Traders often get caught up in the “all or none” mentality, assuming every trading decision comes down to either “Option A” or “Option B.”

Do I enter a position?

- Yes

- No

Should I sell now?

- Yes

- No

In reality, trading decisions aren’t this black and white.

This reminds of a presentation at the 2017 Traders4ACause conference where Andrew Left (@CitronResearch) shared a pithy anecdote that perfectly illustrated this situation (and it’s solution).

The story spoke of an investor who had recently invested in a stock that had since yielded a nice return. The investor was happy with his returns, but unsure of whether or not he should exit the position. There was no clear indication that the investor should sell, however he was wary of giving back any of his profits. He also didn’t want to leave any money on the table (classic trader’s dilemma). Naturally, he sought outside help and approached Andrew Left with the question, “should I sell now?”

Left’s response: “sell half.”

The investor was dumbstruck. Throughout his intense analysis, he never once came to the conclusion that he could both hold and sell at the same time. By selling half, he could lock in profits and take advantage of any potential future upside.

I’m sharing this story with you because many traders find themselves in similar positions. We tend to overanalyze situations when faced with a seemingly binary decision. “Do I realllllyyy want to enter this position?”

A lack of strong conviction leads to a state of analysis paralysis. The solution? Use your conviction-level to determine your position sizes.

Write these rules down:

- You don’t need to buy or sell your entire position all at once

- You don’t need to have 100% conviction in every trade (we’ll get to this later)

Understanding these simple rules will help you become a more agile trader.

Let’s get started with the basics – scaling in and out of trades.

What is “Scaling In and Out”?

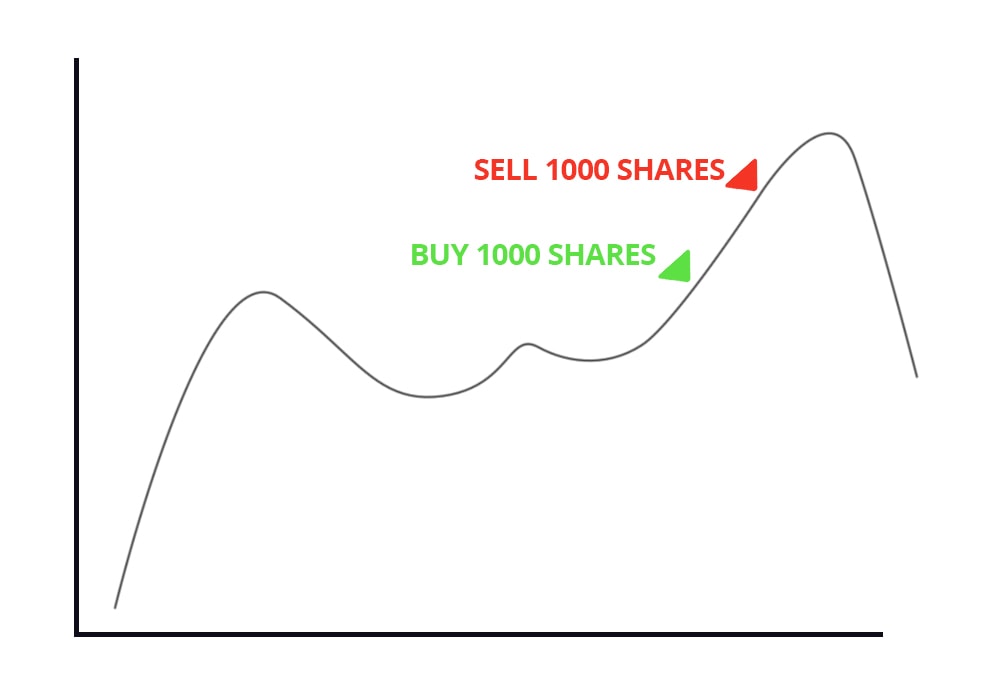

For most beginner traders, the process of trading looks like this:

- Buy Full Position (X Shares)

- Sell Full Position (X Shares)

Advanced traders tend to scale in and out of positions, meaning they spread their entries and exits across multiple trades. They add to winning positions and minimize losing positions.

The process may look something like this:

- Buy ⅓ Position

- Buy ⅓ Position

- Buy ⅓ Position

- Sell ⅓ Position

- Sell ⅓ Position

- Sell ⅓ Position

Notice anything interesting when comparing the two processes?

