This post covers the “outlier” trades that I found to be my BIGGEST flaws for the year. Hopefully, this helps you learn something.

After being inspired by many of the traders at Traders4ACause last year, I wanted to focus on taking my trading to the next level. I’ve always been able to grind out consistency; in other words, slow steady gains each and every day that truly add up faster than you think. My style of trading began when I was in college trading in between classes with a smaller account. My trading style was perfect to slowly build that account from small to large, however this strategy may not be for everyone long term, as it’s important to adapt and see what you’re capable of (within reason).

I made by trading courses because they serve as the foundations that traders need to give themselves the best chance of actually “getting it” and to determine whether or not they can find consistency. Once consistency is found, this opens a whole new world of opportunity. Accounts grow a bit, giving the trader the ability to “take it to the next level” and take on a risk they may not have ever been able to.

For some, it makes sense. For others who are just slowly chipping away at small profits, this may be more than what they are comfortable with.

Most people never want to be left saying “What if?” and “Could I have done that?”

You’d never know unless you tried …

Or, you never know until you try …

This post is not suggesting that traders should get out there and take on ridiculous risk and possibly blow up their accounts and this is not a post for traders that are just starting out. This is not a post for traders who just went full time and want to start seeing larger profits. Keep in mind that more risk exposes you to more potential losses. Just as your profits may grow, so can your losses if they are not controlled.

This post is about my journey over the last ten months taking that ‘next step’ and seeing what I was capable of as a trader because I never wanted to ask myself “what if?” and “Could I have done that?” and not be able to answer it.

Consistent trading gives you the opportunity to excel. Whether or not you take that opportunity once capitalized is up to you. We’ve talked a lot about consistency and why it’s important. Trading is not always straight forward; there will be pull backs, major losses, broken rules and times that you need to go back to basics and regather the confidence that is needed in this profession.

For some, taking it to the next level isn’t about size or profits in each trade but rather new ventures and new ideas. Perhaps consistency over the years gave you the ability to start swing trading, investing or even dive into options trading. In the end, there are different ways to expand your arsenal to see if there are other opportunities to start to grow your accounts.

To keep myself from getting sloppy, I’ve always wired out profits on a regular basis, but after we did an interview with Gregg who questioned why I would sell myself short like that, I started changing my perspective. I have the perfect opportunity to size into large positions, bigger picture ideas and expand my horizons a bit. Gregg was totally right: no better time than now.

So, that’s what I did. I let my accounts grow and started trading with bigger picture ideas in mind and pretty much kicked off the best start to any year I’ve had in 2015. The keyword here is “start.”

So let’s take a look at my biggest failures of 2015 and what I learned from them:

Keep in mind, scaling up trades is not simply changing your lot size from 1,000 to 5,000 or 5,000 to 10,000-20,000. That is a quick blow up, exhausting strategy. Scaling up trades is more about scaling into a winner correctly, which I’ll cover in a future blog post.

Week after week we had one absolute trash stock running fifty percent to one hundred percent. only to give back all its gains in a day or two. Yes, this is my favorite “morning parabolic and sit back” style of trade.

It was pretty seamless almost like when I first started trading: size in to one, scale up use profits on next, repeat, repeat, repeat.

GENE trade perfectly explains two of the three main lessons from 2015:

GENE came along and I had a perfect read on it. I was actually long for the $4 breakout before it took off to $6 and then $7 later on in the day and took the near fifty percent gains on it. This stock has ran not one, not two but almost three or four hundred percent so it should be close to a short right? Everyone is bashing it, everyone is short, we all know it’s trash – only a matter of time, right? (Note: the bias plus crowd tendency forming here)

Nope, as it cruises through $8, then $9 I think to myself “Damn, I should probably start in off the morning pop, get short and then scale in as the support cracks.” Simple enough, right? I had a great trade going. GENE started fading but based through midday with couple pops towards $9 and failed. It re-tested and failed as we approached the final hour of trading. If it cracked, it would be a GREAT time to size in and get the panic washout into close.

GENE started to flirt a few more times with $9 but quickly snapped back to re-test intraday support. Volume was starting to pick up and CRACK; it snapped that support it held all day! I piled in using the houses money (unrealized gain from earlier) thinking, “who in their right mind would be a buyer now?” I saw a great chance for the big washout after running $1s to $9s in just a few short days.

