With great success comes great skepticism.

While some people observe success and become obsessed with cracking the code, others instantly dismiss success as a sham. Pessimists view success as a product of luck and circumstance or, even worse, an intricate deception.

This mentality is particularly prevalent in the trading industry. We’ve heard it all before.

“You’re better off going to a casino than day trading.”

“A monkey could have the same success as a day trader.”

“You can’t compete with algos and high-frequency traders.”

“There’s no such thing as a successful trader.”

We’ve spent a lot of time discussing trading psychology in the past, so this article will not be focused on how detrimental this overly cynical mindset is. Instead, we are going to look at the probabilities of success in trading.

We’re going to show how the pessimistic notion that all traders fail is just as improbable as optimistically assuming every trader succeeds.

An Introduction to Odds

Trading success (or failure) is the amalgamation of the outcomes of numerous trades. If your trading profits exceed your trading losses, you are a profitable trader (i.e., successful). If your trading losses exceed your trading profits, you are an unprofitable trader (i.e., unsuccessful).

Let’s start by looking at the odds of a trade.

Every trade has two possible outcomes – a profit or a loss. A profit is realized when the trade moves in your favor, and a loss is realized when the trade moves against you.

The outcome is dependent on your ability to accurately predict a stock’s price movement. (Keep in mind, you can predict price action in either direction – up or down.)

For now, we’ll use long trades as an example.

When you place a long trade, you are betting that a stock will go up in price. So, what are the odds of that happening?

The odds will vary, but for the sake of this elementary example, we will say they are 50/50. If the odds of the price going up were anything less than 50/50, they would be in favor of the stock price dropping, and you would have a favorable short position. Therefore, the 50/50 assumption is fair for our theoretical example.

Expected Returns

If a stock has a 50% chance of going up and a 50% chance of going down, we can look at the expected return of a trade to determine how profitable a trader may be. Expected returns are calculated as follows:

Expected Return = [Expected Reward x Probability of Reward] – [Expected Risk x Probability of Risk]

We will call this formula the profitability equation.

