Timing is EVERYTHING. The more time that passes the more I realize just how important timing and patience really is.

Bad timing on a trade can be the difference between a profit and a loss. But patience on the trade can be the difference between a normal trade and a legendary trade.

I’ve been blessed to have found what I love doing at such a young age. I love what I do. I jump out of bed everyday at 7am excited to see what opportunity the market gives each morning.

I think A LOT of my success is because of timing. I started trading in February of 2014 with no knowledge of anything. I was COMPLETELY clueless. I didn’t even know “day trading” was a thing. I thought if you wanted to play in the market it HAD to be long term. I was even a sheep in a penny stock chat room for a few months. I never learned anything and I would lose money consistently. I knew that if I wanted to be the best I had to surround myself with the best. Luckily I found Investors Underground. IU changed my life forever. It wasn’t an easy journey. I lost many many times until I finally started to slowly get the hang of things. I was never spoon fed. But after tons of “market tuition” I learned how to slowly be profitable and consistent.

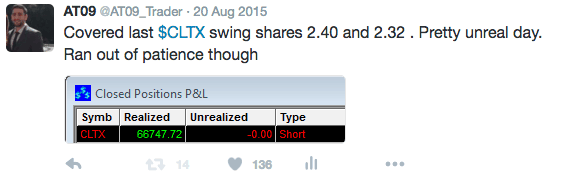

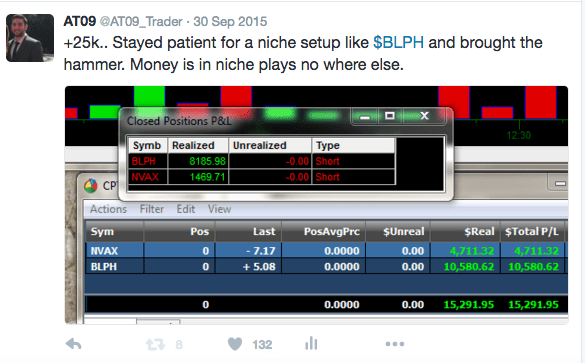

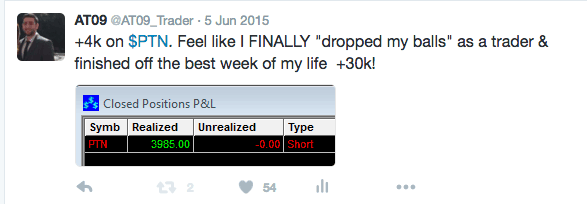

PnL’s went from:

I was in the right place at the right time. Each morning the market would spit out TONS of opportunity and by the end of 2015 I was up six figures from the puny few thousand I started with in 2014.

Being in the green that much is nothing to joke about, but I know I could do better. I know I was meant for better. My biggest strength is also my biggest weakness.

SUCCESS.

It drives me crazy. The hunger for success keeps me up at night. It consumes my thoughts daily. It’s become an obsession. The thought of self-made success intoxicates me. Sometimes it consumes me too much and I don’t enjoy myself because that’s all that’s on my mind.

When Nate convinced me to come to T4AC I was a little hesitant but I knew that if I wanted long-term success I had to surround myself with the best. I was excited to meet everyone, but I had been talking with @MonacoTrader a lot before hand and couldn’t wait to meet him.

As we shared a beer by the pool we started talking about our mutual love for fast exotic cars and how we both started trading. He started explaining that when he was young he started making his money in real estate. I always thought of getting my feet wet in real estate but never knew how to start. Just like trading 2 years ago I was CLUELESS. I was hesitant to start something new that took me out of my comfort zone, but was still up for the challenge.

MonacoTrader went on to say that he started with foreclosed properties. I wont go into his exact strategy but he would build a team, fix the property up and eventually sell for a profit. He would rent some others out and then repeat the process until he could move on to bigger and better properties. Throughout the whole conversation he told me that I was very lucky to be so young.

MonacoTrader is the definition of an entrepreneur. He’s involved in real estate, venture capital and trades just because he loves every moment of it. That’s when it hit me. To be successful… REALLYsuccessful I have to diversify. I can’t just rely on trading as my only source of income.

By the end of 2015 the market started slowing down. Small caps weren’t as active as they once were. I felt that I was losing my edge. So I decided that its time to diversify my investment strategy.

I wanted to use my age and my early success in the market to my advantage. I want to learn all of the hard lessons and make tons of mistakes while I’m young so that as I grow older it all becomes easier because of my experience.

There is a big difference between telling yourself you want to do something and actually taking the risk and going forward with it.

I knew that if I really wanted to give this real estate thing my all I had to take a break from trading. I didn’t want to give 50% of my focus to the market and 50% to real estate. I know I needed 100% focus when starting out.

So that’s what I did. By the end of 2015 I started researching what the criteria is for a foreclosed property that has “potential” I started putting offers on properties that I saw this “potential” in. My offer eventually got accepted and I was immediately overwhelmed with excitement and nervousness. I had no clue what I was getting myself into lol.

**SIDE NOTE**

(When the market was hot I felt school was holding me back a lot. I was a trader in the morning and a full time student from the afternoon to the night. I clearly wasn’t doing as well as I should’ve in school because my focus was in trading. I would skip class to trade. I wouldn’t show up to class on bad trading days. Fail tests because I wouldn’t study. My time was consumed with scanning and preparing for the next trading day. I felt like a total failure because I wasn’t keeping my grades up. I went from an A/B student to a C/D student. Toward the end of 2015 I was very close to dropping out and just focusing 100% on trading. I had many tell me college was important and that I shouldn’t give up on it. I thought they were wrong until I really thought about it. I had spent about $50,000+ so far on college tuition so throwing it away without a degree was foolish. My mind was consumed with trading 24/7 so when this house project became a real thing I decided that I would already be spending some time away from trading to focus on the house so I might as well finish and get my degree on time as well. So that’s what I did. I decided to stay in school and finish it for good. I graduated with a bachelor’s degree in Finance on May 13, 2016. I’m glad I stuck to it. (Anyway back to the blog.)

