Wild week continues in small caps!

Check out the chat logs from today — and I’ll be uploading the HEPA tape + the commentary for members shortly!

Below are some thoughts on recent market action, a video of today’s trades as well as the charts.

It’s been a hot hot run – but it’s only hot if you continue to respect rules, and trade within risk parameters.

Stay grounded. Next trade is treated the SAME as the FIRST trade of this run. There are NO trades made because “YESTERDAY WAS A BIG DAY” so let me SIZE up. Sizing up is not just trading bigger. Sizing up is done on A+ set ups. Sizing up is a benefit of being on the right side of the trade. Sizing up is not “I KILLED IT YESTERDAY LET ME GO DOUBLE SIZE TODAY” so I know the room has been hot many are killing it – but be honest with yourself on every trade. TAKE A MOMENT – am I trading to trade? Or, is this a proper trade?

AND MANY OF YOU ARE NOT KILLING IT – THAT IS OK – BE OK WITH IT

That’s fine – this market is bananas. I’d rather see you make $0 than wish you hadn’t touched some crap name that offers midday you’re out sized and lose half your account. No trade is a win sometimes. Don’t let the noise of others influence you to pushing buttons. The worst thing you can do is try to catch up.

Those days that you flourish small cap momentum traders may not.

At any rate I’ve tried to keep the noise down in the room myself included I realize there are a lot of folks that can’t even borrow the names we’re shorting in the end you need to be up early prepared and have the right brokers and many of them.

Stay focused. BECOME A BETTER YOU TOMORROW – THAN TODAY. Work on something new.