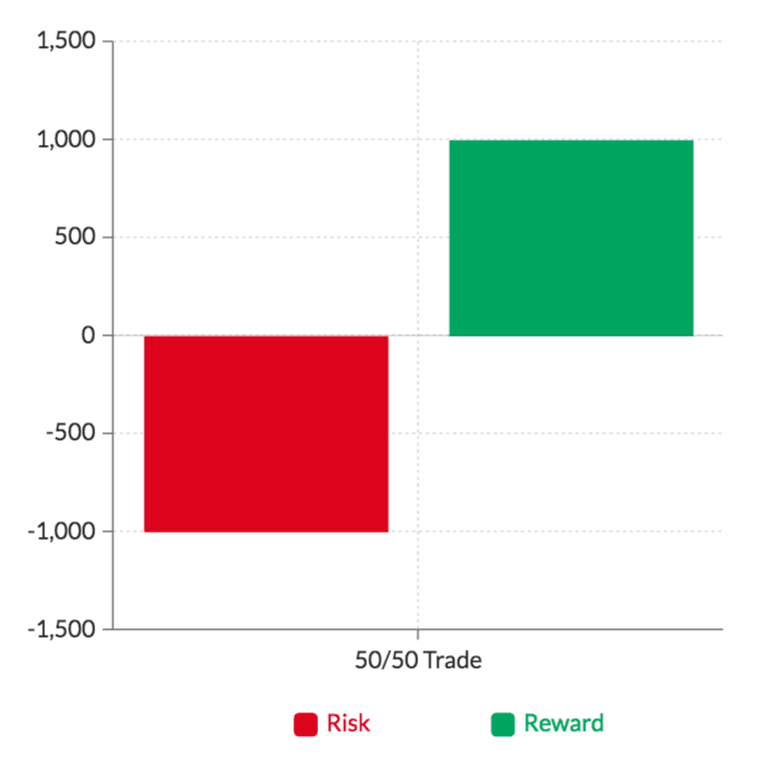

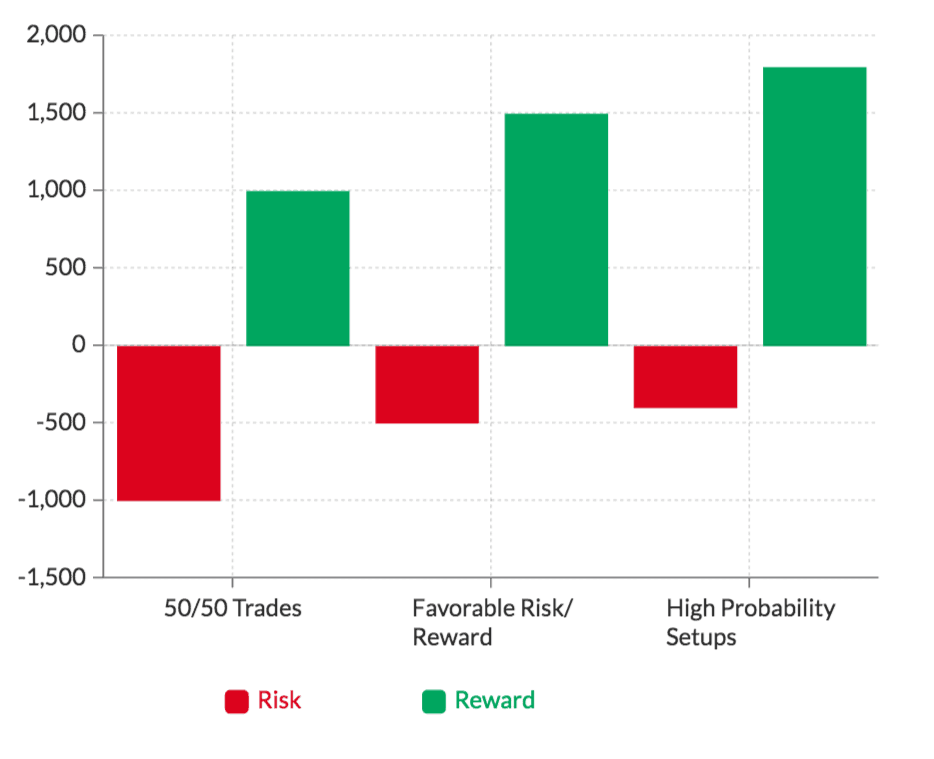

Using our example above, a $1000 double-or-nothing trade with 50/50 odds would have a $0 expected return ([$1000 x 0.5] – [$1000 x 0.5]).

So, with sheer luck alone, the expected return of a trade is $0. These are the same odds as betting on a coin toss.

Of course, we know that trading isn’t as simple as a coin toss, so let’s dive deeper.

The example above is over-simplified and neglects a few key principles of trading. Let’s look at these principles and how they would impact the equation.

Principle #1: Favorable Risk/Reward

In the example above, we assumed that both the risk and the reward would be $1000. This is a double-or-nothing bet that a trader would never take in real life.