The Reclaim

The move that gets me EVERY time after things settle off and I am being patient is this one right here: pic.twitter.com/DkpGSAscOV

— Nathan Michaud (@InvestorsLive) June 2, 2015

My BIGGEST flaw when scaling up size over the last ten months has been sizing in without being able to size back out – whether it’s due to being stubborn, biased or just plain stupidity. I’ve posted this many times over the past few months on stocks like GENE, PBMD, PBTI and many others to show exactly what it looks like and how I fall for it many times. Staying light on the front side, adding into the winner but becoming too biased to adapt once sized in. GENE cracked the support, EVERYONE including myself was anticipating a washout and it never came.

All cash except $GERN for potential gapper (already locked some in from $3.9x’s) start fresh tomorrow #happens pic.twitter.com/yRaZzH9oOZ — Nathan Michaud (@InvestorsLive) May 20, 2015

So ugly day after making $40k between Mon-Tuesday but happens I guess — I got overly excited and went back for more pic.twitter.com/VXykgPGRrJ

— Nathan Michaud (@InvestorsLive) February 25, 2015

First time stubborn all week $KITE let one add get me by not covering wash but have to leave so can’t sit around pic.twitter.com/7xGAMSGAZp — Nathan Michaud (@InvestorsLive) January 16, 2015

Failure to Adapt

This is where I failed to adapt. I had sized in and GENE cracked as I anticipated, but within five or ten minutes the trend had regained control and the support (which should have become resistance) quickly became support again.

If this happens, I need to get back to my partial size (giving myself room to scale into the next trade) or exit the trade fully.

My failure to adapt, keeping my strong biased kept me in the trade full size. Think about what’s going on here. Everyone who was short got excited about that crack and everyone that was waiting for that crack to short, shorted yet the stock still held. What is going to happen?

That’s right – that big trampoline bounce and squeeze.

Here I am full size, fighting trend rips through $10 and runs after hours while still deciding to go ahead and keep the trade overnight. Sound familiar? Remember my stubborn RSOL $65,000 dollar loss I covered in Textbook Trading? Yes, dumb.

Next day GENE gaps up $11 parabolic (my favorite trade). If I had a clear head, this would have been very easy to nail. In fact, I did nail it. I added a bit more and had a perfect washout and cover. GREAT trade,had I not let my stubborn overnight position ruin it. I ended up just shy of a $50,000 loss on it, but this was just the first of many that was about to test my rules, patience, stubbornness and overall trade plan.

DAILY CHART: PATIENCE VS. TOO MUCH PATIENCE ON FRONT SIDE BACK SIDE

I used to have a problem with getting into momentum trades far too early. I would start in and add to a loser but realize it and adapt. I have done extremely well since 2013-2014 not letting the front side of the move suck me in on an intraday basis. So flaw, fixed.

But, take it a step further and let’s look at the big picture DAILY chart vs. INTRADAY.

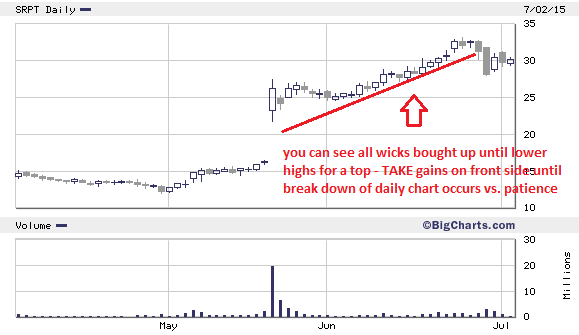

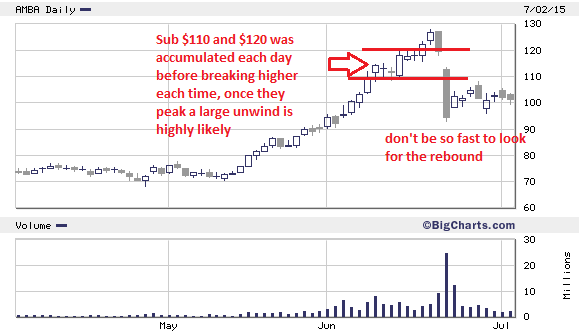

SRPT and AMBA, most recently, have had powerful moves to the upside, and, as you can see by the wicks, have major range on the day only to close near or at the highs.

Each day I was up many thousands but failed to take the gains because why would I? I’m looking for the big picture move; I’m looking for that big candle day where they pull back ten, twenty or even thirty percent in one day. This move is due at any time but my anticipation lead to day in and day out exhaustion wondering WHY I was so patient, WHY I let such a big win (many times $5,000-7,000 gains) turn into a $1,000-$2,000 loss. Try it sometime; it makes trading NOT fun.

