Hope everyone had a great trading day today!

We had some monster plays in the room and I wanted to share the daily video recap I do for members! I’m not going into major detail here about the VWAP but I want to get you guys to think out of the box and see if this indicator helps you!

Focus on the VWAP levels and also check the NYMX chart at the bottom – notice anything about it? We’ve gone over this in many of the webinars discussing how to stay safe on the front side vs. back side of the moves. We’ve also discussed in length about where and how I like to size in once under the VWAP after a CONFIRMATION.

Another big point to understand is on XCOM where the front side of the move was holding VWAP through the day until it started to parabolic. The only two times I like to short is into a speed up relative to prior price action (the only time over the VWAP) or on the back side after a VWAP rejection which you can clearly see on XCOM. We’ll tackle these next week in the webinar and discuss in depth!

Here are the charts that I will be talking about – video is at the bottom!

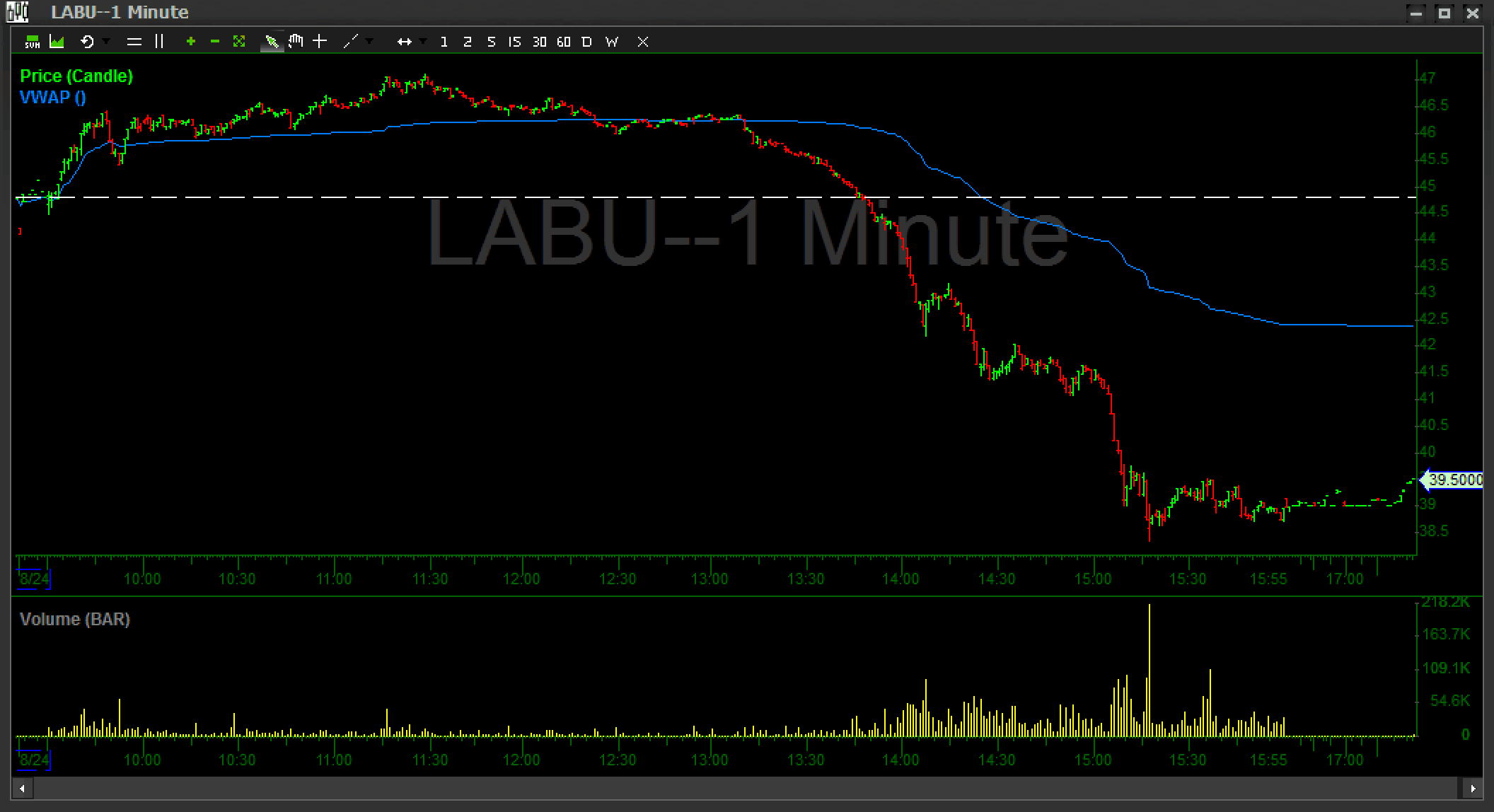

LABU 1 Minute Chart

Play of the day for me – Has been a main radar the last few days on scan. I knew the trade was close and I wanted to be prepared for it because, much like NUGT, when it’s time to reverse these things get ABSOLUTELY destroyed. Another great chart providing confirmation for the size in.