Trade Recap Video Lesson

Chat Logs

Today’s Trades

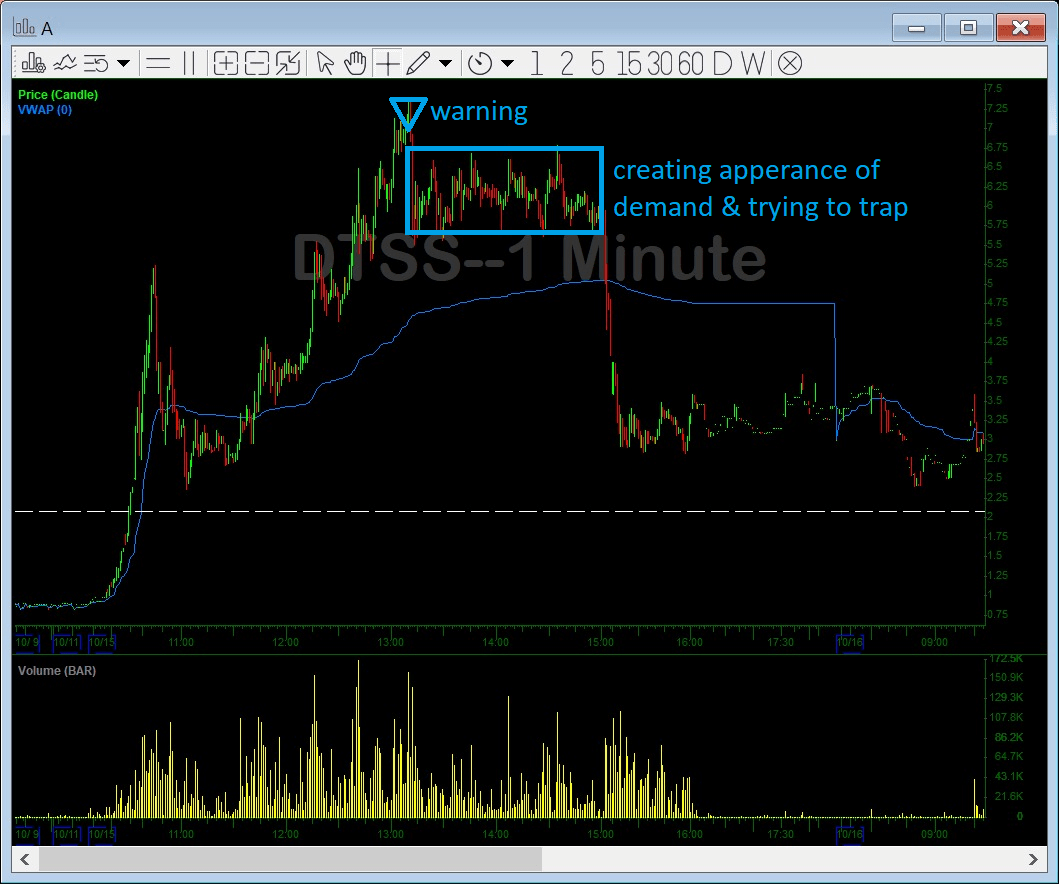

DTSS

If you are long $DTSS you’re asking for it — the highest chance of getting stuck in a halt is this one. No news and late filings pic.twitter.com/360f1OYLVf

— Nathan Michaud (@InvestorsLive) October 15, 2019

$DTSS fortunately they gave some opportunity after I tweeted at $7 regarding what you’re up against here and why I wouldn’t be long.

Not sure why people are bidding for it. But hey, more power to them. pic.twitter.com/Br9JOjvvUP

— Nathan Michaud (@InvestorsLive) October 15, 2019

I notice when there are no buyers and covers don’t come in they just churn churn churn churn 10K blocks over and over trying to create the appearance of something legit, so they can get an exit. And if no vol to offers comes?

— Nathan Michaud (@InvestorsLive) October 15, 2019

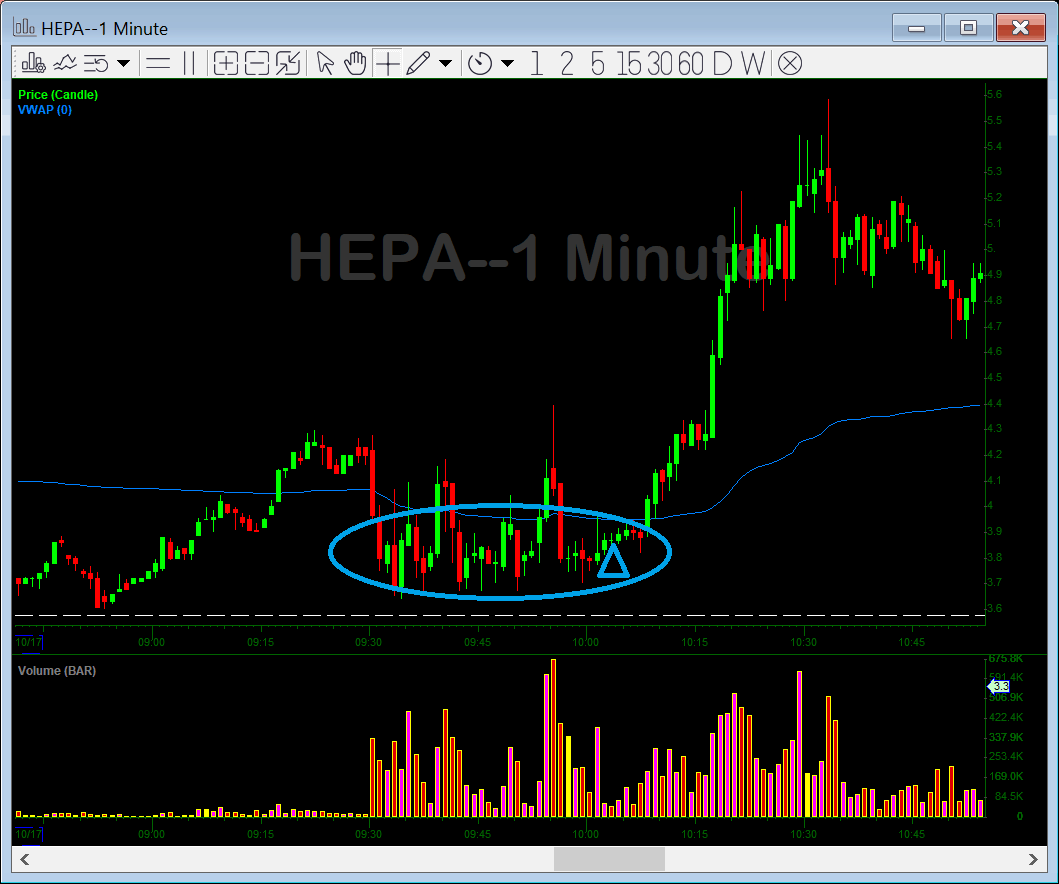

HEPA as tweeted – Noticing the trap happening live in the tape

It’s sub VWAP etc but rather be joining a fade after it breaks down than 50/50 consolidation – so I locked in the short from this AM off rips — and not ignoring the fact that it shoulda died like 10 x

