Check out this interview I did earlier this year with Chat With Traders. The video goes over my trading history, strategy, and a lot of the questions I get asked on a regular basis.

Here are a few of the main takeaways for those who don’t have time to watch the whole thing.

Balancing Day Trading and Other Responsibilities

No one starts out as a full-time day trader. Chances are, you have other responsibilities and you need to find a good balance. If you are a part-time day trader, the best thing you can do is realize you are part-time and tailor your strategy accordingly. What does this mean?

Don’t enter volatile positions that you need to monitor every second. If a stock is up 100% and you’re at work, it’s probably not the right time to take a position. On top of that, you should consider using hard stops to protect yourself from losses.

You Need to Adapt to Changing Market Conditions

The market is constantly changing and what works one day may not work the next. What worked years ago doesn’t necessarily work today, especially with regards to penny stocks. When planning your strategy or studying the strategies of others, it’s important to make sure the strategy is still applicable today. For example, OTC market strategies are cyclical. It used to be a lot easier to make a profit in the OTC markets, whereas now the penny stock market is pretty dull. Occasionally, the volume will return (such as the medical marijuana run a couple years ago), but until then it’s better to focus on other strategies. If something doesn’t work, focus on a new strategy. Great traders are always adapting to the ever-changing market conditions.

Look for Stocks with Range

When scanning for stocks, look for ones that have a broad intraday range. To find a stocks range, simply subtract the daily low from the daily high.

A stock that has a $0.10 intraday range provides very little trading opportunities, whereas a stock with a $2-3 range is a great candidate for a day trade. You are limited in the amount of stocks you can focus on, so make sure you are paying attention to the right ones.

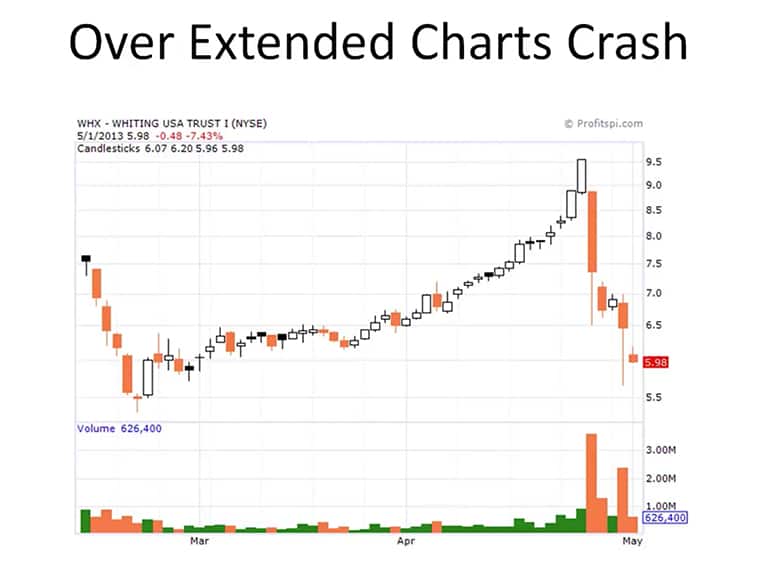

Look for Overextended Stocks

If you are interested in short selling stocks, find stocks that are overextended. These are the stocks that have been running for a few days without any real pullbacks.

You want to be ready when the stock cracks and the trend changes. This is the point when the unrealistic optimism fades and sellers start to flood the market, which makes for a great short opportunity.

Minimize Candidates – Maximize Returns

If you are watching 100 stocks, each stock is getting one hundredth of your focus. If you are watching 10 stocks, each stock is getting one tenth of your focus. You get the point.

Your goal shouldn’t be to catch every trading opportunity available. You will be diluting your efforts which will be counterproductive. Focus on finding the BEST opportunities so you can execute the most profitable trades. Focus on maximizing each trade instead of trying to catch every single play. Trading is about quality over quantity. If you can make $1000 on one trade, why try to catch a bunch of $100 trades?

Focus On When You Make the Most Money

Analyze your trades and figure out which times of the day you make the most money. This tip speaks to the point of minimization yet again. If you are making all of your money during the morning, you don’t really need to be trading during the rest of the day. You may even be giving back profits during that time.

Trading is About Confidence

Enter trades where you feel confident and avoid trades when you are not. This doesn’t mean you can only enter trades where you are 100% certain you will make money; that is unrealistic. It simply means you are focusing on the opportunities that match your skill set.