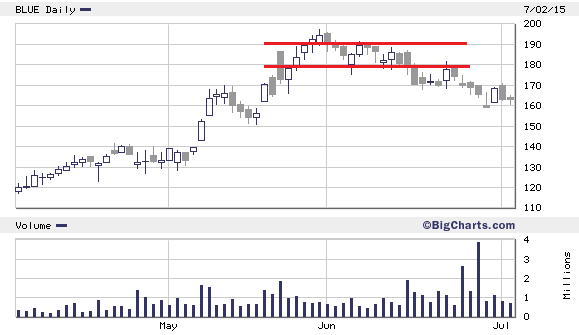

The easiest way to determine when and where to be patient is the daily chart support still holding, much like I discuss in the trading courses. Those psychological support points are not necessarily to the penny, but for example SRPT $30 or $35, AMBA $125 level, or something like BLUE which becomes much easier to see over/under the $180 mark. This is the same idea as the over/under whole and half dollar marks only on a higher number scale.

Nothing is wrong with taking the trade, but when the DAILY CHART trend has NOT broken, and intraday starts to form an ABCD long set up, make sure to respect the trend!

FLIP FLOP – PATIENTLY WAITING FOR CORRECT

Some losses in years past came from ETFs like NUGT, DUST, JDST and UVXY. These losses were not due to a failure to understand what they were, but rather watching them for so long for the potential correction that when it finally comes and I miss it, I start looking for the opposite trade, the rebound.

If you wait for thirty to sixty days for a pullback that never comes and then finally after an FOMC meeting, the snap happens and cracks so fast, you think, “Wow, long opportunity? Dip buy and scalp out?” You may nail it for the base (for the half hour), only to be faced with the situation, “Do I take it off for a small loss or wait it out? It’s down so much!?” Then you’re kicking yourself an hour or two later with an avoidable loss that you got stubborn on.

Well, this happened to me on AMBA in recent months.

I was searching through Twitter and saw that many other GREAT traders fell into the same trap as well. Although it made me feel a bit better that I wasn’t the only one who broke a rule or two, that didn’t bring any money back into my account.

The key takeaway here is if you’ve been waiting for months for a correction, it’s unlikely that the day it breaks down and takes out that support level (as shown above at $125) that the unwind only happens for a few minutes. If you take a contrary trade make sure that you 1.) Leave it alone and wait for the A+ set ups, or 2.) Make sure to have a stop (perhaps a hard stop to prevent emotion).

There are definitely trades to be made but anytime a flip turns into a “let’s see what it’ll do” this is no longer the trade you set out for, so leave the trade.

2015 6 MONTH REVIEW:

As I said, I had a pretty good START to 2015.

It was the ideal lifestyle, which is what makes being a trader so fun. You come to the market, nail and bail for a few hours and answer to no one. Be patient and wait for the setup. Take it, and nail it if you’re right or take it off and move on if you’re wrong. I was taking off during lull for either a walk with my wife or heading to the gym during lull.

I’d been focused on trading a bit less and focused more on looking for the higher reward setups but, as explained, after a few exhausting trades and too much patience, I fell into that trap of continually looking at where I WAS in my accounts prior to a few losses and continued to always look for the next trade since I wasn’t content with where my account was vs. where it was after the first month or two of the year.

I’ve talked about this a million times. Trading to ‘make back’ is just not a good way to trade. I am SUCH a better trader when I’m not trying to “get” to where I was, and just sitting back and waiting for prime set up to nail and move on. Not only is it less exhausting, it’s healthier. Just trade well, profits (ideally) follow. I fell into this trap about three months into the year. I ended up stopping going to the gym in the middle of the day which was really rewarding, and just stayed at my desk so I wouldn’t miss any opportunities since I wanted to “get back.”

This is NOT the way to trade and actually compounds the issue. Good trading comes from a good mindset.

Given the different style of trading I had a lot of bigger wins, but also some bigger losses. There were a handful of trades that gave back a good portion of profits and, at the end of each day, I’d look at how spot on I was, nailing seven or eight of the nine or ten stocks I traded, only to let that one stubborn trade dictate my day. Take the day with AMBA for example. I lost either $13,000 or $14,000 on it, but made $7,000 on SRPT, $3,000 on FIT, and an a handful of other $500 winners. One LOSER and seven or eight winners caused me to end redon the day. Exhausting!

Now, let’s switch gears and get into the good stuff. This was all a big test to see how I reacted to trading larger size, how my emotions would come into play, and whether or not trading was still “enjoyable” at that level. This was a big year. It didn’t necessarily need to be perfect but it was time to scale what I do.

