Nowadays, technology plays a huge role in day trading. Traders rely heavily on their computers, internet connections, and trading software in order to execute their daily trading plans. Awhile back, we gave you a front row seat to the trading desks of many successful traders. This week, we are going to discuss some of the things you need to know when creating your own setup. We highly recommend that you watch the first four videos in our beginners day trading guide if you haven’t already.

- Lesson #1: Introduction to Day Trading

- Lesson #2: Technical Analysis

- Lesson #3: Bullish Setups

- Lesson #4: How to Short Sell Stocks

We are proud to announce video #5 in the series! This week, we will be focusing on the technology that enables you to execute your trading strategy.

Trading Software and Computers

What is Covered in This Video Guide

This video guide goes over everything you need to know about day trading computers and trading platforms. As a day trader, your computer and trading platform can have a big impact on your day-to-day trading activities. Your technology is what allows you to execute your trading plan so it’s important to optimize your setup. Maximizing the effectiveness of your trading setup is one of the “easiest” things you can do to improve your trading results. Of course, you still need to have a solid strategy in order to find success in the stock market, but improving your trading setup can make your day-to-day activities much easier. A fast internet connection, powerful trading computer, and resourceful trading software make it easier for you to execute your strategy. It can also make your daily trading experience much more pleasant.

Here are a few things to consider:

Your Trading Desk & Work Environment

Day trading is great because it allows you to make money from the comfort of your own home. That said, a lot of discipline is required in order to make sure you remain productive on a daily basis. Your environment can effect your daily productivity, so it’s important to make sure you are setting yourself up for success. You want to minimize distractions and create a clear environment that is conducive to a positive trading experience. In this video, we go over a few tips to maximize productivity and keep your trading desk organized.

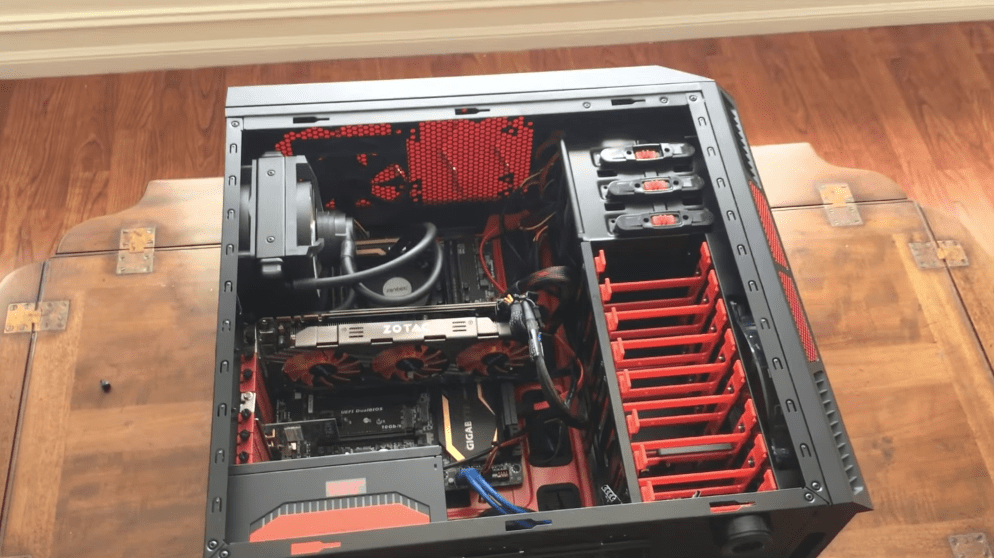

Your Day Trading Computer Setup

Aside from your brain, your trading computer is the most important tool in your arsenal. You do all of your research, charting, and actual trading from your computer so it’s important to make sure that you have a good setup. A sub-par setup can hinder your efficiency and cause unnecessary problems during the trading day. You don’t want to be dealing with a slow computer or bad internet connection during the trading day. That should not be the hard part about day trading. In fact, getting a good day trading computer is one of the easiest things you can do to increase your efficiency as a day trader and it doesn’t need to break the bank. You don’t need tons of monitors and a state of the art computer to execute your strategy. You can start small and upgrade over time. In this video, we go over a few recommendations for setting up a trading computer that will meet your needs.

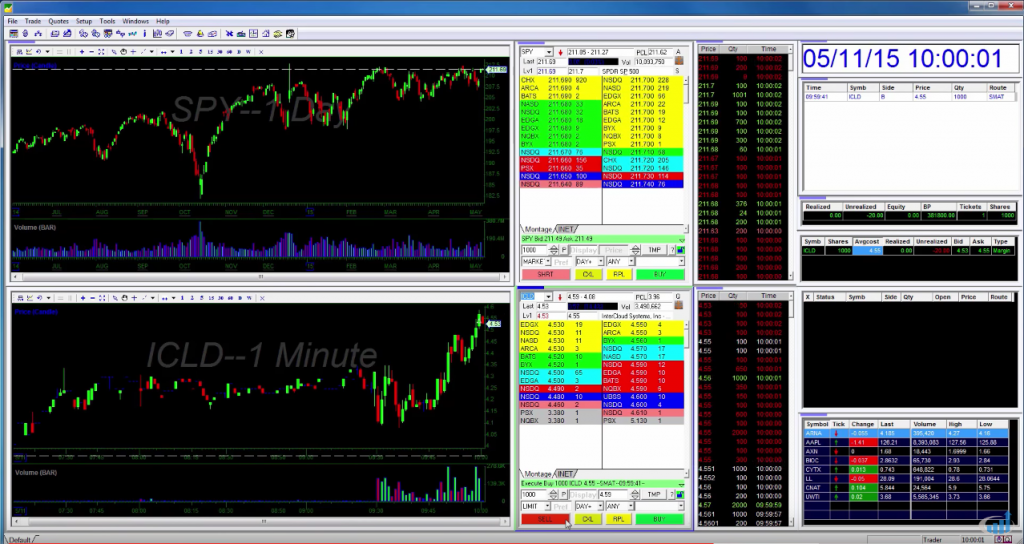

Your Day Trading Software

Day trading software is the tool that provides you with all of the real-time market data you need to make decisions. Trading platforms include stock charts, level 2 screens, market scanners, news, and more. This is by far the most powerful resource you will use as a day trader. Essentially, your day trading software is what connects you to the stock market. You want to make sure you have access to the best tools possible, as this is what will give you an edge in the markets. In this video, we go over the best day trading software and do a video walkthrough of how to use it properly. We cover:

- Setting up charts and technical indicators

- Setting up level 2 screens

- Placing trades and choosing routes

- Best practice recommendations

Next Week: Stock Brokers

In the next video, we will be going over stock brokers. Make sure to subscribe to the channel to be the first to know about new videos!

If you have any questions about this week’s video, post in the comments below. Feel free to share pictures of your trading setup as well!

0 Comments