MOMO 1 Minute Chart

Failed follow through momentum after a gap – trade is covered on Tandem Trader.

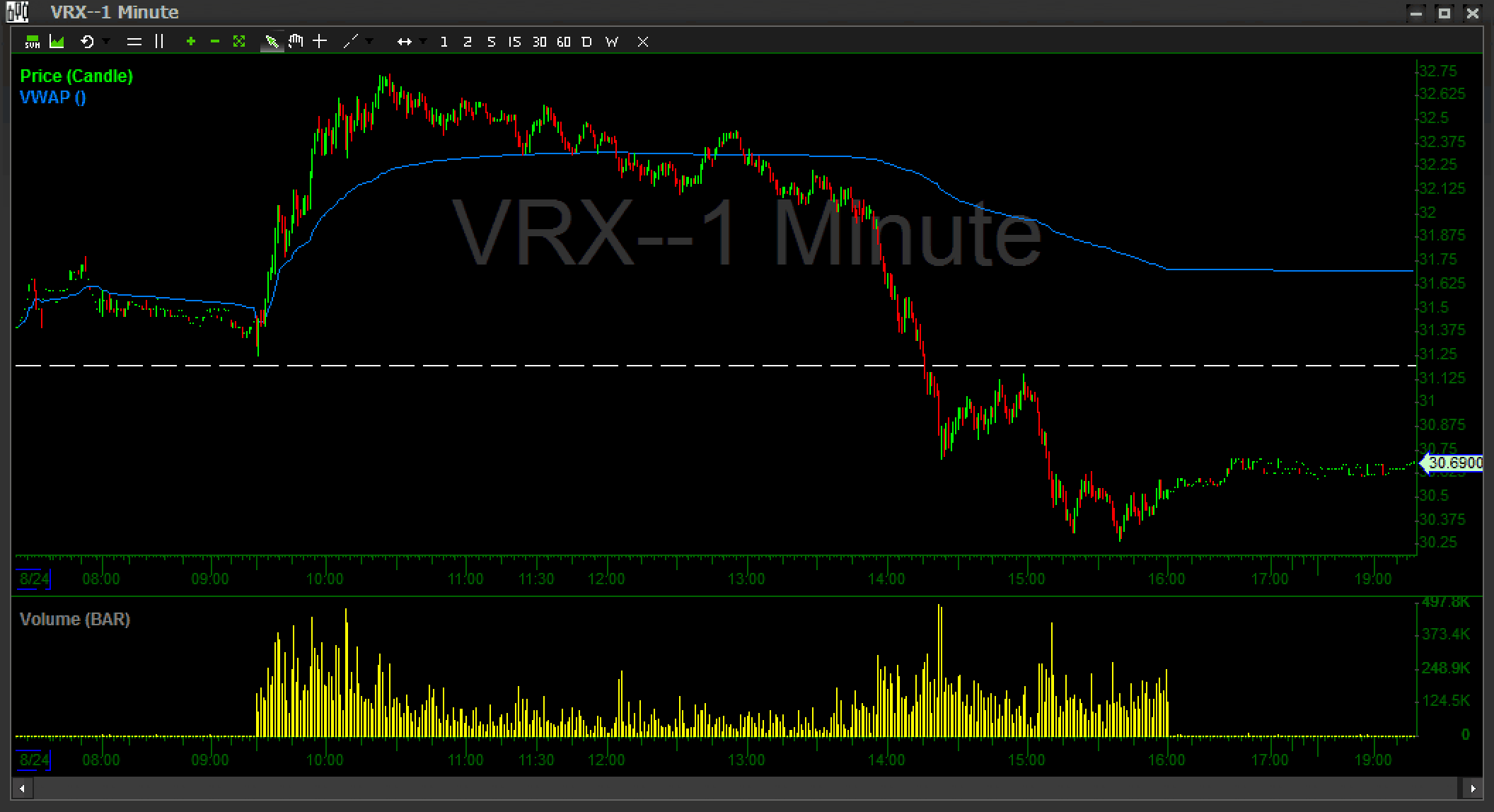

VRX 1 Minute Chart

The key on this one is the bouncing ball analogy we use in Tandem Trader. If your plan is to ANTICIPATE the break down but – at what point based on VWAP reject and confirmation would you start to look to short pops? Leave a comment!