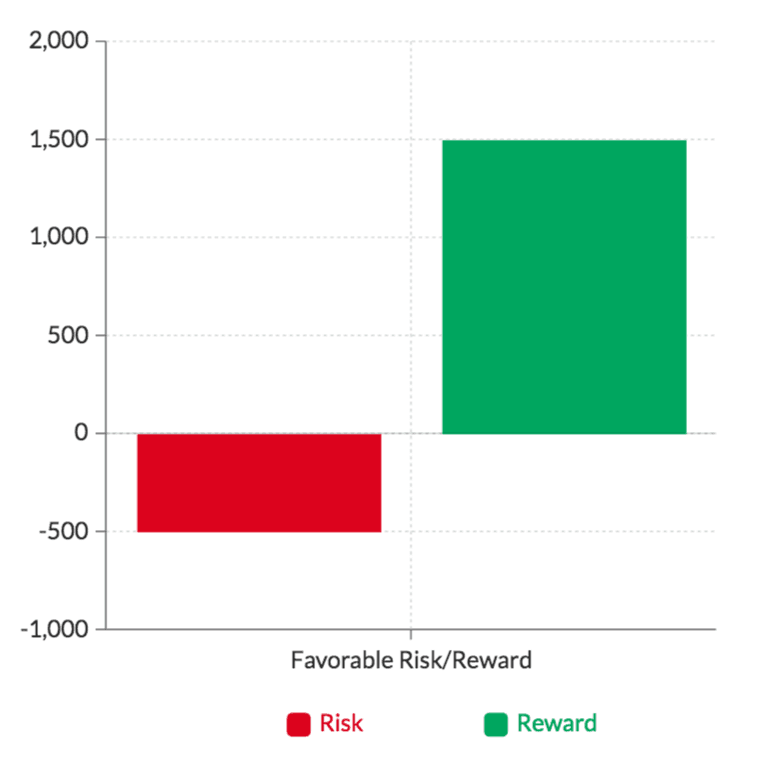

In trading, we hedge risk by making sure our potential reward is higher than our potential risk (generally 3X or more).

So if we purchased 1000 shares in a stock, we might set a stop loss at $1 below our entry price and a profit target at $3 above our entry price. Our risk would be $1000, and our reward would be $3000.

Assuming the odds of success are still 50/50, the new expected return is $1000 ([$3000 x .5] – [$1000 x .5]).

Using this calculation, we can see that 50/50 trades have a positive expected return when we hedge risk properly. Of course, as traders, we aren’t looking to leave our fates to lady luck. We want to find situations in which the probability of success is higher than the probability of failure.

Principle #2: High Probability Setups

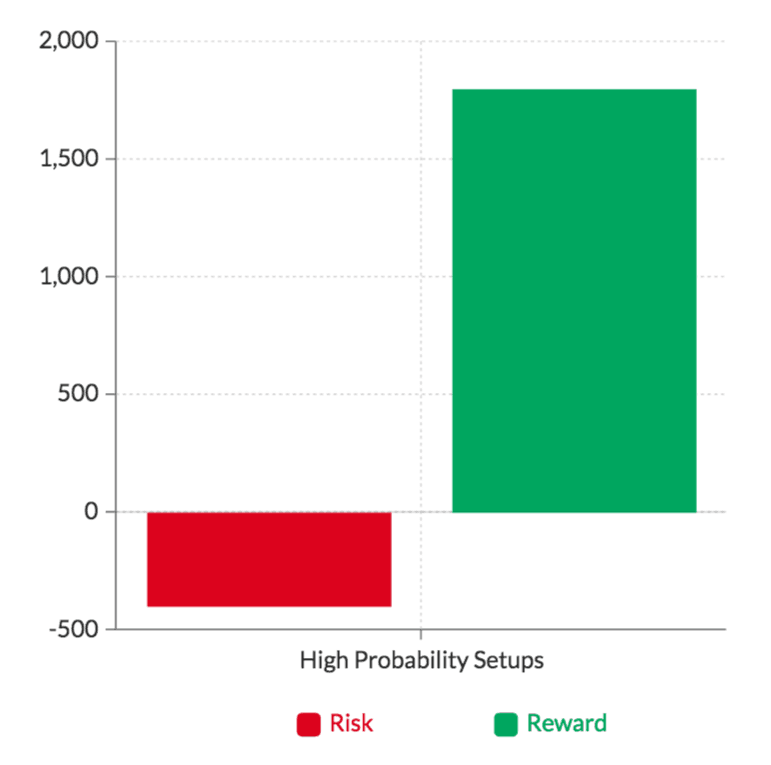

The expected return equation shifts in favor of traders even more when high probability setups are identified. Up until now, we’ve been assuming that the outcome of a trade has 50/50 odds – 50% chance a stock goes up, 50% chance a stock goes down.

