We’ve had quite a bit to talk about lately. I think the best time to learn is LIVE during market hours, but if you can’t be live do it via replays. Unfortunately I didn’t record the live action today like I do sometimes, but for those of you who do have access to it, I’d suggest you review chat commentary as it’s happening live and apply it to the price action & tape.

They key on these types of trades is to let them PROVE your thesis – that your thought process is RIGHT. You will see me go through the trade listing KEY levels to not only break but also HOLD/TRAP.

How to Deal With “Red Flags”

I put a tweet out there today after seeing so many people talk about upcoming dilution. It just made me think about how much money is left on the table by ignoring names because of what could be coming in the future. At the end of the day, just about any name we trade has some sorta skeletons in the filings (some more than others). It’s obviously important to review the basics before jumping into things, but when volume starts to churn, float rotation activates and the tape suggests that the crowd is wrong, I take notice, I don’t ignore it.

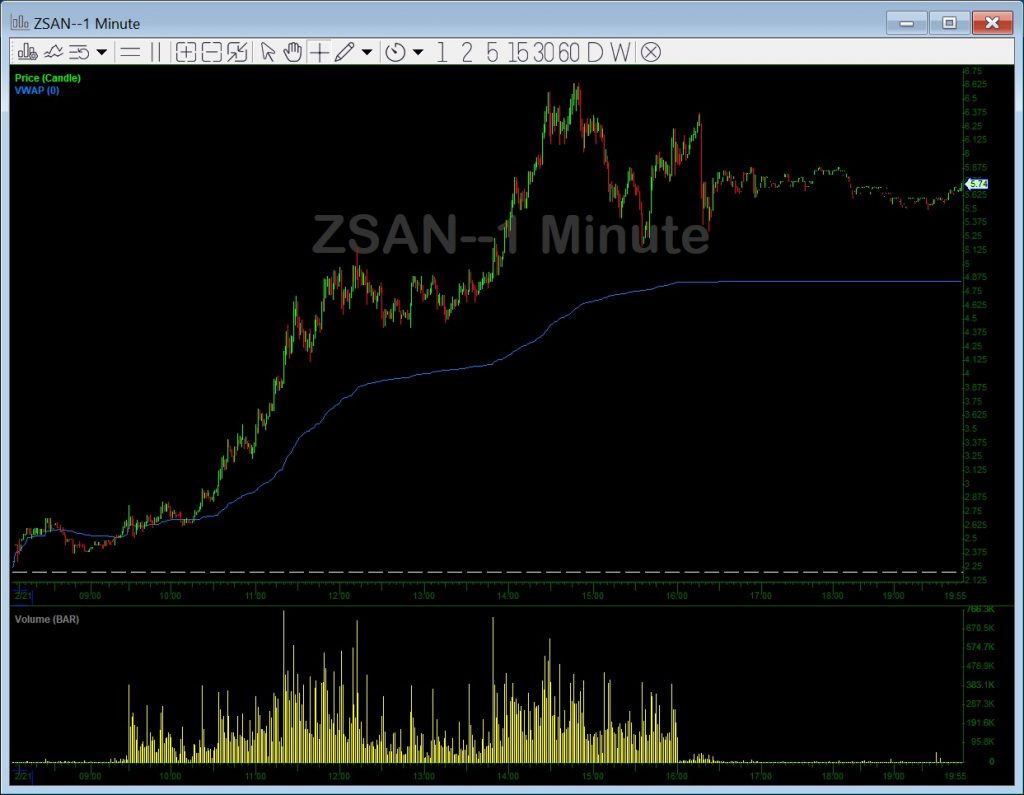

One of the things I used to repeat “Trade the ticker not the company.” Some fundamental guys criticize that quote. Taken out of context, I understand, but the true context of the quote is illustrated in the case of a ticker like ZSAN (which I’ll break down further in the post). Pay attention to the volume, float rotation and front side of the move ONLY.

We are so quick to label pieces of shit – pieces of shit.

They all are.

But this is where “trade the ticker not the company” came in.

It’s not suggesting that you do ZERO fundamental research.

It’s times like this.

Nothing matters except price and volume.