XCOM 1 Minute Chart

The main point I want to show here is on the front side of the move there was never a reason to get short UNTIL it starts to parabolic compared to prior price action. At that point you can see the stuff candle (major volume) followed by another failed attempt at HOD offering proper risk vs. potential reward to the downside. Had you not entered into any of those two spots, the only other place (and for the point of this blog) that I would look to enter is into the VWAP reject throughout the day – do you see it on the chart?

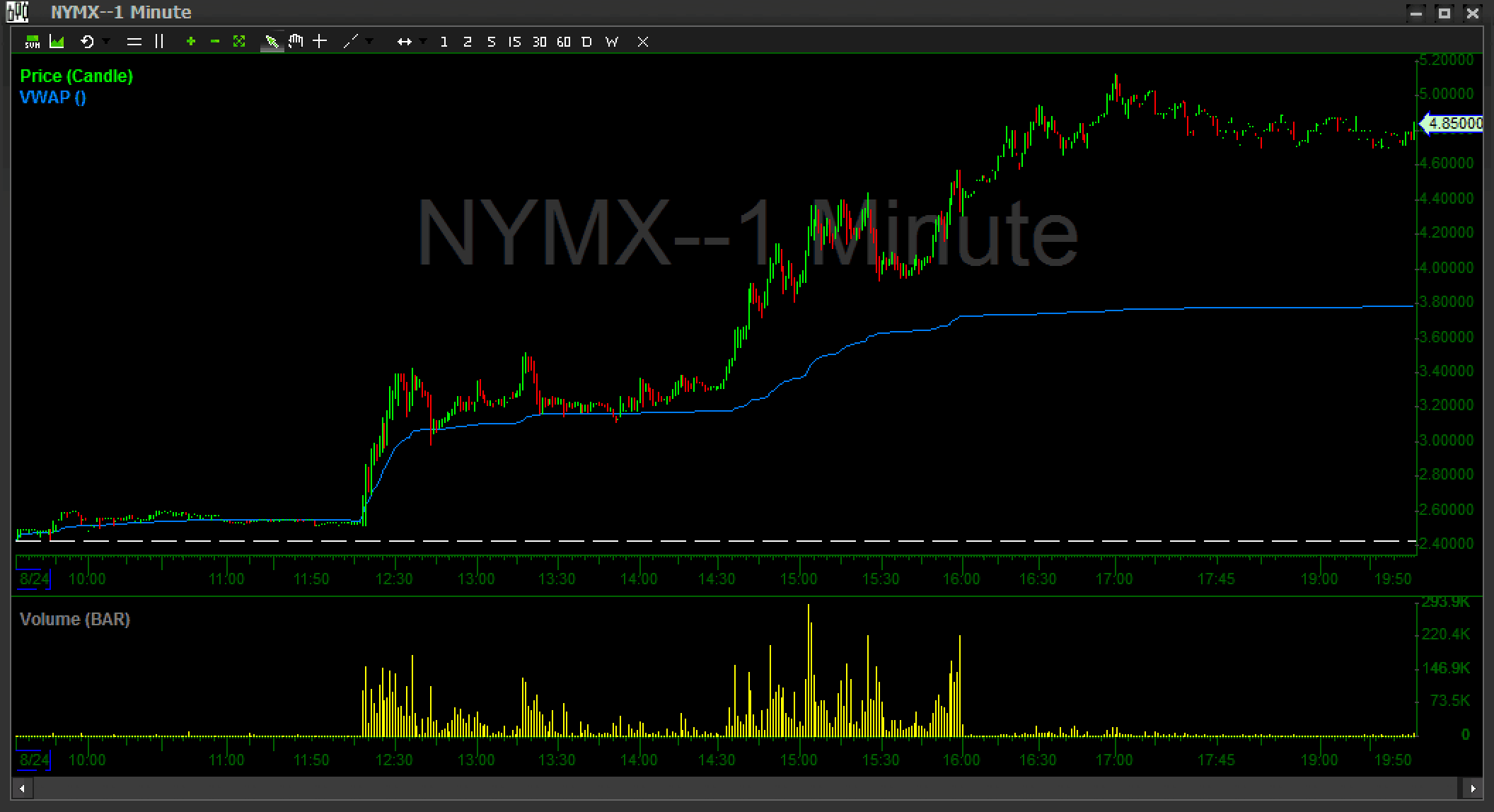

NYMX 1 Minute Chart

The point to consider here is how it did not break under VWAP once and continued to hold trend. It’s important to understand WHEN to be cautious on the short side. If you DO short the front side of the move you need to understand that 1.) You need a set plan 2.) You need an eject spot (place to be wrong) 3.) Be cautious ABOVE the VWAP. The last point is that, especially in this market, many times it’s nice to scoop dips with set risk off this level – especially with the high flying names lately.

Awesome! Thanks Nate. Will definitely be joining soon.

The combination with little baby’s voice and video recap makes more comprehensive))

Jood Gob!!! Keep them coming!!!!