In reality, traders look for high probability setups in which the odds of being right are higher than the odds of being wrong. While we can’t predict the odds with 100% certainty, we can find situations in which the odds lean in our favor.

Take two hypothetical examples to illustrate the point.

CASE 1 (Fundamental Analysis): Assume a company valued at $10 million reports that they lost a $2 million contract. Do you think the stock will go up or down? More specifically, what are the odds? Obviously we can’t confidently determine the exact odds BUT it’s safe to say that negative news is more likely to trigger selling and send the price down.

CASE 2 (Technical Analysis): Assume that you’ve analyzed the stock charts of every single public company since the inception of the stock market. You find that 80% of the time when a stock breaks out above it’s 52-week high, it proceeds to run another 10%. Using this historical data, you could assume that a stock breaking above its 52-week high is a bullish setup in which the odds of a price increase are higher than the odds of a price decrease.

Let’s see how this would impact the profitability equation.

To be conservative, let’s say we can find setups in which there is a 60% chance a stock will go up in price and a 40% chance a stock will drop in price.

Combine these odds with our risk/reward model above, and we see that the trade now has an expected return of $1400 ([$3000 * 0.6] – ($1000 x 0.4)].

Compounding Odds

The examples above illustrate the methodology behind trading.

The goal of a trader is to find high probability setups and place trades in which the potential reward outweighs the potential risk by at least 3-to-1. We see how this can shift the profitability equation in favor of the trader.

Of course, this isn’t to say that trading is easy, and traders are guaranteed to make money. They are not. Remember, we are simply discussing the idea of whether or not traders can be consistently profitable.

Trading, in theory, is a lot easier than trading in practice. That said, the rules still hold true.

Every trade can be analyzed using the profitability equation to determine whether or not it is a worthwhile trade. We can also use the profitability equation to predict a trader’s net profitability (an amalgamation of trades vs. one trade at a time).

Net Profitability = [Average $ Profit Per Trade x Win Rate] – [Average $ Loss Per Trade x Loss Rate]

This approach allows us to use a trader’s historical returns to estimate future returns.

We would use aggregate data that would include:

- The Trader’s Win/Loss Rate

- The Traders Average Gain and Average Loss

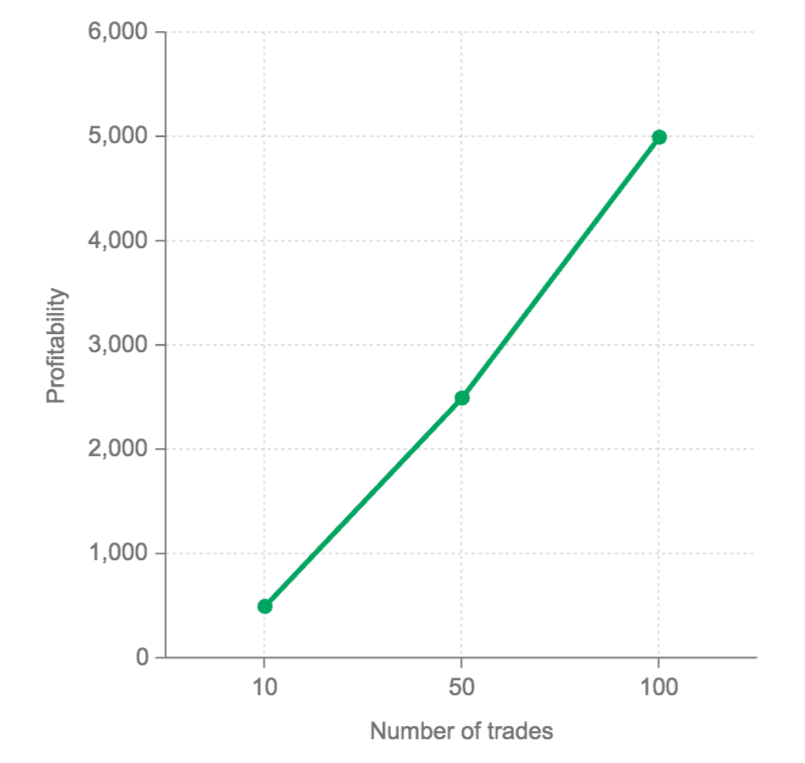

Let’s assume a trader wins 50% of the time and loses 50% of the time. The average profit is $200, and the average loss is $100.

