You’ve probably heard the expression, “Jack of all trades, master of none.”

This simple maxim speaks volumes on the relationship between effort and outcome.

Simply put, those who try to master everything will master nothing.

The world’s best cardiologist doesn’t moonlight as a nutritionist, and the world’s greatest violin player has little interest in an NBA career. Experts are experts for one key reason: they hyper-focus their activities in a narrow field. Over time, this selective focus compounds and puts these individuals in a league of their own.

In trading, this translates to finding your niche, or identifying the trading style that allows you to achieve exceptional performance. This could be value investing, short selling, or penny stock trading – it doesn’t matter. There are a thousand ways to make a buck in the market, all of which require focus and discipline.

Trading virtuosos are successful for the same reason as experts in any other field; they are specialists with well-defined areas of practice. Just as expert cardiologists don’t concern themselves with other fields of medicine, expert traders do not partake in market speculation outside their niches.

The Diversifiers and the Specialists: Why Focus Matters

The term “focus” can get lost in a sea of exhausted, feel-good buzzwords (alongside “hustle” and “passion”) so it’s important that we clarify its practical definition.

To put it simply, your “focus” is your “center of attention.”

It is the authoritative force that guides action towards goal achievement.

What you focus on will dictate the nature of your achievements. If you spend your free time watching Netflix, you may turn heads at trivia night, but you’re unlikely to develop any skill sets outside the realm of binge watching. Contrarily, if you spend your time studying the markets, you just may learn a thing or two about trading. Choose wisely because focus is a finite resource with intrinsic opportunity costs.

The Power of Hyper-focus

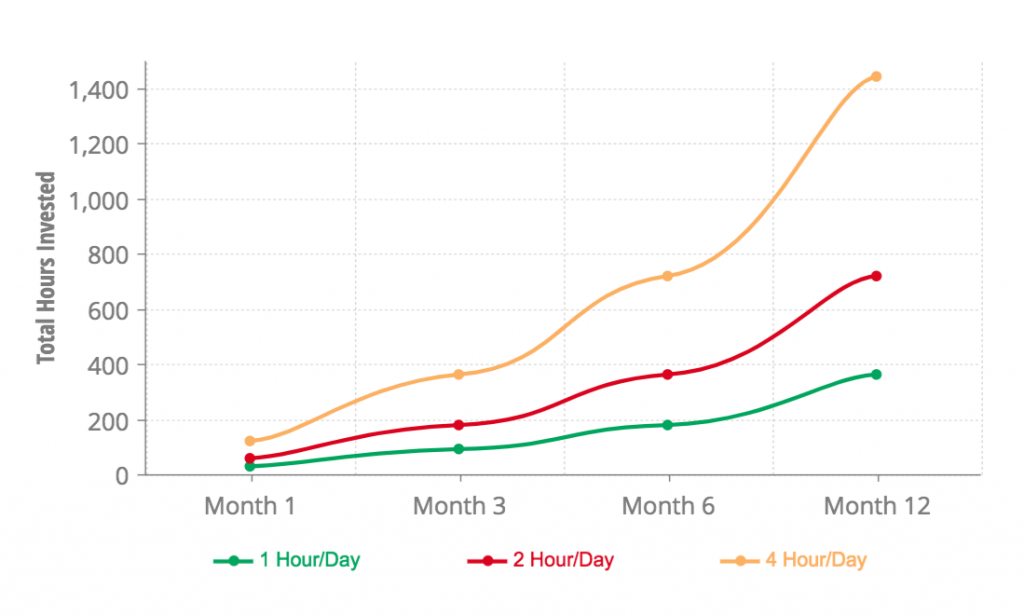

Time spent focusing on one thing is time not spent focusing on another and this is why hyper-focus is crucial to mastery. An individual who dedicates 100% of his/her time to one activity is likely to achieve better results in that area than an individual who dedicates 25% of his/her time to four separate activities. The math is straightforward.