PROS:

DISCONNECT FROM THE P&L

I was finally able to now jump around if I was down $2,000-$3,000 or even more if it was part of the plan. Most days I’m not looking to just jump out of the gate and risk thousands, but there are certain trade setups that a typical stop and typical plan will not work. The reason for this is that these are your PRIME set ups, YOUR opportunities, and the BEST “LEADS,” as Michail talked about at Traders4ACause. If you want to trade them like any other, you can do so, but you’ll end up asking yourself when it works out so perfectly why you didn’t exhibit any risk on the 90%+ set ups that come around so very rarely. Notice I said 90%, not 100%. Yes, you may be wrong and the 10% chance these PRIME set ups don’t work is where all the stuff I talked about above kicks in.

Some who are risk adverse may disagree, but I tend to agree on PRIME set ups only because I see this similarity across every great trader I know. When those PRIME set ups (90% + hit rate) show on your radar, focus on ENTRY and exhibit risk (within your means of course).

I’ve done this extremely well so far in 2015. I’ve allowed my winners to run on these set ups instead of just covering for the $2,000-5,000 score which has allowed them to extend into much larger winners. The problem with putting on additional risk on these PRIME set ups is, if they are NOT ready yet and you fail to adapt in time, (if they reclaim support and/or trend forms and too much patience) what will you do with the trade? Where is your stop? If you can’t answer these you’ll run into the same problems I discussed above.

STOP BECAUSE OF YOUR PLAN NOT EMOTION

One exciting thing about most of my trading in 2015 (except on a few outlier trades) is I am taking losses because it’s part of the plan going into the trade vs. taking losses because I “have to” or emotionally decide to.

This is one big issue that many traders don’t put enough thought into.

You should NEVER be stopped out of a trade for ANY reason except because that was your plan to do so.

How many times have you covered because of the “what if” factor? I used to do this a lot and emotionally cover a trade because I hadn’t stopped out where I planned to. So far this year I’ve been making a plan starting in small and only adding if the trend continues (unless I had plans to scale in on a dip with a set risk). This has really helped the random adds allowing me to let trades work for me.

WINS RATIO STILL GREAT, BUT LETTING PROFITS EXTEND vs. LOSERS

There has been a few off days that I just couldn’t make a dollar if my life depended on it, but for the most part the market has been action packed and my hit rate has been pretty good. Even if I only hit one or two winners it could still wipe out a handful of losses.

This isn’t hard to do if rules are respected.

Too many times we let losers just dictate the path for us on the day. We fail to stop, we want to “see” where it’ll go and it only compounds the loss. Upon review, we realize that it’s likely we would have been majorly green if we respected the original stop on the trade.

In prior years I always cut profits quickly. The ability to let a winner run (or fade) has absolutely compounded some profits for me. This has been a huge success in 2015.

WHAT NOW?

One goal I’ve discussed with Eric Wood, which we are going to work on together, is using stops. We both have ‘lazy’ mental stops which has worked because we know when to stop out when it counts. We know if the trend is changing and we know we need to cut it off. However, there are most definitely paper cuts and small dents that I could avoid if I just had a stop in place. I’ve never used them except maybe a handful of times this year and I’m looking forward to seeing how they will improve my trading in the next half of 2015.

In summary, scaling up has been a mediocre success. I started out great and pretty much hit a wall three months in falling into the “get back” mode. Minimizing the year is no big deal, as it can be traced to a dozen outlier trades and increased emotions due to size and range I’ve never experienced before. All and all, it was a great opportunity and I’m super happy I’ve done it.

Will I continue to press?

It’s unlikely I’ll press day in and day out with ridiculous size. It’s fun when it works but can also stressful at times when you don’t adapt to a reclaim and watch a $7,000-10,000 win go to a $10,000 or $20,000 loss which was completely avoidable but has to be experienced before you realize it.

If you don’t believe me that it needs to be experienced, than find me a great trader that hasn’t blown up once or twice when they first started. YOU CAN’T.

For me, trading has always been about finding a balance between trading, happiness and life. My plan is to continue to trade on a higher level than prior years, size in on the PRIME set ups, but really be more selective about my trading. The past ten months have been insanely rewarding. They have allowed me to become more immune to P&L swings (obviously within reason) so I could just let the trades work.

The biggest benefit to me over the past ten months is learning to let winners run.

I may be good at minimizing losses, but I’m probably better at minimizing wins. This has been the biggest change in my trading in 2015. Once I’m on the right side of the trade, no matter if it’s a $500 or $5,000 win, I’m patient and as long as it’s working in the right direction I let it continue to trend vs. quickly locking in.

Closing thoughts:

I’ve learned a lot this year, as I do every year.

I’ll likely start to share my main trading account again at some point because there is so much to learn. I wanted to take a step back and focus on myself over the last year to see what I was capable of. I didn’t want to fall into the trap that many fall into when they start to let what others may think of them dictate their trades.