Assuming these numbers hold true, the trader has an expected return of $50 per trade ([$200 x 0.5] – [$100 x 0.5]). If the trader places ten trades, he will make $500. If the trader places 100 trades, he will make $5000.

The trader can increase profitability in the following ways:

- Increasing the average profit

- Decreasing the average loss

- Increasing the ratio of winning-to-losing trades

The Obvious Counter Arguments

We’ve done the math to show how traders can be profitable, but we also know that the majority of traders are not.

The calculations above are not intended to make trading seem easy, nor are they intended to make it seem like traders are guaranteed to be profitable. If you’ve ever listened to a pitch for an MLM scheme or timeshare opportunity, you know that what sounds super simple on paper is much more difficult in real life. Complications always arise.

So, what do those complications look like in trading?

There are only two parts to our profitability equation, so let’s look at where they can go wrong.

Losses > Gains

The most common way traders disrupt the profitability equation above is by allowing their losses to exceed their gains. The profitability equation is highly dependent on a trader’s ability to enter trades with a favorable risk/reward ratio.

On paper, this seems simple. Traders are in full control of their risk management. If you say you’re going to cut losses at $1/share and take profits at $3/share, you are in full control – you simply place the orders.

Unfortunately, emotions creep up, and a variety of situations may unfold. A trader may ignore their stop loss and take a bigger loss than anticipated or ignore their profit target and turn a winner into a loser. This behavior, compounded over time, diminishes the expected return of every trade.

Inability to Determine High Probability Setups

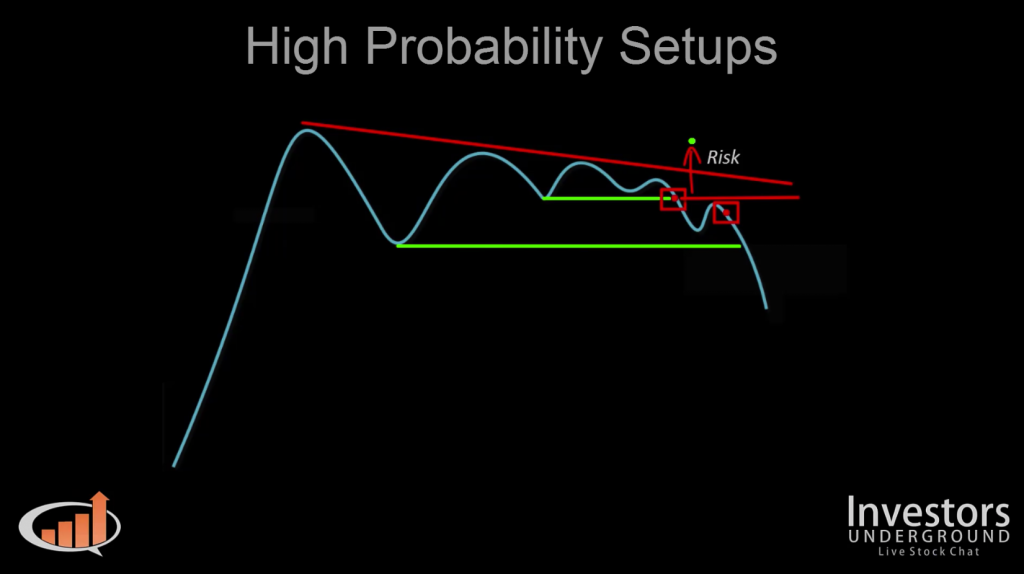

The second part of the profitability equation is the “high probability setup.” These are the setups that have favorable odds (i.e., ≠ 50/50).