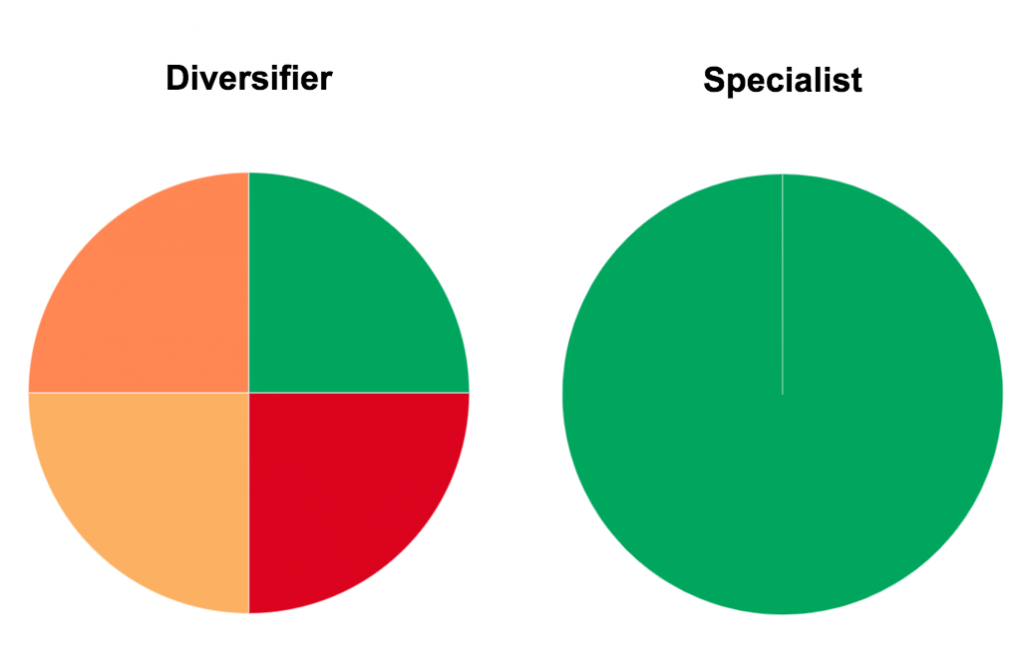

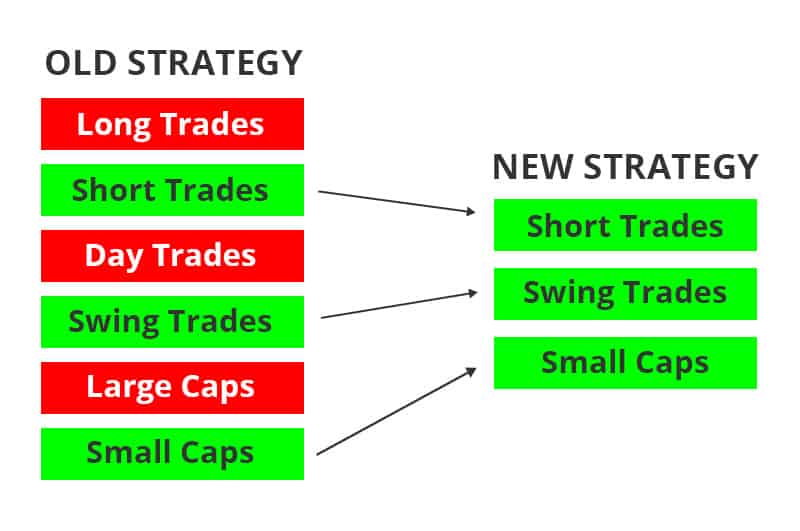

The concept is clear, but many traders fail to see “trading” as a broad category with a multitude of sub-niches. While these traders may be 100% committed to day trading, their focus within the realm of trading is scattered. Zoning in on a niche is where the real money is.

Think about any successful trader you know, and if you don’t know any, do some research. It’s unlikely that this trader trades a broad range of assets over a broad range of timeframes using a broad set of strategies. It’s more likely that he/she is focused on a very specific asset class over a very specific timeframe using a very specific strategy.

While the diversified trader is busy analyzing currency pairs, studying complex options strategies, reviewing the bond market, and planning intraday trades on commodity futures, the focused trader is analyzing overextended small cap runners: that’s it. Diversification may be an effective risk mitigation strategy in the world of investing but it’s a surefire way to dilute your efforts in the world of trading.

Let’s look at some of the common problems traders run into.

