What do you do when you don’t have enough information to make a decision?

You have three basic options:

- Admit your ignorance and do more research

- Avoid the decision altogether

- Make the decision with whatever limited information you have

In these situations, relying on false or incomplete information can be more dangerous than having no information at all.

If you don’t have any information, you at least know what you don’t know. If you have false information, you miscalculate your competence and pay the price accordingly.

Day traders are used to dealing with information in this way. Diligent traders are on a perennial quest to fill in the informational gaps in their trading strategies while reckless traders repeat the same mistakes because they fail to see the bigger picture. The latter group is often doomed from the start because they enter the world of trading with some costly misperceptions.

We will generously refer to these misperceptions as “myths” but, in reality, they are false beliefs that can be extremely costly.

Let’s get to it.

Myth #1: All Day Traders Fail

Many would-be traders avoid the field all together because they believe that day trading is a pipe dream. This group believes that it’s impossible to time the stock market and all day traders are doomed to fail.

As the old joke goes…. How do you get your trading account to $1 million? Start with $2 million!

The idea that all traders fail simply isn’t true. Most estimates of trading success (i.e. “90% of traders fail”) are anecdotal, and while they are rooted in truth, they don’t paint the full picture.

No doubt, trading is difficult. So is everything worth pursuing.

If you want to live an above average lifestyle, you need to do something above average. Naturally, the career paths that enable these lifestyles also have lower success rates. If it was easy, everyone would do it. Whether you want to start a business, become a touring musician, or climb to the top of the corporate ladder, you should know the odds aren’t in your favor. The same is true of trading.

The majority of traders DO fail but that doesn’t mean that trading success isn’t possible.

The proof is right here at Investors Underground. We have plenty of traders who have been making exceptional livings as full-time traders. You can check out some of their stories here.

If you believe that all traders fail, you’re setting yourself up for failure. You’re better off throwing in the towel before you even start.

If you can come to grips with the fact that trading success IS possible BUT it is also difficult, you can begin to focus on the steps you need to take to defy the odds.

Myth #2 No One Shares Their Secrets

The second myth is similar to the first but with a unique twist. Some would-be traders believe that day trading IS possible, but ONLY if you have access to Wall Street’s well-guarded secrets.

This crowd is distrustful of any form of education because they believe that the proprietary formula for trading success is as exclusive as it is esoteric. Why would anyone TEACH when they could just make money using their perpetually profitable system?

This logic (or lack thereof) is simplistic and represents a failure to understand how the markets truly work.

This myth is rooted in two major misconceptions:

The Zero-Sum Game

A zero-sum game is a situation in which oner person’s loss is equivalent to another person’s gain. Take a coin flip as an example. If I bet on heads and you bet on tails, my gain is your loss and vice versa.

Trading is NOT a zero-sum game and you don’t need to lose for me to win. For example, if I knew AAPL’s stock would go up tomorrow, I lose absolutely nothing by sharing that information with you.

The market is bigger than both of us.

Even traders who make millions of dollars per year are small fish. Estimates show that retail trading only accounts for about 10% of market volume.

Secret Strategies

The majority of retail traders do not have secret systems, algorithms, and strategies.

We don’t view the market as a code that needs to be cracked. We see it as a chaotic system that can be navigated with the proper tools, analyses, and risk management strategies.

Successful traders don’t have algorithms that spit out foolproof buy and sell alerts. They put in the work, look for high probability setups, and manage risk accordingly.

Some of the best traders only win 50-60% of the time. They’re successful because their winning trades are way bigger than their losing trades.

Here’s how this process looks:

- Find a high probability setup

- Account for risk

- Take a win or a loss

The combination of high probability setups and favorable risk/reward ratios compound in the trader’s favor over time. We’ll discuss this further when we get to Myth #4.

Myth #3: The Markets Are Rigged

Another big trading myth is that the markets are rigged. People usually come to this conclusion after they are exposed to small pieces of provocative information such as the role of high-frequency traders in the markets.

In reality, this thesis doesn’t make any sense at all.

When people make this statement, they usually mean, “the markets are rigged against me.” Otherwise, it wouldn’t really matter, right? If the market was rigged to go up and you were aware of this manipulation, you could simply enter a bunch of long positions and make a killing.