High Probability Setups

Unfortunately, there is no way to forecast the odds of a trade with absolute certainty (especially when you are getting started). Many traders mistake low probability setups with high probability setups and enter trades where they have no edge. These miscalculations range from mistakes of naivety to downright foolishness.

Once again, this behavior compounds over time and converts the profitability equation into a loss equation.

If you want an example of high probability chart patterns, watch the video below.

Crunching the Numbers Again

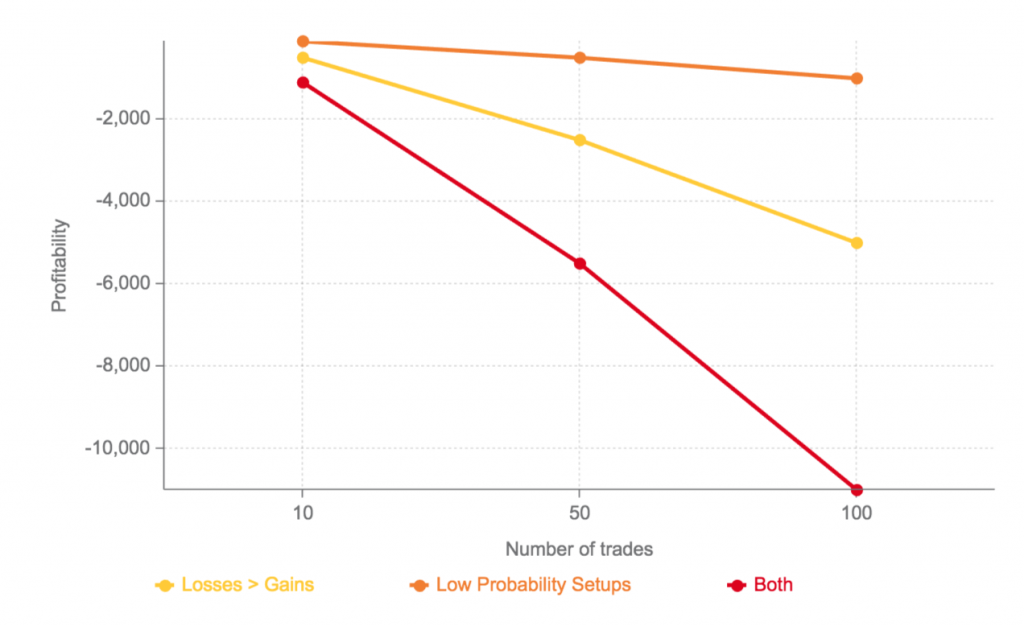

Let’s look at a quick example of how the profitability equation is impacted by these common trading issues.

- Losses > Gains – Let’s flip the equation around. A trader has a 50/50 win/loss rate with an average profit of $100 and an average loss of $200. The expected return of every trade is a $50 loss ([$100 x 0.5] – [$200 x 0.5]).

- Low Probability Setups – Low probability setups shift the odds of a trade in favor of losses. Let’s look at the equation with a 30/70 win/loss rate (where average profits are still higher than average losses). The expected return of a trade is a $10 loss. ([$200 x 0.3] – [$100 x 0.7]).

- Both Downfalls – When both issues occur, the expected return of a trade is a $110 loss. ([$100 x 0.3] – [$200 x 0.7]).

The profitability equation is delicate and small changes to the inputs (i.e., the trades) can have a major impact on the output (i.e., profitability).

To recap, the goal of this post is NOT to show that it is easy to make money in trading. The goal is to show that it is POSSIBLE.

Trading is not for everyone, but you should at least have a reasonable understanding of the odds before dismissing the legitimacy of the game. Up until now, we’ve been having a rational conversation. We’ve been discussing things logically and looking at both sides of the argument. Next, we’re going to discuss some irrational counter-arguments that should be immediately dismissed.

The Irrelevant Counter Arguments

Some counter-arguments are logical and worth defending; others have no merit. Blind cynicism is just as delusional as blind optimism. Here are some of the irrational counter-arguments we hear all too often.