Ironically FannieMae (FNMA) owned the property lol. After the property was officially closed the search for a contractor began. Keep in mind I still really didn’t know what I doing. All I knew was my estimated budget for materials, my budget for the contractor and my estimated sell price based on comparable homes that sold in the area.

***At first the plan was to fix up the property and rent it out, but the more I thought about it the more I realized that the house wasn’t in the best area so finding a good tenant and collecting rent might’ve been more of a challenge than I first thought. So as the project came closer to completion I decided to just “flip” the house instead and use that money to fix another property in a better area for more reliable rental income***

This is what it looked like in the beginning:

My mornings went from waking up at 7am checking the morning news/gappers. To waking up at 7am and driving to the local Home Depot/ Lowes in the area and calling contractors from the numbers I saw on their vans. A new grind had started. I didn’t know what a “good price” was or if I was getting ripped off so I decided to interview as many contractors as possible to get a range of prices. I showed about 30 contractors the property over a 2-week span telling them what I needed done for the property. I would get tons of different estimates ranging from 15-70k.

I didn’t want to choose the cheapest one because I didn’t know what kind of work they’ve done in the past, or if they were just going to take the money and run like many contractors do. I got drunk one weekend with my friends and shared my situation with them. While dealing with all the stress of this house I forgot that one of my friends Peter owns a hardware store and deals with contractors for a living. I told him that if he was able to find me a good contractor I would buy all of my materials from him. It worked. He found me a guy that was cheap and did really good work and has also been friends with Peters father for longer than I’ve been alive. Peter also agreed to give me 10% off everything in store.

Now that the hunt for a contractor was over, I had to hunt for a plumber and an electrician. The plumbing was an absolute mess. Pipes were stolen/broken. The house had a lot of electrical issues that weren’t up to code, which meant that, it had to be fixed too. Luckily my contractor had his own team that had a plumber and electrician. Their prices were a little higher than expected, but the house also had more issues than I expected.

MonacoTrader had also told me to watch out because there might also be “random issues” that come up when work begins on the house. He said that some contractors would take advantage of me. He was right. One problem was my age. Because I’m so young the contractor wanted to take advantage of me because I clearly didn’t know better. There was a problem with one of the pipes in the bathroom, then a few days later a problem with the gutters. It felt like every single day there was a new problem that would cost 500-1k to fix. I was already on a tight budget because this was my first project, but there was nothing I could do about it. I had to learn the hard way.

As all of this was happening I was still checking in on the market every day at close. I didn’t want to get rusty while I was away. I wanted to see how the market was changing so that when I came back I wouldn’t be as lost. Like I said in the beginning of this TIMING IS EVERYTHING. It seemed like timing and luck was on my side again. The market got even worse for small caps in the beginning of 2016. I would see many traders on twitter struggling. Many telling me that I’m not missing anything and that I’m probably saving money by not trading this market. My idea to diversify couldn’t have come at a better time.

Anyway. All my research led me to the fact that the kitchen and the bathrooms are what sell a house. I cant cheap out there. Now I had to decide what cabinets, countertops, tiles, flooring, paint etc etc to buy for the house. I was overwhelmed. I went to Home Depot, but their selection was average and shitty to be honest. I had to go to a tile and floor specialty store. I needed to get tiles and flooring that would catch the eye of a buyer. I eventually found a combination for the kitchen, bathroom and main flooring that would catch my eye and hoped it would do the same for a buyer.

Time kept passing. I would visit the property a couple times a week to see the progress.

During February-April I still didn’t want to trade because this market was much more different than I was used to. Instead I decided to just observe and see what I could learn and try to find a way to adapt.

After the long wait of about 4.5 months the project was finally completed. It took much longer than I had expected because the town was such a headache with inspections. The inspector would work 2 days a week and when I would schedule an inspection he wouldn’t show up. Toward the end the contractors team would start showing up less and less as well. The whole thing became a big clusterfuck.

Now the scary part was if it was going to sell for my projected price. This being my first project I was okay with going breakeven because it was a learning process, but I REALLY did not want to take a loss on it. I didn’t want to put in all that work to have a loss. It would discourage me.

THE FINAL RESULT!

After it was all said and done I learned a lot from this project. The most important thing I learned is that trading really is my true love and passion. There is nothing like it. I love every moment of it. Like Modern_Rock says:

“If someone cut off my hands I would find a way to trade with my feet instead.”

July was my FIRST month back trading full time. I was more than OK to trade smaller and be ready for a slower month, but to my surprise the low float market was on complete fire. My expectations were far exceeded. Once again I was in the right place at the right time and was able to recognize the opportunities in front of me and take advantage of it leading to a 100k month which is about 3x more than my profit expectations for this house over the 4.5 month span that it took. Crazy.

I always thought being consistent was a slow process, but now I realize that being consistent and not egotistical in the market is a gift. After this house project I learned that It really is hard to make a dollar in the “real world”.

Even though taking a disgusting house and turning into something someone can live in was fun. I know for a fact that I don’t have the same love for it as I do for trading. Going forward I’m going to continue trading full time and handle real estate on the side. It’ll keep me busy during lull, and will help me diversify my investment strategy.

I’m glad I went through this because it led me to fell in love with trading all over again.

Wow Alex, thanks for sharing, the house looks really nice!

thank Adam for this experience and story. Well done