After Step 1, the beginner trader has a full position and, therefore, has taken on full risk. The advanced trader, has ⅓ of a position and, therefore, has taken on ⅓ of the risk.

If the trade proved to be unsuccessful after Step 1, the advanced trader could cut the position with less downside. If the trade proved to be successful after Step 1, the advanced trader could continue to build a position with higher certainty.

The Rebuttal: What About Commission Fees?

Many traders are hesitant to scale in and out of positions because of the resulting increase in commission fees. One buy and one sell order equates to two per-ticket commissions, whereas three buys and three sells equates to six.

First, you should be aware that some brokers offer “per-share” commission structures that allow you to navigate in and out of trades without worrying about racking up per-ticket commissions.

Second, the goal of this strategy is to improve your results: your P&L. Better trading performance will inevitably result in higher profitability, even with an increase in commission fees.

Using “Conviction” to Determine Position Sizes

Scaling in and out of positions gives traders the ability to match their position sizes to their conviction (essentially, minimizing risk).

In the above example, we used ⅓ position sizes, but ½ , ¼ , ⅛ sizes are appropriate as well.

The process of scaling in and out of positions increases your agility and decreases your risk.

Of course, it’s important to have a clear understanding of what is meant by “conviction.”

The term “conviction” doesn’t refer to a trader’s intuition. Conviction, in this case, refers to the probability that a trade will work out as hypothesized.

Traders rely on patterns to make decisions, and these patterns become clearer with time. For example, it’s very easy to recognize an ascending triangle breakout on a chart after it has happened. Time has made the pattern 100% clear.

Recognizing the same pattern before it has fully developed is not as easy. It could be argued that “certainty” (aka conviction) and “profit potential” reach a point where they become inversely related. A trade with 100% certainty is a hindsight trade with zero profit potential.

A trader’s job is simply to manage risk, and using conviction to determine position sizes can help achieve this.