In this sense, it doesn’t even matter if the markets are rigged because you control your own trading positions. You just need to work on identifying which direction the markets are “rigged” to move in. Rigged to go up – buy. Rigged to go down – sell/short.

Ultimately, this argument comes down to semantics and perception. There ARE factors that influence the market. You can view these as forms of market manipulation or you can view them as basic market conditions. The latter perspective enforces more accountability and is more conducive to a proper mindset. Regardless, your goal remains the same – learn how to predict future price movement.

Myth #4: Trading is Just Gambling

Trading is often compared gambling and, at first glance, the two activities can seem similar. Both involve making risky “wagers” that expose the wagerer to both upside and downside.

Gamblers place bets and traders place trades.

The main differentiation comes from the probabilities and strategies that are factored into the “wagers”, and the extent to which these factors are relevant. Let’s compare the two.

We’ll use roulette as an example since the outcome of this game is almost entirely based on luck. In roulette, you choose from predetermined odds, place a bet, and collect your winnings.

Let’s say you place $1000 on the safest bet (a color bet) which gives you a 47% chance of doubling your money. If you win, you make $1000, if you lose, you lose $1000, so the expected value of the bet is -$60 (as determined by [(1000*.47)-(1000*.53)].

The “safest” bet still has a negative expected value, which is why the casino always ends up on top.

Now, let’s look at trading. Traders have more control over the probabilities of their “wagers” because certain setups have a higher likelihood of winning than losing. For example, a certain chart pattern may have a 75% chance of breaking out and a 25% chance of failing.

That said, for the sake of this example, we’ll assume a trade has a 50/50 outcome. A risk conscious trader would use a risk/reward ratio of at least 1:3, meaning they risk $1 for every $3 in potential profit. This risk profile is fully in your control since you decide when to sell.

Let’s say a trader places a $1,000 trade with a 5% stop loss and a 15% profit target. This trade would have an expected value of $100 (as determined by [(1000*.15)-(1000*.05)].

The expected value could be improved even further if a trader were to a) find higher probability setups (i.e. 75% chance of winning) and b) find better risk/reward ratios (i.e. 1:4).

Whereas the odds are fixed in gambling, they are flexible in trading, especially as traders gain access to more information. Traders have the ability to minimize randomness better than gamblers because the markets do not move randomly.

Whether you view the markets as efficient or irrational, there are PROVEN factors that impact price action. As you begin to understand more of these factors, you can improve the probabilities of your trades.

Myth #5: You Need a Lot of Money to Trade

While some people believe in the practicality of day trading, they still feel like it’s a rich man’s sport.

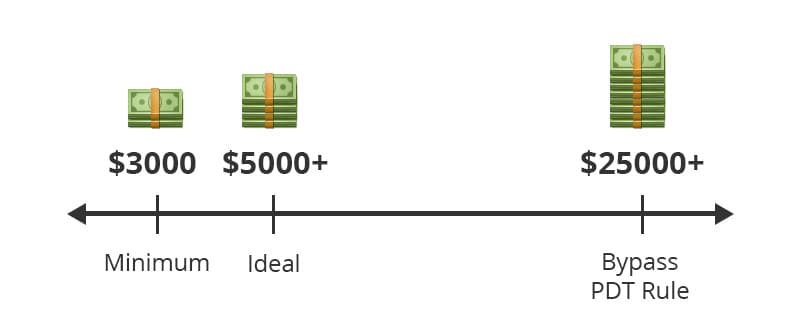

We see this time and time again from traders who don’t think they can even trade if they have less than $25,000. These individuals probably read a single blog post or comment before completely disregarding trading.

It’s true that traders with under $25,000 can only place a limited amount of trades per week, but this is merely a limitation and not a barrier to entry. As previously discussed, this limitation can be beneficial in certain cases.

You can still grow your portfolio with limited trading activity. If you place three trades per week that yield 5% on $3,000 positions, you will make $450/week. If you start generating consistent profits, you will be able to grow your account and bypass the PDT rule altogether.

Myth #6: You Can’t Trade if You Work

It’s easy to dismiss day trading if you work a full-time job. After all, if you can’t sit behind 12 computer screens all day, how are you supposed to become a successful trader?

There are two parts to this answer.

First, the warning. You should never trade when you can’t monitor a position that requires your attention. For example, if you buy into a low-float runner before a meeting at work, you are putting yourself in a precarious situation. That said, there are plenty of different trading styles and they don’t all require you to be glued to your screen. If you work a full-time job, you need to build your trading style around your limitations, which leads to the next point.