ON THE FRONT SIDE

— Nathan Michaud (@InvestorsLive) February 21, 2019

Some traders miss major trades out of fear of what could happen. Here are some examples:

- “I’m not going to trade it because they filed an S-3“

- “I’m not going to trade it because they can still raise $$ left over from last time”

- “I’m not going to trade it because they have an ATM” (not case here just example)

- “I’m not going to trade it because … “

That’s all fine – if it’s not for you it’s not for you. But for me, I give all these things a chance to prove themselves. The more negative the bias, the more likely a squeeze. On ZSAN today, everyone was talking negative, talking about how terrible it is etc only to see the price continually head higher. This to me = a sign. Take note. Price action speaks loudest.

Keep in mind, ZSAN is no stranger – this was my trade of the year in 2018 before CLPS overtook it. These guys know how to trap shorts and know how to run a solid campaign (in the market).

It’s insane how much shorts are pressuring this.

Look left — this is not their first rodeo.

— Nathan Michaud (@InvestorsLive) February 21, 2019

Recognizing the Crowded Trades

Flip that thought for a second. If everyone is bullish and going long, that’s a sign of a crowd. I take note. Much like today as you’ll see when I got short into the $6.40-6.50s because of that exact sentiment change.

When everyone is on the same side of a trade, it can easily become “crowded,” which leads to an amplification of the reversal. Think about it like this – if everyone is short a stock and it continues to breakout, what are the shorts likely to do? Cover. This, of course, fuels an even stronger move to the upside.

Look I’m not suggesting you shouldn’t be cautious of these types of situations (red flags); they’re common in what we trade. I won’t overnight them the majority of the time unless I have a flyer left and a good average, and I won’t really get aggressive pre market because I assume they’re all going to raise within 30 minutes of open.

BUT WHAT I DON’T DO IS THIS – I DON’T IGNORE THE MASSIVE PRICE ACTION, THE TREND AND WHAT THE TAPE IS SPELLING OUT DESPITE ANY & ALL RED FLAGS –> ON THE FRONT SIDE OF THE MOVE !!

What a trap!

— Nathan Michaud (@InvestorsLive) February 21, 2019

Be Aware of the Risk

When I trade these things I am FULLY aware of the risk at hand. A lot of the times, I sound like a broken record in the chat room when I warn traders about the risk involved in certain trades.

I got stuck in a negative situation with MBOT the other day because I overstayed. The trend changed, the tape was heavy and I turned into “I’m up $5/share let me see what it does” mode — which quickly turned into “Whooops, where’d my gain go?”

This is an example of not trading the tape correctly, over staying and ignoring risk. Thus, I paid for it.

