Managing risk while day trading is definitely no easy task. There are so many factors affecting a stock and so many thoughts and emotions affecting a trader. That said, as day traders, it is important to find ways to manage and minimize risk when possible. Obviously, we can’t control everything, but there are a few things we can control. Managing risk is equally as important as finding profitable trade setups. Which do you think is easier: minimizing losses by $200 or squeezing an extra $200 out of a profitable trade? Most traders would agree that cutting losses is easier because it is fully within your control.

We all hear the same mantra over and over again. “Cut Losses! Cut Losses! Cut Losses!” Cutting losses is a strategy for AFTER you are already in a trade. This post is focused on ways you can analyze and account for risk do you find yourself in less situations where you are forced to cut losses.

Trade Momentum & Avoid Speculation

As traders, we are constantly trying to predict the future: that is, future price movement. Some of us take this too far and try to make other types of predictions, such as expected news or pending results of a drug trial. When you do this, you are basing your trades off of speculation and exposing yourself to inherent risk. For example, if you enter a trade because you are expecting a company to have great earnings, you are exposing yourself to a) the risk of the company reporting bad earnings and b) the market’s reaction to the earnings. As momentum traders, we are focused on reacting to price movement. There are proactive elements to our trading but we certainly don’t rely on speculation.

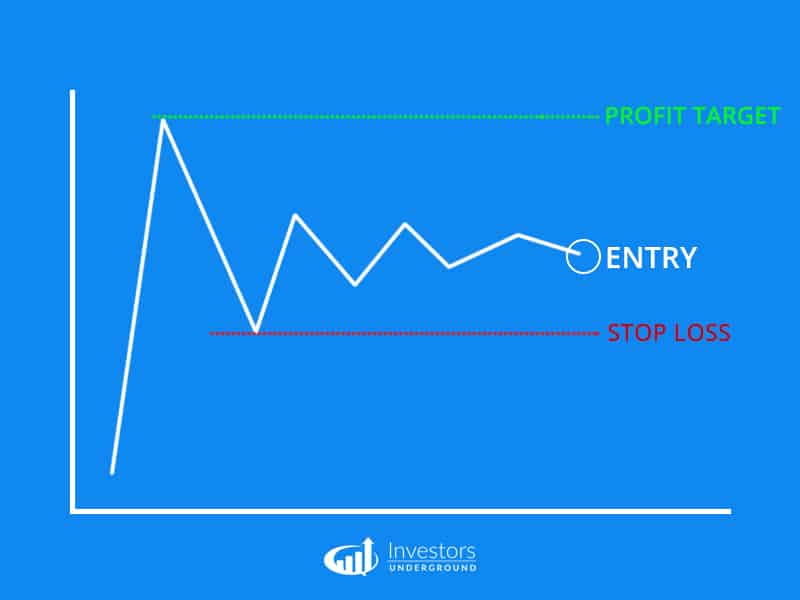

Have an Exit Plan

A trade is comprised of two main actions: an entry and an exit. Most traders stare at charts all day planning an entry yet few put that same energy into planning an exit. As traders, it’s important to have both an entry AND exit plan before entering a trade. Your exit plan should answer the following questions:

- Where will I exit if the trade goes in my favor?

- Where will I exit if the trade goes against me?

If you know the answer to both of those questions, the trade will go a lot smoother. You eliminate some of the stress of managing the trade by protecting yourself from indecisiveness. You also give yourself a better understanding of your potential risk.

For example, if you enter a trade at $5/share and plan to stop out at $4/share, you know you have a potential risk of $1/share. If you buy 100 shares, you are risking $100. If you buy 1000 shares, you are risking $1000. There should be no surprises.

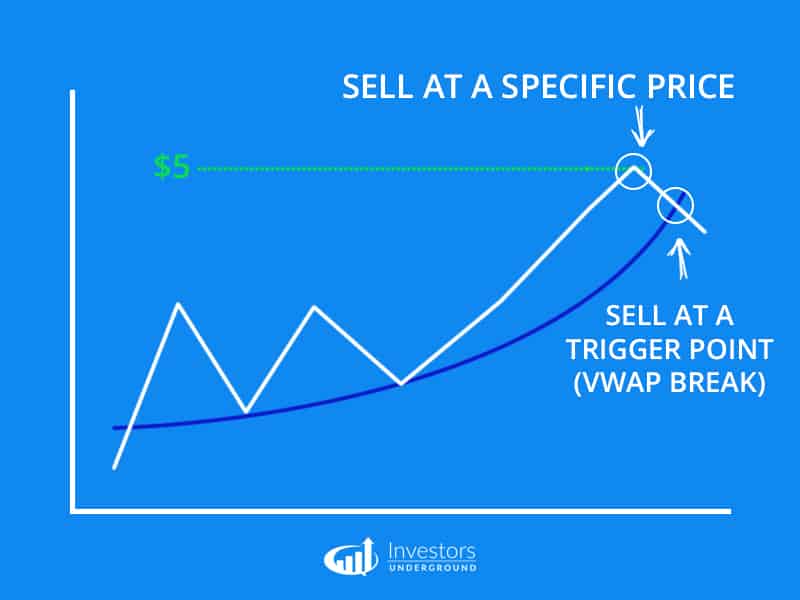

Of course, you need to make sure your exit plan is well formulated. You can’t just choose random numbers. There are two main ways you can plan an exit:

- A certain price point (i.e. $5/share) – You may decide to exit a trade at a known support or resistance level.