— Nathan Michaud (@InvestorsLive) October 17, 2019

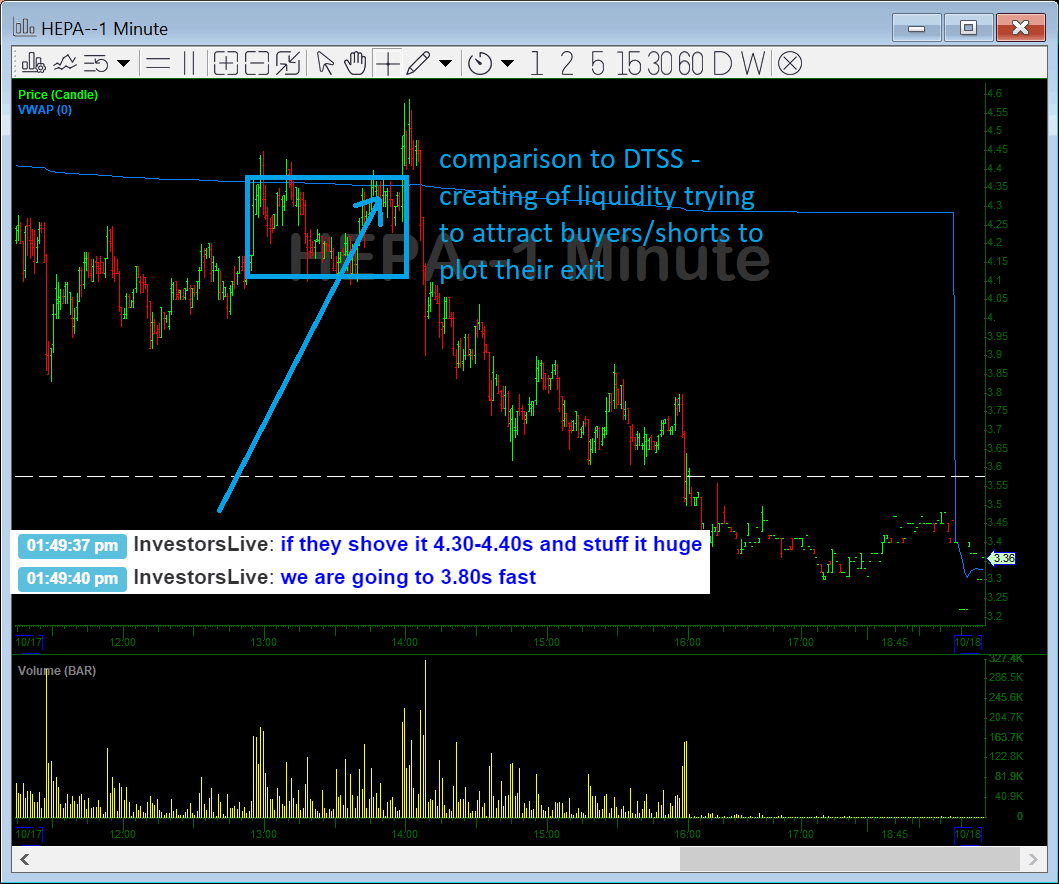

HEPA Exit Move:

You saw this on $DTSS

Now, it’s happening $HEPA

They’re trying to work on their exit here.

They prob have too many and are trying to create a trap so they can exit.

if they fail it’ll be same as $DTSS

Key is – don’t bring emotions to table.

Levels posted in room. https://t.co/ci8VzFgq1t

— Nathan Michaud (@InvestorsLive) October 17, 2019

Tape told this story clear as day – it was just up to the trader to listen. Some call L2 and tape silly & made up philosophy – and suggest chart is the only tool to use. Those are the same people that don’t understand and are too proud to learn something new. It takes time, SCREEN TIME. The best way to learn is to watch it back with the commentary.