The Markets are Rigged

Some people believe the markets are rigged. This group doesn’t view the odds of a trade as 50/50. Instead, they believe the odds are heavily weighted against the trader.

While this makes for a controversial talking point at a cynics’ round table, it makes no statistical sense. If the odds of a trade are not 50/50, the trade is a high probability trade. If the odds are 70/30 in favor of the stock going down, you have a high probability short setup. If the odds are 70/30 in favor of the stock going up, you have a high probability long setup.

So, when someone says the markets are rigged, the logical follow-up question is, “Which direction are they rigged to move in?”

You Can’t Compete With Algorithms and High-Frequency Traders

If you think the system is rigged, it’s time to start pointing fingers. Algorithms and high-frequency traders are generally the first culprits named. These high-speed trading systems combine advanced technology with programmable trading strategies, and they are often viewed as unfairly advantaged market participants.

Fairness aside, high-speed trading is irrelevant to the question of whether or not traders can be profitable. Daily trading is not a zero-sum game. At the end of the day, there is NOT an equal amount of winners and losers.

High-speed platforms are not trading against you specifically. You are not competing. In fact, they are trading alongside you. They have the same goal – to take profits from the market.

Think of this like a coin toss in which you are making predictions alongside a computer. Even if the computer somehow has an advantage, you are not disadvantaged. You can both guess heads, you can both guess tails, or you can choose different guesses.

Trading is Like Gambling

With all of this talk of odds, one may misconstrue trading with gambling. It’s a banal comparison that is neither 100% accurate nor 100% inaccurate. It all comes down to the individual trader.

The market can absolutely be used as a vehicle for gambling. Let’s get that out of the way early. That said, there are some key distinctions between gambling and trading.

Unlike gambling, trading can have positive expected returns. The game is not rigged.

Contrarily, most forms of gambling are rigged in favor of the house. Take roulette as an example. A conservative bet on black has a 47.4% chance of yielding a positive return. The expected value of a $100 bet is -$5.20 ([$100 x .474]-[$100 x .526]). These odds can’t be manipulated, and you cannot find an edge. You cannot control the risk/reward part of the equation ($100), and you cannot control the odds (47.4/52.6).

In games of pure chance, you can never find an edge.

In trading, you can.

You Cannot Predict Intraday Price Action

Many investors (and aspiring investors) believe in the “buy and hold” investment methodology. They recognize that great investors like Warren Buffett and Peter Lynch have made fortunes using this investment strategy, but they struggle to name any successful traders (so they must not exist).

This group believes you can predict stock price action but only across long periods of time. Intraday price fluctuations are considered to be “random” noise that should be ignored.

As we know, intraday price action is not just noise. While “buy and hold” investing has proven to be lucrative over the past century, it’s not the only way to make money.

Many predictions are actually easier to make across shorter timeframes. There are fewer variables in play, and the intraday “noise” is actually less susceptible to unpredictable events.

Take some real-world examples to back up the point. It’s a lot easier to predict a rainstorm tomorrow than it is to predict a rainstorm two months from now. It’s a lot easier for a company to forecast next month’s sales than it is to forecast sales for the same month next year.

Investors confuse trading for noise, but traders do NOT aim to predict “randomness.” A stock’s average price fluctuations are of no interest to a trader. Instead, traders focus on momentum and volatility – seeking high-probability setups in which price action is more predictable.

Think of this differentiation with another real-world example. If you predict that there will be a line at the Apple Store on a random Tuesday, you are predicting randomness. If you predict there will be a line at the Apple Store the day after an iPhone release, you are making a high-probability prediction.

90% of Traders Fail

Last but not least, let’s address the idea that 90% of traders fail. This number is thrown around quite a bit.

To be fair, let’s get two things straight:

- The majority of traders DO fail

- 90% is a made-up number

There is not a survey of every trader in the world. Therefore, the idea that “90% of traders fail” is entirely made up. While there is merit to the idea that the majority of traders fail, it is difficult to assign a percentage.