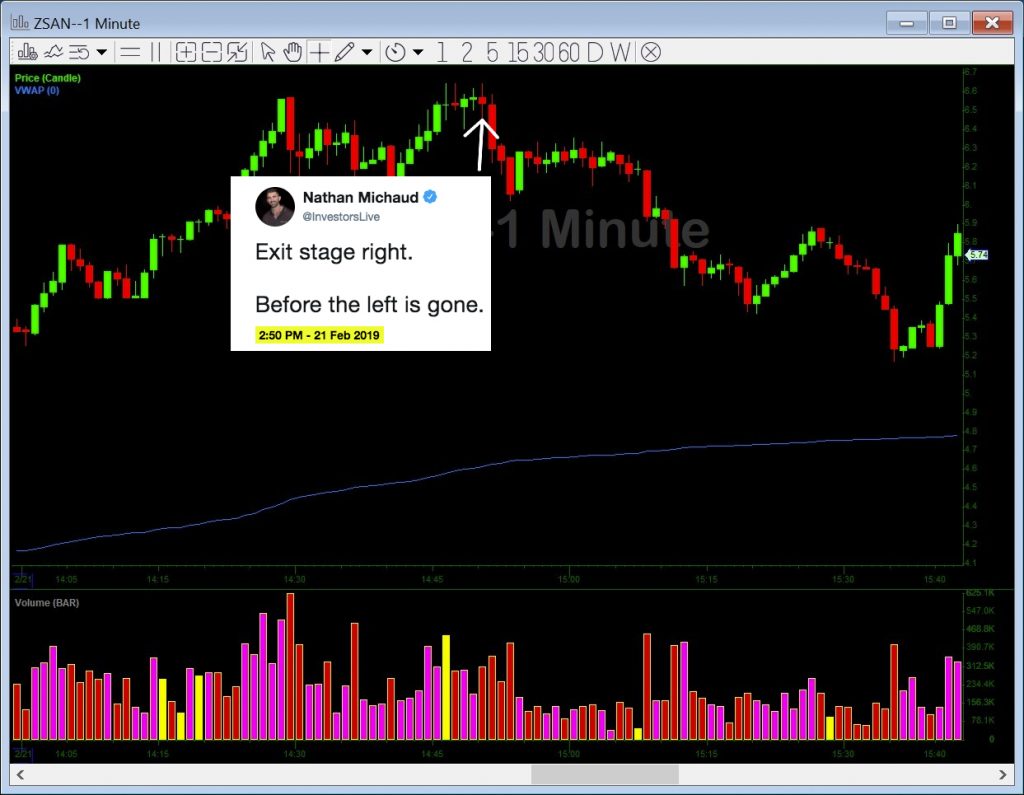

I did not ignore what the tape told me today though. Here is the time stamp suggesting I was exiting on the right before the bid side was gone. In other words being on the offer before they blow out the bids.

Exit stage right.

Before the left is gone.

— Nathan Michaud (@InvestorsLive) February 21, 2019

Did they file to raise $59,570,000? Yes surely did, effective and all they raised $50,000,000.

Did they file an S-3 the other day? Is that EFFECTIVE? No.

Notice anything? Yes, they still have $9 million left on the other one despite this recent one not being effective and if they can get it going well over $7 + that’s going to help them in a major way on the next one. Rather than pretend I’m a fundamental expert I’m going to link to Ricky who did a great video discussion a similar situation on MBOT and I think you should watch it.

Threw this together real quick for everyone

How Everyone Got Birdboxed by $MBOT – How to DDig with Ricky Analog – Ep. 11 https://t.co/WIcODkyTgT via @YouTube

— RickyAnalog_STN 🐢 (@RickyAnalog_STN) January 15, 2019

Like I said I’m not the fundamental master like some of the guys who I trade with are. Also, I will not claim to be. What I am good at is anticipating range on names — the “Where can this go?” and understanding a solid trap when I see one coupled with social sentiment and crowd mentality so that’s where I focus a lot of my efforts once I have a general understanding of what I am up against.

So let’s get right to it – I pulled a few select chat logs out because I want you to focus on everything I said and nothing more. Speaking about the level they were holding where they set the trap and the action to go along with it.

ZSAN Trade Video Recap

ZSAN Commentary from Chat

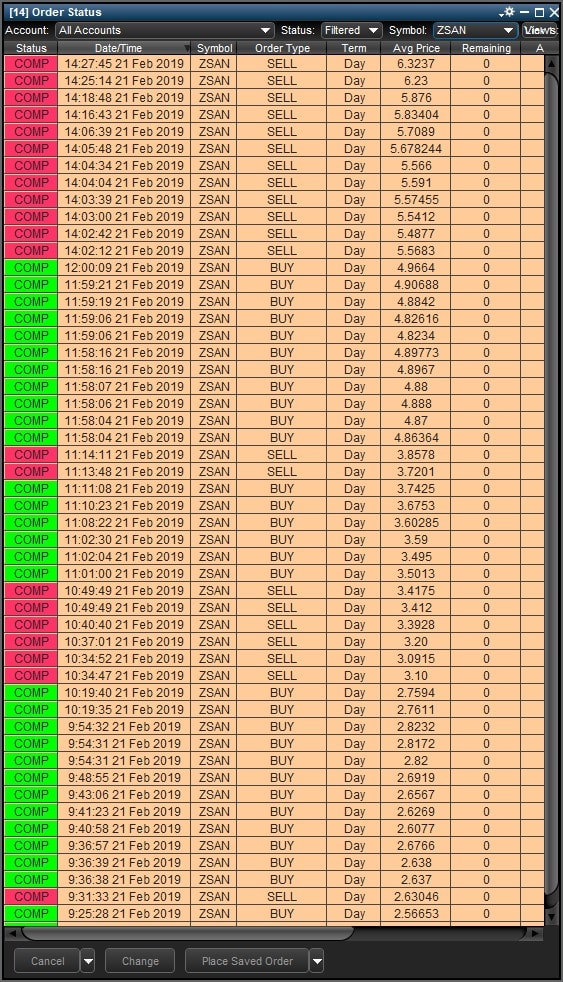

09:17:10 am InvestorsLive: ZSAN possible momentum trade later on

09:21:15 am InvestorsLive: ZSAN will be quiet trade off dips for me if this catches momentum