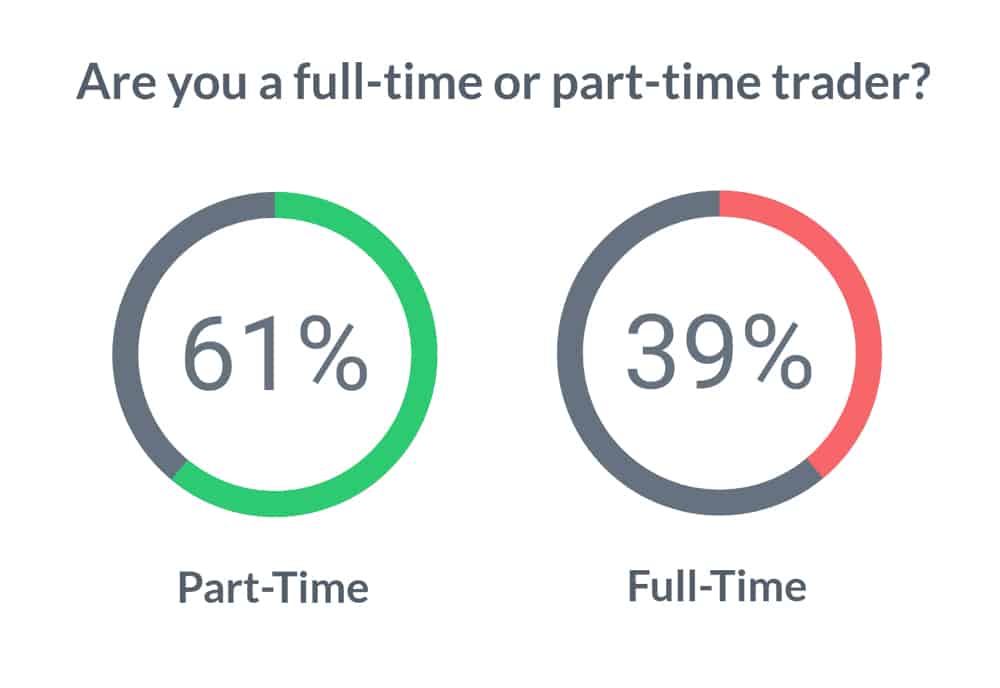

Most traders start out as part-time traders with full-time jobs. It’s rare for retail traders to start their career in trading.In fact, we don’t even recommend considering full-time trading until you’ve proven yourself over a longer period of time. We surveyed the members of our community and found that the majority of them are part-time traders.

Having a job can actually work in your favor. Your full-time income can provide you with the security that is lacking in the world of day trading. Day traders aren’t guaranteed a salary. Even worse, they may receive a negative salary (i.e. trading losses). If you’re determined to become a full-time trader, use your job to enable your trading career. Your salary can provide the security you need as you pursue your trading dreams.

Remember to stay patient and focus on the bigger picture.

Myth #7: The Tools Make the Trader

Many new traders assign too much weight to the tools of the trade. They obsess over brokers, platforms, and hardware.

I’ll make this one simple – the setup does NOT make the trader.

You can make money with any broker, platform, and computer setup.

If you think you need a fancy setup, you’re focused on the wrong things. The setup is the EASY part of trading and it can always be changed in the future.

Experience is far more important.

Focus on your STRATEGY – the rest will follow.

Myth #8: You Need to Be a Numbers Whiz

Last but not least, we’ll address the myth that you need to be some sort of numbers whiz if you want to excel in trading.

Fortunately, you’re not building a complex auto-trading algorithm. You are just trading stocks – and basic math skills will do.

You don’t need to be a prodigy, nor do you need any fancy degree.

Most trading lessons don’t require any prerequisite skills from a Finance 101 class. You don’t need to know calculus to read a chart, and you don’t need to memorize derivative models to calculate your risk.

Day trading lessons can stand on their own. The best traders are those who are persistent, hard-working, humble, and adaptive.

Nathan, you really are amazing brother. Nice professional yet simple tips… totally agree.

thanks Nate, good stuff here.

He’s really is good at what he does. Time to change that Nikola T-shirt to a Tesla T-shirt!

I needed this. Thanks

Good read.