Again the tape lies 😂

Damnit all, the tape — NEVER trust it.$HEPA

It’s all lies.

— Nathan Michaud (@InvestorsLive) October 17, 2019

HEPA Trader Lounge Discussion:

Trader Lounge is the spot where all members can hang out and ask any questions. Anything goes, given that the momentum chat is STRICTLY business no off topic during the day – so I spent the afternoon reviewing the HEPA action real time. I will be posting the live tape w/ commentary for members as noted.

Also as you’ll note I keep it raw in the room and tell it straight up – I don’t beat around the bush.

01:30:04 pm InvestorsLive: watch here

01:30:11 pm InvestorsLive: flush time if they can’t hold it

01:30:22 pm InvestorsLive: if u took part in the 4.40 rip ss

01:30:33 pm InvestorsLive: then id be covering some around core and always re add 4-380s

01:30:34 pm InvestorsLive: if it flushes

01:31:11 pm InvestorsLive: helps keep emotions out

01:35:11 pm InvestorsLive: bidder pulled after that

01:35:12 pm InvestorsLive: did u see that

01:36:58 pm amckee25: yes i did

01:37:22 pm lynncsy0507: Hi Nate, what does that mean by bidder pulled?

01:37:37 pm InvestorsLive: exactly that

01:37:40 pm InvestorsLive: bidder was there

01:37:41 pm InvestorsLive: they pulled

01:37:46 pm InvestorsLive: while they sold offer

01:43:58 pm InvestorsLive: remember its about taking notes

01:44:01 pm InvestorsLive: and how it reacts after

01:44:03 pm InvestorsLive: there is no yes no answer before

01:44:14 pm InvestorsLive: its about recognizing what is going on here

01:44:18 pm InvestorsLive: and then applying it later

01:45:43 pm Masstrader: thanks

01:46:00 pm Masstrader: talk about timing

01:46:01 pm lynncsy0507: Thanks

01:46:03 pm InvestorsLive: 🙂

01:46:07 pm InvestorsLive: cov around core until gets heavy

01:46:09 pm InvestorsLive: is goal there

01:46:10 pm Masstrader: lol

01:48:58 pm Roy_Kid: well in this case then HUGE volume for the day it will suggest that is going higher then based on the volume

01:49:28 pm InvestorsLive: I think ur missing point

01:49:31 pm InvestorsLive: u use the levels I gave

01:49:32 pm InvestorsLive: and watch the tape

01:49:37 pm InvestorsLive: if they shove it 4.30-4.40s and stuff it huge

01:49:40 pm InvestorsLive: we are going to 3.80s fast

01:49:54 pm InvestorsLive: if we build over $4.40s we can churn out and remember the trap we saw 4.10-4.20

01:50:24 pm InvestorsLive: key is that they are stuck — they are setting either 1. a trap or 2. creating appearance we are breaking out and selling slowly

01:52:32 pm Roy_Kid: ok great analysis , one last thin how to reconize when someone stuck?

01:52:43 pm InvestorsLive: we’re talking about it

01:52:47 pm InvestorsLive: past 20-30 min

01:53:13 pm RyanM: Who is gunna be in mor pain, Roy? That is who’s stuck

01:53:21 pm RyanM: based on what happens

01:53:33 pm InvestorsLive: this price action in itself

01:53:34 pm InvestorsLive: the tape

01:53:37 pm InvestorsLive: is suggesting what i am saying

01:53:41 pm InvestorsLive: now its about how it reactgs

01:53:45 pm InvestorsLive: at the levels I gave u

01:54:14 pm RyanM: if it builds above = shorts stuck

01:54:19 pm Roy_Kid: right thats what i mean you are able to tell via price action and tape , thats what i was wondering what the clues were there

01:54:35 pm RyanM: stuffs and longs have to stop out = longs lose

01:58:52 pm InvestorsLive: https://twitter.com/InvestorsLive/status/1184887568560771074

01:59:04 pm InvestorsLive: https://twitter.com/InvestorsLive/status/1184174016845799424

01:59:10 pm InvestorsLive: should answer ur question

01:59:57 pm Roy_Kid: cool thanks

02:00:21 pm InvestorsLive: edge = reactive

02:00:28 pm InvestorsLive: if they flush and hold have to be cautious

02:02:49 pm Lticker: Took a little meat of hepa

02:04:13 pm InvestorsLive: i leaned as well into the rip

02:04:23 pm InvestorsLive: but if 4.40s bases have to size down

02:04:37 pm InvestorsLive: but would not be add add adding thats for sure only if cov 410 range like discussed

02:06:11 pm InvestorsLive: 🙂

02:06:12 pm JowydS: nice!