09:21:21 am InvestorsLive: def think potential

09:26:02 am InvestorsLive: ZSAN will be quiet trade for me tho – no need for crowd wrote my game plan — praying newsletter/chats leave it alone if it sets up

09:30:11 am InvestorsLive: ZSAN rip

09:30:26 am InvestorsLive: locking around core ZSAN

09:30:30 am InvestorsLive: add back if it holds strong

09:36:53 am InvestorsLive: ZSAN vs 2.50s r/r not to shabby

09:48:41 am InvestorsLive: ZSAN good clean up work

10:22:52 am InvestorsLive: ZSAN like butter 😛

10:22:58 am InvestorsLive: hope you guys all nailed as well

10:34:10 am InvestorsLive: ZSAN oh baby nice $2.51 avg

10:34:25 am InvestorsLive: from pre — 2.60s adds quiet trend join for me once people get loud and long be locking in!

11:58:32 am InvestorsLive: ZSAN may re join any good flush I think a lot of short add add adders

12:02:49 pm InvestorsLive: ZSAN some big candles off $5 but they’re still soaking – impressive. Trading the flush cautiously.

12:03:12 pm InvestorsLive: $4.40s guide 4.50s over/under ideal then snap back like before – some serious size exchanging hands

12:03:36 pm InvestorsLive: for new traders I’d avoid 100% at this level just a scalp until it confirms then scale for squeeze

12:04:01 pm InvestorsLive: only trading it given the padding from the $2.5x’s entry — have to assume each rally is a stuff until they trap and say otherwise

12:09:24 pm InvestorsLive: ZSAN nice job all but remember

12:09:28 pm InvestorsLive: at this level be Nimble be smart

12:09:38 pm InvestorsLive: lock around core etc fast .30 rip

12:09:39 pm InvestorsLive: if new avoid

12:12:33 pm InvestorsLive: ZSAN sick scoops

12:20:03 pm InvestorsLive: ZSAN – if no locks $5 + make sure you have a plan — as long as prior levels hold that I mentioned before I see everything as a trap

12:32:14 pm InvestorsLive: draw a line across on this ZSAN

12:32:22 pm InvestorsLive: for some clarity on upside vs. back side

12:32:27 pm InvestorsLive: one line can help you see quite a bit

12:32:57 pm InvestorsLive: that’s the area I am using for my trades – but again if you didn’t sell into the $5 rip then i would avoid 100% because you’re already not abiding by the rules of trading a flush

12:39:43 pm InvestorsLive: If you drew that line on ZSAN you’ll see how well it held

12:39:49 pm InvestorsLive: and didn’t let shorts win there

12:39:56 pm InvestorsLive: this should be telling

12:50:47 pm InvestorsLive: crazyyyy soak ZSAN

12:50:52 pm InvestorsLive: sick trap right there

12:50:55 pm InvestorsLive: hope you guys are watching

12:51:06 pm InvestorsLive: bam!

12:51:12 pm InvestorsLive: hope you all watched that

12:51:40 pm InvestorsLive: you ALWAYS watch these huge momentum names if you watches what you saw was 4.50s soak … weak …. ramp weak … ramp weak … break 4.50 and reclaim swipe

12:51:49 pm RyanM: amazing

12:51:54 pm InvestorsLive: Shorts are now bent from hammering the 4.50s

12:52:13 pm hermstocks: great commentary; thanks Nate

12:54:10 pm InvestorsLive: if you drew that line — you saw the reason why

01:05:38 pm InvestorsLive: Just reminder make sure you pay yourself around core ZSAN just in case – can always re add around the core but if it swipes up will be $5 5.20 then $5.50 very fast imo

01:05:50 pm InvestorsLive: 5.68 is circuit at moment

01:07:12 pm InvestorsLive: $4.90s having a field day so far either big seller or someone trying to protect

01:07:14 pm InvestorsLive: re; ZSAN

01:16:45 pm InvestorsLive: ZSAN insane pressure form shorts still – impressive

01:20:53 pm InvestorsLive: ur trigger this round ZSAN is $4.90 if they swipe and base there then you know.

01:42:56 pm Almond: ZSAN whichever way just pls decide

01:49:06 pm InvestorsLive: They have decided the direction most just didn’t realize it or trying to reverse it re: ZSAN which is good. Keeps size out on long side.