Here’s the thing:

I enjoy watching traders post PnL’s.

They made $X on this, why? How and why was it on their radar? Why did they exhibit larger than normal risk? What did they see? How can I scan for that?

Don’t look at the PnL that someone posts as a WOW, look at it as a WHY?

Why did they exhibit more risk there than normal?

There aren’t questions to ask the trader posting them, these are questions to ask yourself, this is how YOU learn.

This is the stuff you need to do as a trader to continually get better, I’ll never stop learning and neither should you.

Thank you for these posts Nate. I may be the only one commenting but i greatly appreciate these. Im currently just here going through this post and dissecting it. Im about 2 hrs in just reading, drawing the charts, and taking notes. This process is actually the same for each of you posts haha. I am learning a lot and cannot thank you enough. Much love – Pat

Thx Pat sometimes folks comment – I encourage and constructive criticism at the end of the day love to put quality post out there that people like

Understood Nate. Just wanted to let you know how helpful these are to me. I was wondering as well if you can provide me with a link or post of some clarification of market makers and the games they play and how all of that works? Executions? etc

Hello Patrick, Considering that in 2 years you’ve never received any response here, I offer this idea: There’s a guy I learned of many years ago who is very sharp with leads, stories, instruction, etc., with some of it coving what you seek. Have a look here:

MG takes teaching to another level.

He does not seek to be paid for the lessons he imparts.

He’s got some deep stuff on doing SEC Filings research.

I hope this helps.

https://www.google.com/#q=games+that+%22market+makers%22+play+%2B++%22michael+goode%22&*

Nate,

Sometimes I question if trading is for me because of the mistakes I make and even when I am not right all the time. You are my mentor and to hear you go through your own struggles as I do, you keep me going. It’s your honesty and transparency that makes you the best trader and teacher. I will only ever listen to your advice and it’s only your advice that has helped me to become more consistent over time. I hope I am lucky enough to become half the trader you are.

Cheers 🙂

What does: “Sometimes I question if trading is for me because of the mistakes I make and even when I am not right all the time” actually mean?

With respect: I’m totally baffled as to what you are trying to impart.

That was two years ago. Now that I look at what I wrote I’m going to have to be on your side and agree with you. I wish I knew what I was thinking at that time so I could give you an answer.

Cutting losses…ugghhh the struggle is real.

Nate… I can see your struggle.. You are trying to live up to Greggs comment about you.

So now, you are trading to please Gregg and is not working that well, you sound uncomfortable.

Gregg had 25 K in the bank for the first two months and did not trade.

After that, he came back, tried to quit and then one day he had a eureka moment, where he realized that he really understood. (I get that from his video on IU).

The rest is profit.ly 10 mill history.

But that is Gregg.

I believe you need to be patient and find the trader in you.

Right now, you feel as if you need to go to the next level, and dp what Gregg (and Tim Grittani) do, but you are not doing what he did (but expect his results). If you want to be like Gregg (10 million/year) do like he did. Stop trading until the light goes on.

Having said that, you could just keep doing what you are doing and I assure you that in a few years, your style will seize up. Stop trying to be Gregg!!!

If you need the science behind this, check out Nash equilibrium

https://en.wikipedia.org/wiki/Nash_equilibrium.

I think if that’s what you took from the article you totally misread it

I’m not trading “for” anyone

I’m inspired by guys like Michail last year at T4AC ans Gregg and when in a position to do so it’s worth seeing if Im settling for less than my potential. As with anything, if you’re good at golf, baseball, football and never try to take it to the next level, never are inspired by a professional athlete … where does that leave you? Would you have regrets knowing you coulda been someone but never tried to take it to the next level?

I was in a position to try to get to the next level and with that I shared the flaws I started to make along the way by doing so.

I have ZERO regrets and happy to have taken it to the next level, allowing me to disconnect from PnL.

August had my best day ever in it and couldn’t have done it without being inspired.

Good luck to you!

Well said Nate. Congratulations on your succeses. You are very good at this new field of “transparent trading” and evidently a lot of people benefit from your honest openess and writing what is in your mind. Very good work Sir.

Define ‘transparent’! Here’s what another person says about NM/IU:

(written by someone else, i.e. not MY opinion)

“Pros: Very, very slick marketer. Is extremely skilled at harnessing the implicit legitimacy of Profit.ly into massive amounts of sales of DVD’s and monthly advisory newsletters.

Cons: Trades cannot be verified. The chat room is a poor quality experience where no specific trade entries from Nathan are given. Yet another trading charlatan that will not verify real trades”