The Overwhelming Nature of the Markets

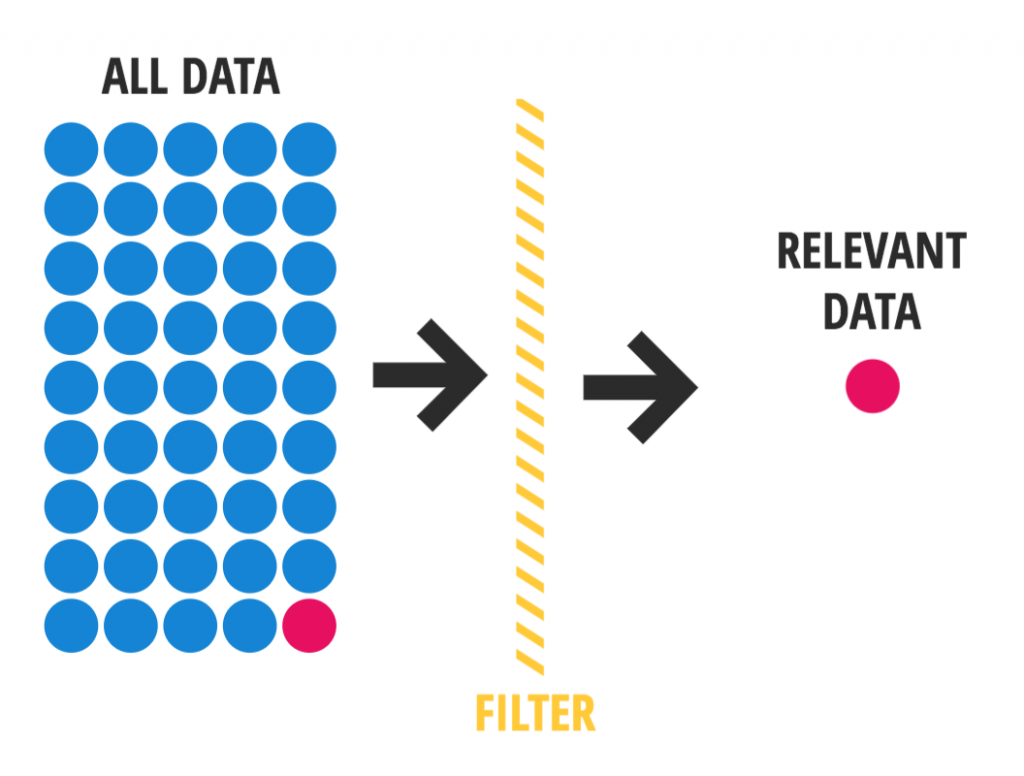

The fast pace of the markets is enough to trigger latent onset ADD in the most centered buddhist monk. The market consists of countless flashing numbers representing millions of transactions every single second. It’s an overwhelming arena in which noise filtration is vital to one’s success.

Without the proper noise filtration system, traders will chase every ticker that hits their scanners, Twitter feeds, or chat rooms.

A trader’s foremost responsibility is to eliminate noise. This can be achieved by differentiating between information that is relevant to your strategy (<1%) and information that is not (>99%).

Refinement by Elimination

If you’re new to trading, it may be easier to start by defining what you’re not interested in. Think about the indecision you may face when choosing a restaurant to eat at. It’s a lot easier to name all of the places you don’t want to eat at before settling on a few worthy prospects. If you had to consider every restaurant in a 5-mile radius, you’d go hungry before reaching a decision.

The same logic applies to trading. You may not be able to define your strategy with precision, but you should be able to define what it’s not. These negative descriptors will build the foundation of your noise filtration system, and as you continue to refine your criteria, you will be on your way to developing a well-rounded trading strategy.

Noise filtration systems serve as prerequisites to more precise trading strategies. These systems help new traders carve out a unique trading strategy over time.

Traders who lack guiding principles will get sucked into the chaos of the markets and trade erratically. Here are a few ways this can happen.