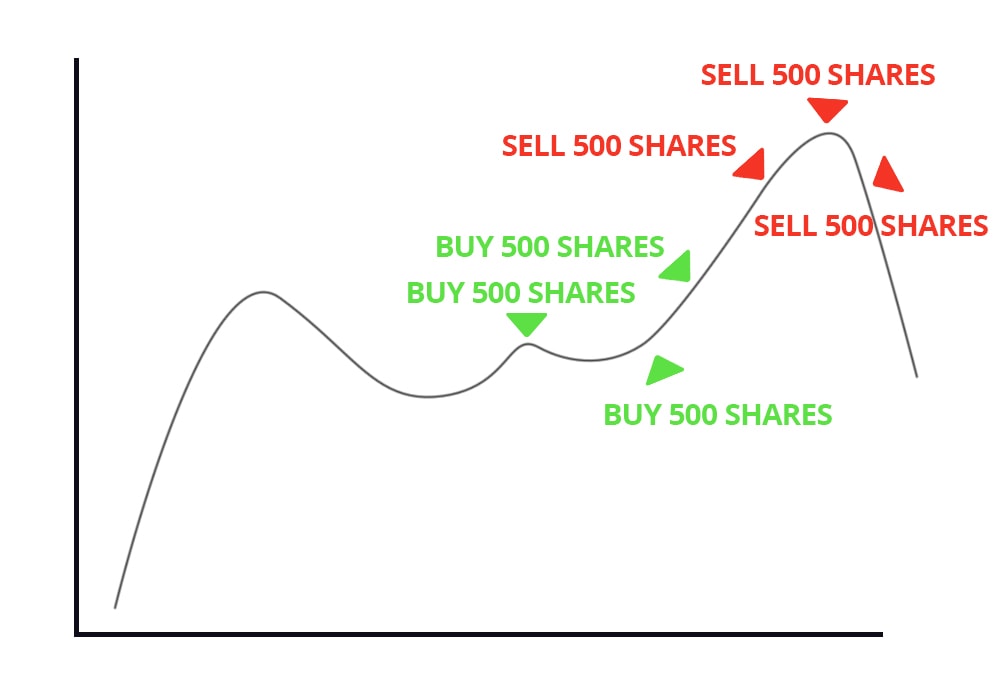

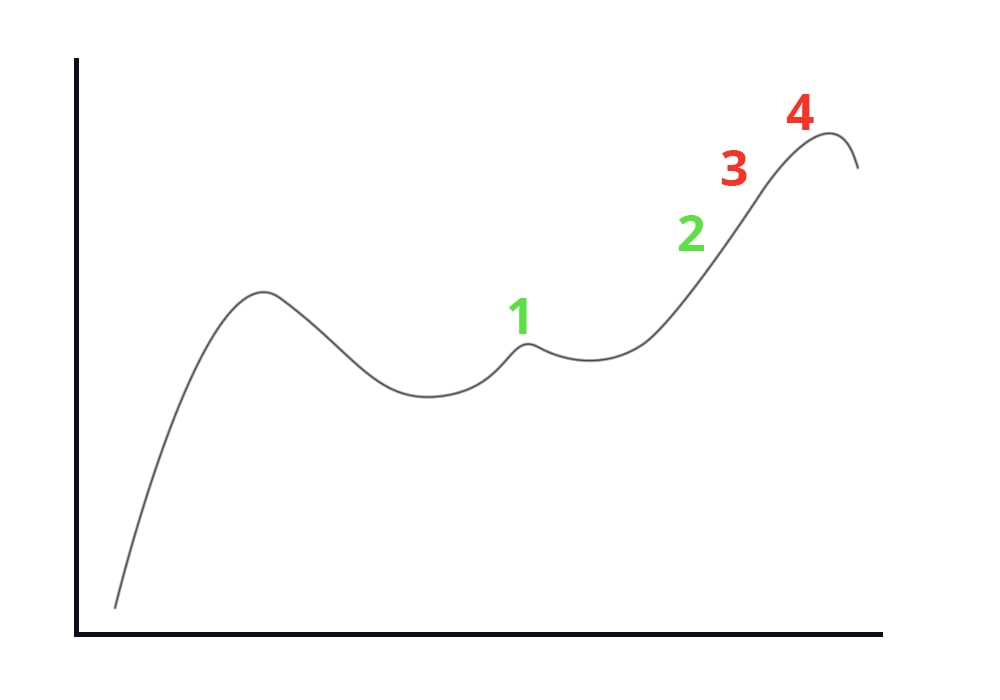

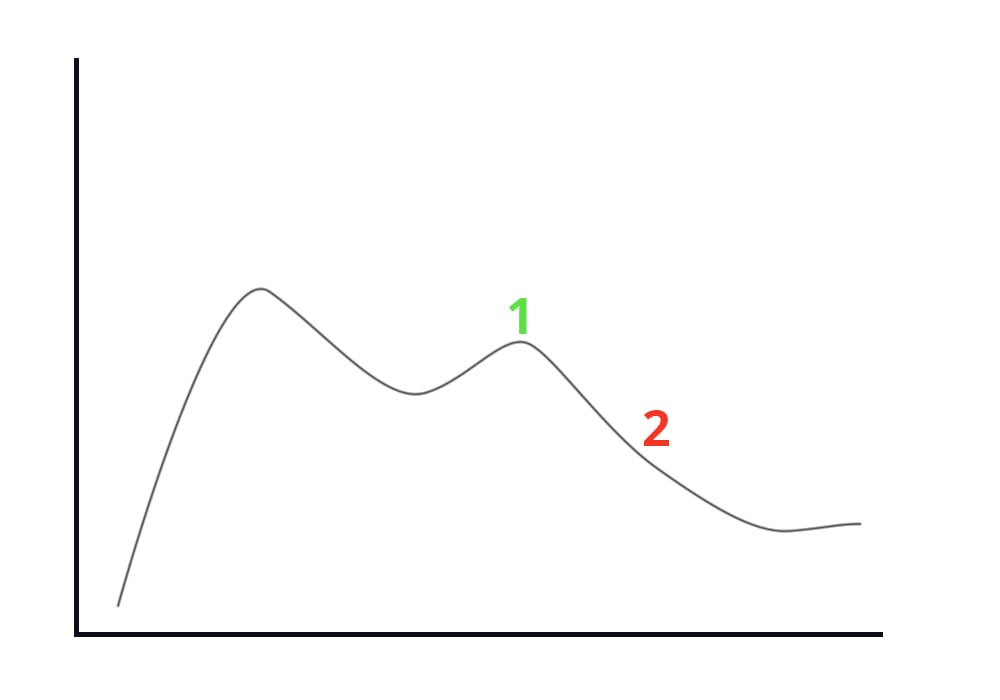

Hopefully this example helps illustrate the point:

Here’s how this strategy would pan out in a profitable trade:

- Point 1: This stock may breakout. (Buy ½ Position)

- Point 2: The breakout is confirmed. (Buy ½ Position)

- Point 3: This breakout may continue. (Sell ½ Position)

- Point 4: Profit target hit. (Sell ½ Position)

Here’s how this strategy would pan out in an unprofitable trade:

- Point A: This stock may breakout. (Buy ½ Position)

- Point B: The breakout failed. (Sell ½ Position)

An Additional Benefit to this Method

Realizing that your position sizes are flexible can help you minimize risk, but there’s an additional benefit. Taking smaller positions (i.e. “scaling in”) can help you avoid analysis paralysis, which may lead to an increase in profitable trades.

I hear this from new traders a lot, “I had the right trade idea but I was too scared to pull the trigger.”

Many traders freeze up because they take position sizes that don’t match their conviction (they feel the need to use the same position size on every trade). This indecision stems from the inherent uncertainty surrounding the trade. While you can’t control the uncertainty, you can control your exposure to it by minimizing your risk. If a 1000 share position exposes you to $1000 risk, a 100 share position would expose you to $100 risk (which may be easier to stomach).

Apply it to Your Trading

There are two ways you can start applying this to your trading immediately.

- Focus on WHY you freeze up before entering a trade – If you find that you’re freezing up because you’re going in too big, start with a smaller position (you can always add shares later).

- Start scaling in and out of positions – Test out the process so you can be comfortable with it. Scaling in and out of trades is a great skill for any trader. As you familiarize yourself with the process, you can start matching your position sizes to your conviction levels.

Test out this approach in your trading and leave a comment below if you have any questions!

Thanks for this content Need to use this blog more its very helpful, Nate, thanks for all the massive amounts of content you manage to pump out on the daily.

Good info, thanks guys!

Thank you for the blog. Great info.

Thank you Nate

Thank you Nate. You really hit the nail hard on the head with this 1. Really appreciate it😀

I always appreciate an expert traders thought on any trade, its extremely helpful and educating thanks nate.

Thanks Nate for this very helpful information. Everything you described is what I’m going through right now as a new trader. Will definitely put this,into practise.

Your lesson comes handy. I am starting to trade and I am 1 in one out position. I will practice it from now on.

Thank you

Thank you sir!!

Great content.

Im new to trading still after about a year i still get a case of the jitters , This really will help me , Thank you

Thanks Nate! This has been my problem 8 months down the road.

I really appreciate all you do. Great help.

Thanks for the reminder, that’s my style take a small size increase position when you have an up surge, when I hit my target I sell 50% and decrease position along the the way… taking immediate profits of the table…

Nate scaling in and out as you describe makes perfect sense. But how do I do that as a new trader whilst under PDT?

This is great for starters like myself. I will try this process.

I like entering trades in 3 stages for all of the reasons you mention, but you know what? I do it mostly to get better entries. If I enter, and the price goes down a little, I add. Once it starts going up, I add the last third. If it does not go down at the second stage, I add twice on the way up. I get Way better entries, and if it goes down after I enter first, I am happy that I am getting a better entry price with my second add.. If it keeps going down, I would not add and that would be my exit signal. It is not easy to be me.

Thank you Nate. God bless you for your help to us the Newbies.

Great content ! Thank you for the free advice !

Excellent article Nate, Thank you.

Keep doing this great work!

Thank you for your help

Thank You so much, Nate, the fact that you put this out for free is awesome of you … much appreciated I am forever grateful this is exactly what I needed to read once again thank you, and may the Lord continue to bless you.

Nate, this explained step by step is great, I learned from you I’m implementing it, thanks a lot, using house money is incredible the risk reward radio potential. God bless you.

Blessed trader

Thanks a lot Nate! This is great info, I will start implementing this right away.

Thank you sir. Very useful article

how do you figure out how much is 1/2 a position size?