01:49:28 pm Almond: Thanks! tht’s my boy

01:49:30 pm wmtra7453: the timing of that comment nate. wtheck

01:49:42 pm InvestorsLive: 😉 only been staring at it all day

01:49:59 pm AndrewPZ: NostraNate

01:49:59 pm OddStockTrader: ZSAN nasty

01:50:18 pm P_Mil: congrats Nate and team

02:05:45 pm InvestorsLive: 1/2 ZSAN

02:06:41 pm InvestorsLive: 1/4 left

02:06:48 pm InvestorsLive: maybe 6.50 + on rest we’ll see I’ll keep a flyer

02:07:13 pm InvestorsLive: if we pull back and trap $5.50s again then I’ll get back 1/2 + but awesome job all fast buck from the line I said to draw

02:21:07 pm InvestorsLive: 6 test here ZSAN

02:25:19 pm bk2011: ZSAN awesome

02:25:23 pm InvestorsLive: locked more ZSAN

02:25:28 pm InvestorsLive: minimal left sick re: 6.50

02:25:30 pm InvestorsLive: almost thur

02:27:50 pm InvestorsLive: all out ZSAN

02:29:09 pm InvestorsLive: ss ZSAN starter expecting 7 w/ size

02:33:18 pm InvestorsLive: Just reminder nice nail ZSAN and flush to sub 6.20s ok to lock around until we are on back side

02:33:20 pm InvestorsLive: be smart about it

02:34:35 pm InvestorsLive: They are still working thru some big covers ZSAN see the flush then bid swipes back

02:36:16 pm InvestorsLive: There has yet to be a big blow off on ZSAN fwiw – so take that into account if trading it – thought is the blow off will be sneaky and just be lots of fails before pulling big not sure we get a parabolic just a rotation of emotional shorts into offers. But as you know we are front side of move. PLENTY of back side that you don’t need FOMO to miss.

02:36:49 pm InvestorsLive: I think most will wait for that parabolic candle but I think its hiddenly been happening as we speak

02:36:59 pm InvestorsLive: bingo

02:40:10 pm InvestorsLive: Key area becomes $6.20 IMO if it stays over that be cautious and locking in from $6.45s — if it starts to get heavy — that’s when things may get funky still plenty of time before close

02:44:51 pm InvestorsLive: Watch these candles ZSAN

02:44:58 pm InvestorsLive: near break out and huge size coming out

02:45:10 pm elkwood66: ZSAN feels exactly like PTI 5 months ago

02:45:17 pm InvestorsLive: No don’t say that

02:45:22 pm InvestorsLive: my biggest loss of 2018

02:45:31 pm Nkaz: me too lol

02:51:49 pm InvestorsLive: bingo ZSAN again

02:51:53 pm InvestorsLive: 6.20 is key guys

02:52:50 pm InvestorsLive: 6.20s again the battle

03:11:53 pm InvestorsLive: !!!!!!!!!!

03:11:55 pm InvestorsLive: 1/2 cov

03:12:05 pm InvestorsLive: rest maybe $5.50-4.80

03:12:05 pm BipolarTrad3r: great job nate

03:12:13 pm InvestorsLive: I really hope you go back and read comments

03:12:28 pm InvestorsLive: and look at chart etc- no I told you so at all just looking at tape

03:12:31 pm InvestorsLive: not expecting a parabolic

03:12:35 pm InvestorsLive: sneaky selling into ramps etc.

03:12:38 pm InvestorsLive: just perfect

03:12:41 pm InvestorsLive: hope many got

03:15:51 pm Catfish: Beautiful commentary on ZSAN thank you Nate

03:15:52 pm InvestorsLive: UNIT again off the push

03:21:24 pm InvestorsLive: 1/4 ZSAN left

03:27:54 pm InvestorsLive: done ZSAN

03:55:27 pm InvestorsLive: Thinking along Eric thoughts re: ZSAN

03:55:32 pm InvestorsLive: they never let shorts out today

03:55:54 pm InvestorsLive: It’s rare I have a perfect trade like that — but imo most shorts are bagged from sub $5 so they didn’t let them out — and likely still trapped

03:56:14 pm InvestorsLive: so with that said — weak open and rip tomorrow very well can get some serious $8-10 action

04:05:52 pm InvestorsLive: ZSAN man 5.20 to 5.80

04:05:54 pm InvestorsLive: that move

04:05:56 pm InvestorsLive: holy trap

I watched it happening and your commentary was very educational. I’ve watched many dvds. But watching these plays develop is changing my thought process. Of course thanks to you for explaining.

Great stuff as always! Thank you!