Fear of Missing Out (FOMO)

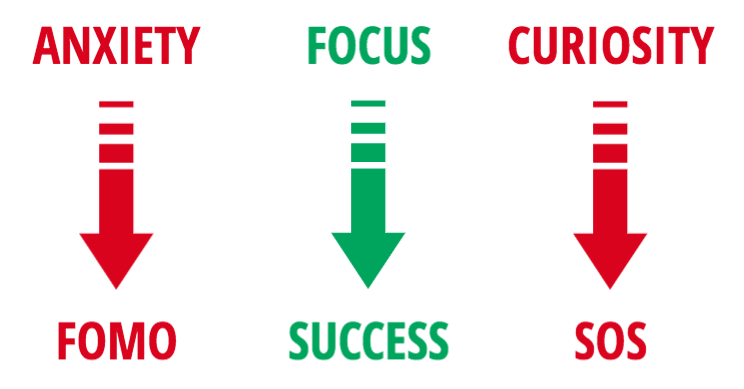

FOMO (fear of missing out) is the leading driver of irrational trading. By its very nature, FOMO is rooted in emotions, and even the most disciplined trader can fall victim given the right circumstance.

FOMO is the reason Johnny Large Caps takes his eyes of FAANG and decides to take a bite out of the latest low float runner. The grass is always greener on the other side, right?

Why waste time trading the 5-10% moves you’re familiar with when the 100%+ moves are ripe for the picking?

It’s this exact mentality that gets traders into trouble. Traders stray from their expertise in hopes of achieving exceptional gains. They naively enter unchartered territory, leaving their trading edge at the door. What starts as a dream of unimaginable gains ends in a nightmare of unmanageable losses.

If you find yourself entering a trade solely out of fear of being left behind, force yourself to take a step back. There will always be another trade. The costs of trading without an edge far outweigh the potential gains of riding the latest market trend.

Shiny Object Syndrome (SOS)

Shiny Object Syndrome (SOS) is the cousin of FOMO. Whereas FOMO is rooted in anxiety, SOS is rooted in wild curiosity.

SOS can easily be mistaken for ambition, but is better classified as directionless wandering. Traders may succumb to SOS out of ambition, curiosity, or boredom. Regardless, the results remain the same.

Traders under the influence of SOS get bored easily and change their strategies regularly. One week, they’re trading penny stocks, the next they’re trading options. They lack direction, therefore they lack focus.

To avoid Shiny Object Syndrome, focus on defining your niche and using your noise filtration system to avoid trades outside your area of expertise. Sometimes, the best trade is no trade.

The Path to Success

The path to success is paved with discipline and deliberation. Well-hypothesized trades are rooted in well-defined strategies. If you want to make it as a trader, you need to make a habit of defining and refining your strategy.

Take some time to think about your strategy. Grab a piece of paper and draw a line down the middle. On one side, list what your strategy IS and on the other what it IS NOT.

Here are some considerations:

- Equity Type

- Equity Price Range

- Timeframe

- Time of Day

- Chart Patterns

- Catalysts

- Fundamental Indicators

- Technical Indicators

- Risk Tolerance

- Volatility/Range

- Volume

- Trend

- Long/Short

- Profit Targets

As you continue to trade, you can continue to narrow the criteria for your strategy. You will learn more about what does and doesn’t work for you and you will adapt accordingly.

Thank you Nate, it is really helpful. It is pretty easy to get loose. Focus and follow the plan

I appreciate your information as well as your advice

Focus on a smaller piece of the pie st first

Thank you. I really enjoyed this lesson!

Thank you Nate, that was a great reality check. You nailed it on trading psychology.That makes so much sense.

Hi Nate, Hope your well? Thanks I am paper trading at the mo, and defo have “SOS” I know I am splashing a bit but I have already realized that I am much more comfortable swing trading than day trading.Thanks again

Doug, UK

Thanks IU.. you guys are in a league of your own.

Very helpful article. Putting it into practice tonight. Thank you

Thank you very helpful, exactly what I was looking for.

Very helpful and well explained.

Nate,

Thank you for this. It’s really helpful.

Thank you for all the advice and trading lessons Nate man.

Thank you Nate! I could not have opened this email at a better time. I have been all over the place lately and had my worst losing day ever today. I even contemplated quitting and adding to the 90% plus statistic that fail at trading. Looking back I was down small, overtraded trying to come back and made the losses worse, chased every shiny alert and made bad decisions all day and completely lost my focus. My account and my mentality paid the price. Going to reaccess over the weekend on what I am best at so I can drill down on it. Thank you again!

Thank you Nate,Your emails always super helpful. Thank you.

Thanks Nate

You always provide sound advice in a clear and precise manner.

Thank you Nate

This is the best blog post! Reading for the 3rd time

The best way to help a new investor. 🙏