02:06:12 pm InvestorsLive: glad we talked

02:06:17 pm InvestorsLive: this is how u learn tape guys

02:06:23 pm InvestorsLive: understanding the other side of the trade

02:06:26 pm InvestorsLive: seeing it real time

02:07:10 pm Roy_Kid: yeah this is awesome

02:07:32 pm Roy_Kid: this looks good

02:07:34 pm Roy_Kid: now

02:07:49 pm JowydS: sutffed and walked probably

02:07:54 pm RyanM: Such sick commentary Nate

02:07:55 pm InvestorsLive: :up

02:07:57 pm RyanM: thanks

02:08:03 pm Trade2live: Wow learn a lot today. Thanks Nate!

02:08:12 pm InvestorsLive: $3.80s fast

02:08:15 pm InvestorsLive: if $4.10 can’t reclaim

02:08:31 pm JowydS: this is super sick

02:08:37 pm richard_yuen: wow

02:08:39 pm Ryan_P: wow. that was quick

02:09:40 pm GabiPoli: really nice! thanks Nate!

02:09:50 pm MA_Trader: Thanks Nate

02:10:02 pm MA_Trader: That was wild!

02:10:12 pm InvestorsLive: got it on tape too

02:10:14 pm InvestorsLive: + the comments

02:10:21 pm MA_Trader: Awesome!

02:10:22 pm InvestorsLive: its ok to nto “get it”

02:10:24 pm InvestorsLive: its subjective

02:10:28 pm InvestorsLive: you leanr it over and over again

02:11:07 pm kpenright: that would be a good one to discuss in a webinar if it hasn’t been already. Id be interested at least

02:12:59 pm InvestorsLive: its not really webinar topic

02:13:02 pm InvestorsLive: its screen time

02:13:05 pm InvestorsLive: again its subjective

02:13:07 pm InvestorsLive: u learn by watching

02:13:09 pm InvestorsLive: not by being told

02:13:23 pm InvestorsLive: this is the biggest disconnect w/ people thinking you can just be told and get it

02:13:26 pm InvestorsLive: not a chance

02:13:57 pm ult1lar: It helps to be told what to watch

02:14:08 pm Roy_Kid: yeah especially with tape i guess

02:16:07 pm xChris: if you say they are stuck do you think we can see new lows or just slowly fade to pm lows as target?

02:16:34 pm InvestorsLive: time will tell

02:16:38 pm InvestorsLive: have a great average to find out right

02:16:40 pm InvestorsLive: cov some around core

02:16:48 pm InvestorsLive: and can always re scale in when $4.20 confirms or $4.10 etc

02:18:37 pm kpenright: i know but as someone that does a lot of training with adults (OSHA training) adults learn by visuals and then hands on experience. It may help some of us to see things like that discussed then go apply them in simulation training to see if we can do it ourselves.

02:18:58 pm InvestorsLive: Def u should be recording screens

02:19:03 pm InvestorsLive: when I say to watch the action

02:19:08 pm InvestorsLive: that’s how you learn and play back

02:19:09 pm InvestorsLive: no via webinar

02:19:14 pm InvestorsLive: I’ve been doing this since 2008 🙂

02:19:24 pm InvestorsLive: I’m right on this one – on how folks learn

02:19:26 pm InvestorsLive: hehe

02:19:36 pm InvestorsLive: You may think you learn one way — which is the case most times

02:19:55 pm InvestorsLive: but in reality these is one way to learn tape — and that’s live in action with this commentary

02:20:01 pm InvestorsLive: and/or review the tape + comments

02:20:02 pm kpenright: ohhhhh good point i could record this lol

02:20:17 pm InvestorsLive: chat logs always there

Hi nice video . How do you overcome fear in trading ? .I mean a good set up but just pure fear to take a trade ? Thanks