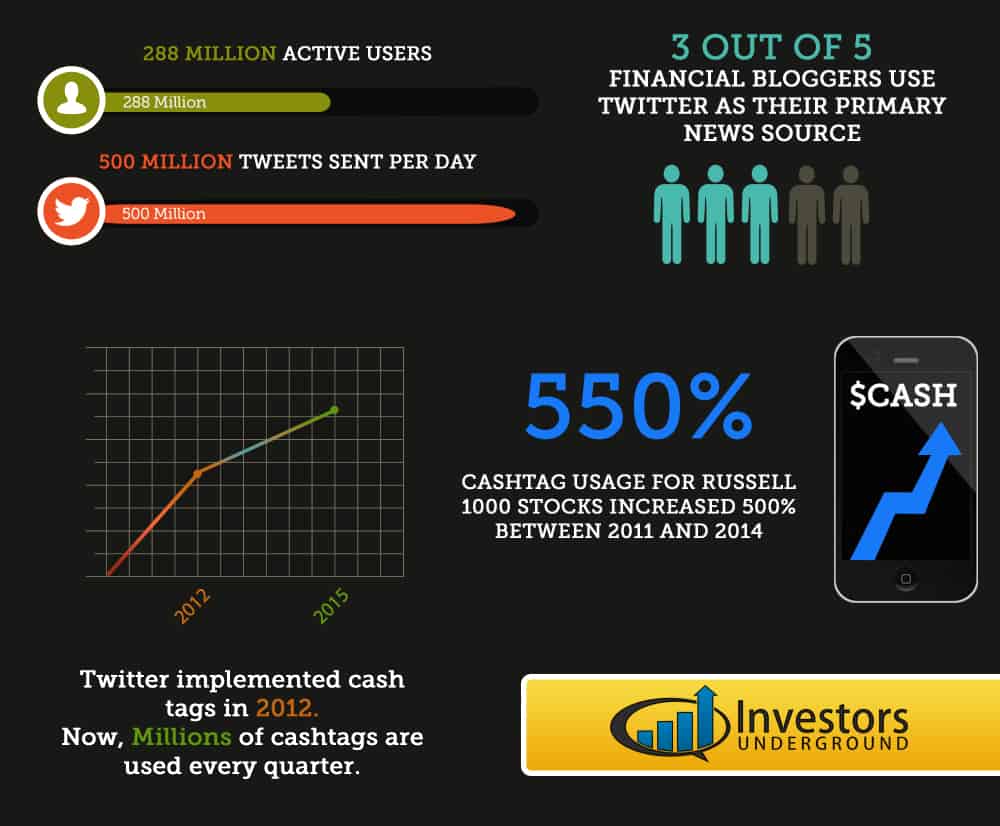

Believe it or not, Twitter can be a great scanning tool. A stock’s price is controlled by the public sentiment. Twitter gives you the ability to see how other traders feel about a stock. Furthermore, it gives you real-time access to market news and trade ideas. There’s a lot of noise on Twitter but if you can filter through it, it can be a valuable tool. In this segment of the course, we discuss how to use Twitter to improve your trading.

Understanding Former Runners

Those who have seen Textbook Trading are familiar with the concept of former runners. A former runner is a stock that has experienced a significant price run some time in the past. Why is this important? First, these are familiar tickers. Traders tend to remember the stocks that experience exponential runs due to the excitement surrounding the move. Secondly, these runs are proof that the stock has the ability to experience high levels of volatility (assuming the share structure has not changed). In this segment of the course, we discuss how you can find former runners and use them to plan better trades.

Watched it.. Good job and thanks

When did scanners became main stream? Was it the 90´s or more recent?

How did traders managed before scanners came about? I bet they ad lots of liquidity and volatility to the market. I hear people say that once a stock shows up on everyones scanners, the price moves. Great Job Nate!!!!

“How did traders managed before scanners came about?”

Stock charts used to come in books published quarterly. I used a draftsman board, T square, triangles, scissors pencil and rubber cement! That was a llong time ago!

So what indicators do u use with ABCD pattern?