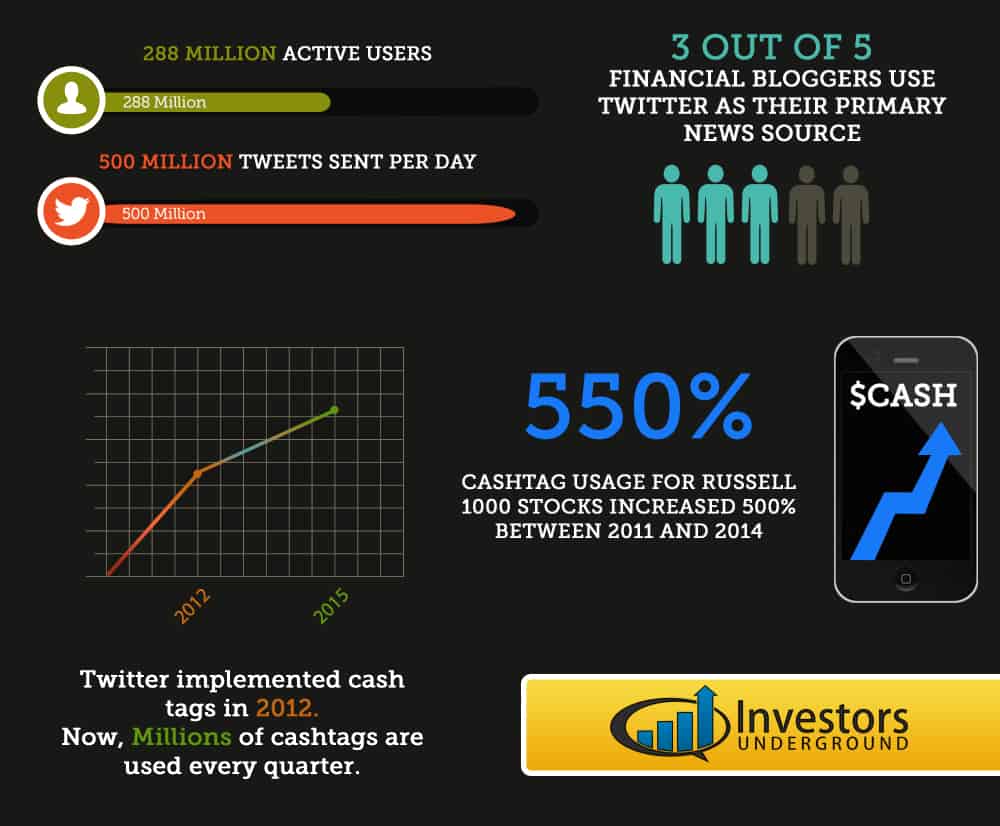

Use Twitter as a Tool

Twitter is a great tool for getting information. Want to know why a stock is moving? Look it up. Many traders are vocal about their strategy which gives you instant access to valuable information. On top of that, certain Twitter users have the power to move the market by releasing hit pieces or other influential information.

It’s All About Volume

Volume is one of the most important criteria for finding good momentum trading candidates. Focus on trading stocks with high volume (particularly higher than average volume). This generally provides better trading ranges, improved liquidity, and overall better trading opportunities.

Short Selling is Not Easy

A stock that is easy-to-borrow isn’t necessarily a good short. Short selling can be dangerous because you have theoretically unlimited risk. Don’t short a stock just because “you can” or “it is up a lot.” Know your risk, know WHY you are shorting a stock, and trade accordingly.

Balance Risk and Reward

Look for a 3:1 risk/reward ratio. This mean you risk $1 for every $3 you expect to make. By consistently trading stocks with good risk/reward ratios, you give yourself room to breathe as a trader.

Failed Follow Through Momentum

When a stock is running, see how it responds to future momentum. For example, if a stock runs from $10 to $15 one day, watch how it reacts at the $15 range the next day. If that area becomes resistance, the follow through momentum failed. This often provides a good opportunity to initiate a short position.

Understand Emotions in the Market and Look for Shifts in Sentiment

A lot of great opportunities come from changes in market sentiment. For example, if a stock is running 10 days straight, there’s a good chance that everyone is very bullish. If that stock starts to go down, people may have been given a reason to sell their position. This can be a good time to short. Similarly, if a stock has been going down for days and begins to turn, this can be a good time to launch a long position. Obviously, you need to do a more in-depth analysis before entering a trade like this, but the general idea is simple: look for shifts in emotions.

Scaling Up Does Not Mean Buying More Shares

First of all, you need to find consistency as a trader before considering scaling up your strategy. Scaling is about making the most of your day trading talents.

When it comes time to scale up your strategy, you need to be cautious of the increased risk. Scaling up doesn’t mean you go from buying/shorting 1000, to 2000, to 3000 shares. You need to focus on scaling into a position (i.e. not taking a full position right away). This seems simple, but you need to have a reason to continue to add to a position. It can be helpful to pretend you do not have a position so you can analyze the stock. Would you buy/sell it if you weren’t already in a position?

Don’t Compare Yourself to Other Traders

It’s okay to be inspired by other traders but you shouldn’t be influenced by them. You don’t know the path they took to get where they are at now.

It’s good to learn from others but you shouldn’t try to emulate what they are doing. One thing that all great traders have in common is that they think for themselves. As a new trader, it’s important to get into this habit early.

Utilize Your Trading Community

Trading is a solo activity and certain habits (both good and bad) can begin to seem normal after time. If you bounce ideas off of other traders and begin discussing your trading strategies together, you may be able to help each other. For example, there is a lesson to learn in every loss. You may not be able to see it initially, but it may be obvious to another trader.

Nail and Bail. Don’t Stay and Pray.

The whole idea of momentum trading is to get in and get out of a position in a short period of time. If you are sticking around for longer, you are probably in a position for the wrong reasons. Get in the habit of nailing a trade and moving on. If the trade doesn’t work, bail and move on. Don’t stick around just to see what a stock will do.

Good Interview Nate.