Two key points are worth addressing.

1. Worthwhile Endeavors Often Have Unfavorable Odds

By its very definition, being above average has unfavorable odds. Whether you want to run a successful business, become an elite athlete, or snag a six-figure corporate gig, the odds aren’t in your favor. There’s a reason why the most coveted roles in our society aren’t easily achievable.

Defying the odds takes hard work and dedication. If you want to live an above-average lifestyle, you need to beat the averages.

The idea that trading success has low odds shouldn’t come as a surprise. When we hear people say “trading is too difficult” or “most traders fail,” the obvious response is “no kidding!” If it were easy to be your own boss and generate exceptional wealth, everyone would do it.

The traders who succeed actually LOVE the challenge. They become obsessed with beating the odds – and they eventually do. Trading success is difficult but possible.

2. Success Varies by Environment

Averages of large populations are not reflective of the averages of smaller groups within those populations.

Take income as an example.

The average income of Harvard graduates is over 50% higher than the average income of college graduates in general and over 100% higher than high school graduates with no college degree.

Certain environmental factors can have an impact on success.

Do you think 90% of traders at successful hedge funds and prop firms fail? They don’t.

Not all traders are created equal. Therefore, the success rate will vary by trader (or groups of traders).

We’ve been running IU for over 10 years and we’ve seen every type of trader you can image. Some traders come to the market ready to start pushing buttons and making easy money. Others take the time to learn a skillset, test their knowledge, and scale their strategies. Needless to say, the latter group gets better results.

You need to be committed if you want to succeed. You can further increase your chances of success by surrounding yourself with the right people and getting access to the right resources.

All I could do is penny stock 1600 a month bills 900 to 1200 Then the taxes on the profit is ridiculous

Excellent article one of the most helpful reads I have come across.

Love it

Thanks

Great article! Very in depth but simple to understand!

Great article! Gives a good perspective on investing.

Thanks for showing a live ABCD setup. Love to see more high % setups

Great and valuable article.

I am impressed

Loved it

Easy to understand

Great article! In many circles, the mere mention of day-trading sends the trolls shaming and ridiculing those who even attempt it. Yet I know several traders who make a decent living from it. Thanks for make sound arguments which helps us really separate the real “noise” from signal!

I enjoy the reads, Thanks!

That was the most succinct yet thorough rebuttal to the typical cynical day trading perspective on the whole internet. Kudos to you guys for your quality content.

It is great article to help build up our skills but reality is different than theoretical studies. For instance, today I was trading in GNMK. I was tracking ( abcd) trend. It was beautiful until I bought my stocks on point (c) but unfortunately, the trend never goes up. I felt like somebody is controlling the trend and catching it on a certain price. That was true and what proved my idea that I sold my stocks before the end of trading day in 20 minutes and I kept observing the trend. And guess what…. at 15:30 stock price dropped from $11.63 to $11.22 then the trend shots up to point (d) $13.70 after trading hours (4:00 PM). The whole process happened during low market volume & liquidity. Which makes me laugh and question?? Is this legal??

Quarterly earnings are always published before or after market hours.

I turned $70,000 into $50,000 my first two months day trading. After the day to day emotion wore me out, I finally found those high probability plays that worked for me. Then that $50,000 turned into $250,000 in 4 months. Then one emotional trade brought it back down to $213,000. And the game is still on going back up to $230,000 as I write this.

I listen to no sceptic. I only look at my track record. Day trading can break you or you can make a ton of money. It’s solely up to you.

Hi

High probability plays?

Can you add more details?

Yehuda::After that article I know why I never became a day trader

As I was reading the last couple paragraphs three Rocky theme music started playing in my mind.

I’m ready… LET’S DO THIS!!!!

run into door face first…

Nice one Nate . Very simple to understand have your edge and risk management and proper risk to reward by doing this process money will follow trade well not trade P&L even if I am making 10 pound I am not looking at it as money rather my process , working on my strategy, consistency and mastering emotions once I master this all then I can scale up my share size.