Hopefully, by now you are aware of our new “Learn How to Day Trade” series where we will be going over a wide range of valuable day trading lessons. Think your past the beginners stage? Have a look at some of these videos and then decide! While these videos are designed to help new traders learn about our approach to day trading, they are loaded with great information that is relevant to day traders of all skill levels. In case you missed the first two videos:

Learn How to Day Trade: Part 1

Learn How to Day Trade: Part 2

In the first video, we gave an introduction to day trading, discussed risk management strategies, and touched on some high probability chart setups. In the following video, we discussed candlestick charting, stock volume, and level 2 screens.

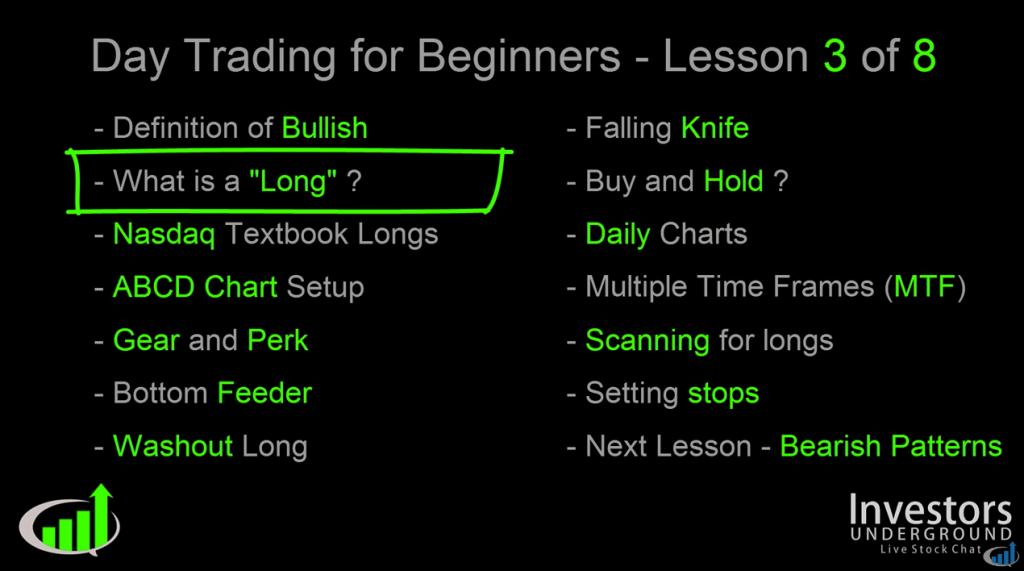

This week, we’d like to introduce one of the most actionable lessons in the series so far. We will be discussing everything you need to know to get started with “long” setups. Without further ado….here’s the video:

Learn How to Day Trade: Part 3

What Is Covered in this Video

This video is packed with actionable trading strategies. We go over a lot of the long setups and chart patterns that we utilize every day in the chat room. You may want to review these setups a few times so you can commit them to memory!

Definition of Long Trades

What exactly is a long trade? No, it has nothing to do with how long you hold your position for. A long trade is simply taking a position where you buy low and sell high. This is the standard approach that most casual investors take when buying stocks. While day traders don’t utilize the same tactics as investors, they can still profit from long setups. This is often referred to as “going long,” “taking a long position,” or being “bullish” on a stock. All of the following setups discussed in the video are long setups.

How to Trade ABCD Chart Setups

The ABCD chart pattern is one of our favorite long setups at Investors Underground. This setup is easy to spot, great for beginners, and best of all, it’s been consistently profitable for years! The ABCD pattern is an ideal setup because it allows you to go into a trade with a set risk and a much higher expected reward. We call this a high probability setup, as discussed in the first video.

Gearing and Perking

“Gearing and perking” refers to a type of price action where a stock will repeatedly wind down and pop back up. When the stock pops back up, it provides us with a great opportunity to take a long position. Recognizing this pattern can be a great way to start planning a future trade.

Washout Longs and Bottom Feeders

As a day trader, it’s important to remember that taking a long position does NOT mean you believe in the company or think it is a good stock. As traders, we are simply taking advantage of a stock’s price action. We could care less about the company’s future earning potential, their “innovative” new products, and any other hype. On that note, not all long trades are placed strong bullish charts. Sometimes, a stock chart is so beat down that it may experience a small bounce before continuing it’s down trend. This type of bounce, often alluded to by gearing and perking, provides a nice opportunity to get long. For these types of plays, it’s important to not overstay your welcome.

The Importance of Multiple Time Frames

As a day trader, it’s important to avoid tunnel vision and focus on understanding the “bigger picture” of the markets. Although our goal is to buy and sell stocks within the same day, there are other traders/investors out there who are utilizing much longer timeframes. This means that the trading activity for any given day is influenced by a variety of different traders with different goals. For example, you may be looking at a 5-minute chart where a stock has been dropping all day and consider taking a short position. Another group of traders may be looking at the same stock on a daily chart and recognize that the stock is nearing a strong long-term support area, causing them to consider taking a long position. If you short into a high level of buying volume, you could find yourself in trouble. This is why it’s important to understand the broader scopes of the market.

Stop Losses and Proper Trade Management Strategies

Finding a great setup and choosing to take a position in a stock is just half of the battle of becoming a successful day trader. The other half is managing your trades properly. Understanding when it’s time to sell, add shares, or minimize a position requires another skill set. In this chapter we will discuss a few strategies for properly managing trades and deciding when to exit your positions.

awesome stuff. Nate is first rate… (get the rhyme?)

I love the way he simplifies such complex information

This is an excellent introduction to the ‘Beginners Guides’ series. These have proved invaluable for reinforcing the TxtBk trading tutorials. But I haven’t found the rest of the series: #4,5,6,7&8. I highly recommend continuing them as it pays off for the new subscribers as well.

Thanks for your generosity.

Rooch

No questions! You make me wiser every time. Excellent production. Thanks