Day Trading Encyclopedia

Stock Brokers Short Lists

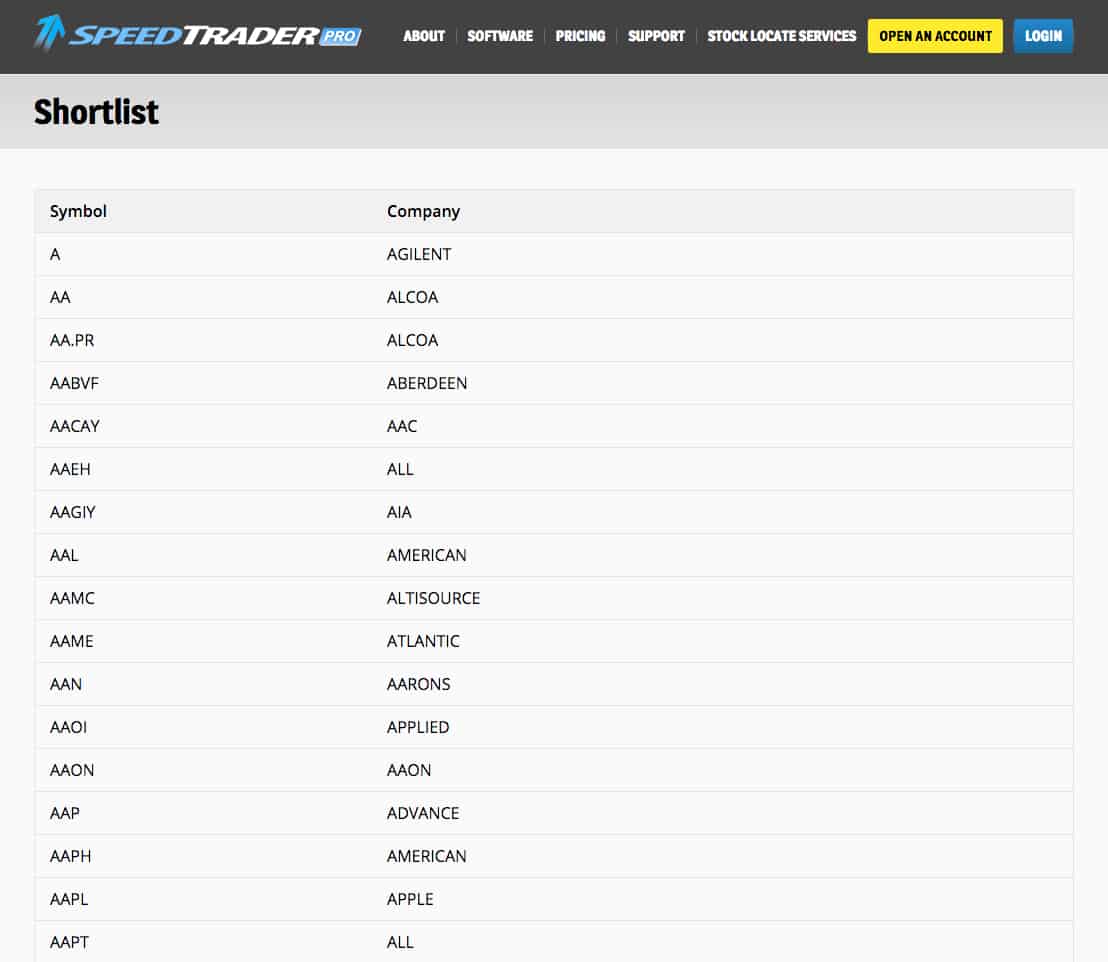

Example of a Short List

Short Lists

This is an updated list of stocks that are available to short. Brokers provide this list in the mornings, however, most traders will simply check on the individual stock by placing a deep out of the market short sell order to see if the system acknowledges it without a restriction warning. For example, if XYZ is trading at $26, a day trader may place a sell short order at $29 to see if the platform accepts it. If there are shorts available, then the trade order will go live immediately; otherwise, the order will be rejected due to unavailability of shorts. Many platforms offer a method to request short shares by calling, messaging or e-mail the brokerage. It is imperative that traders are aware of the margin requirements on short shares. While day trading buying power normally requires 25% maintenance margin or 4 to 1 intra-day buying power, more volatile issues may require a higher maintenance margin. A 50% maintenance margin means the account only get 2 to 1 leverage intra-day. This can turn into a serious problem if the stock goes into a strong short squeeze to trigger an intra-day margin call unbeknownst to the trader. Violent short squeezes are fueled by margin calls and unavailability of short shares. In essence, this traps the short sellers with no way of cost-averaging their shares since there aren’t any more shares available, which continues to cause automatic liquidations as the stock price squeezes higher.