- A certain trigger (i.e. VWAP break) – You may decide to exit a trade when a stock breaks above or below a trailing indicator such as VWAP or a moving average.

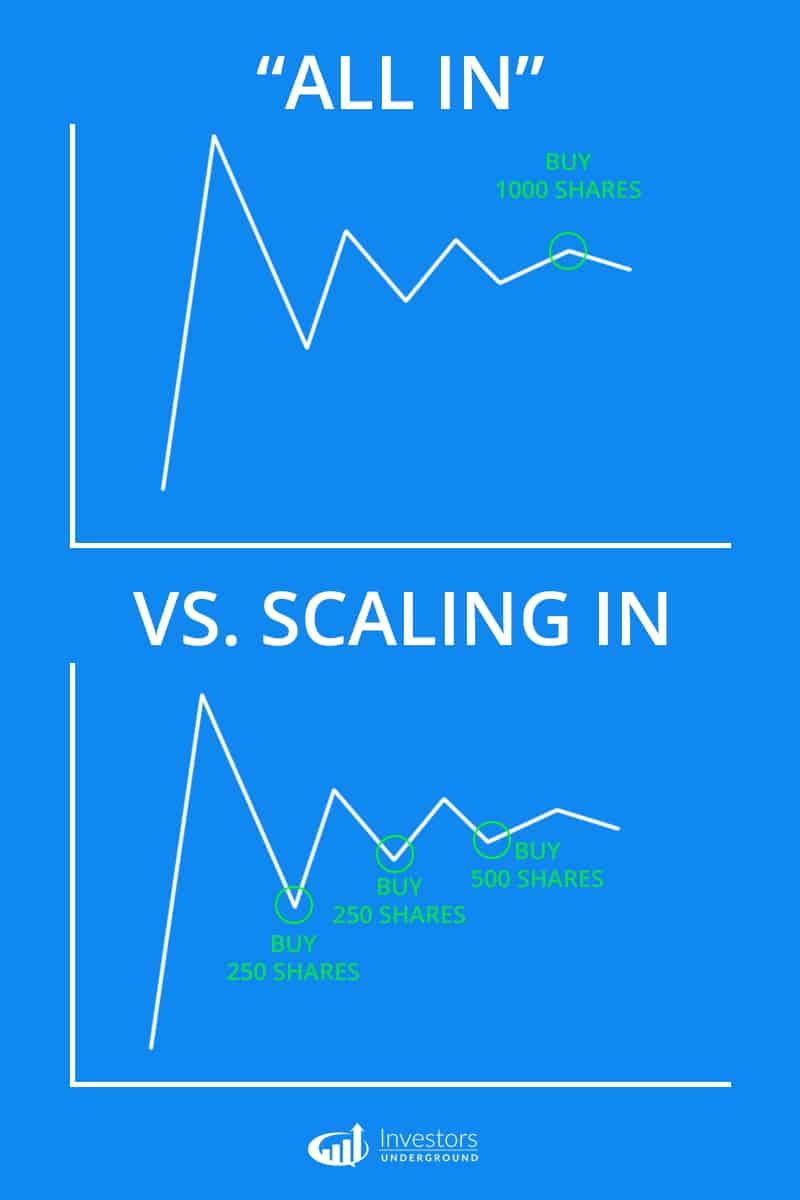

Scale Into Trades

Many traders simplify the trading process by choosing one entry point and one exit point. If you are new, this may be an appropriate tactic. As you become more experienced, you have the option to scale into trades, meaning you have multiple entries.

For example, let’s say you expect a stock to break out when it reaches $10. You decide you want to start accumulating shares on dips so you don’t miss the breakout. Do you go in full size? Of course not. The stock may hit the breakout point (resistance level) and bounce back.

Scaling can be used to match your position sizes to your conviction in a trade. For example, if you are expecting a stock to breakout soon, but you know there is a chance that it may hit a resistance level you may start a position with 1/2 or 1/4 of your normal size. If your thesis is proven correct, you can continue to add to the winning position. Not only does this help you mitigate risk, but it may help you get better entries as well. If you always enter a trade with full size, you could find yourself placing reactive trades (i.e. entering a position after a stock breaks out). If you scale into positions, you can place anticipatory trades (i.e. preparing for a breakout).

Take Profits

The concept of scaling into trades can be applied to your exits as well. You don’t need to liquidate your entire position at once. If you enter a trade and it immediately goes in your favor, you may want to sell some shares to lock in some profits.

It’s always better to regret taking profits early than it is to regret turning a winner into a loser.

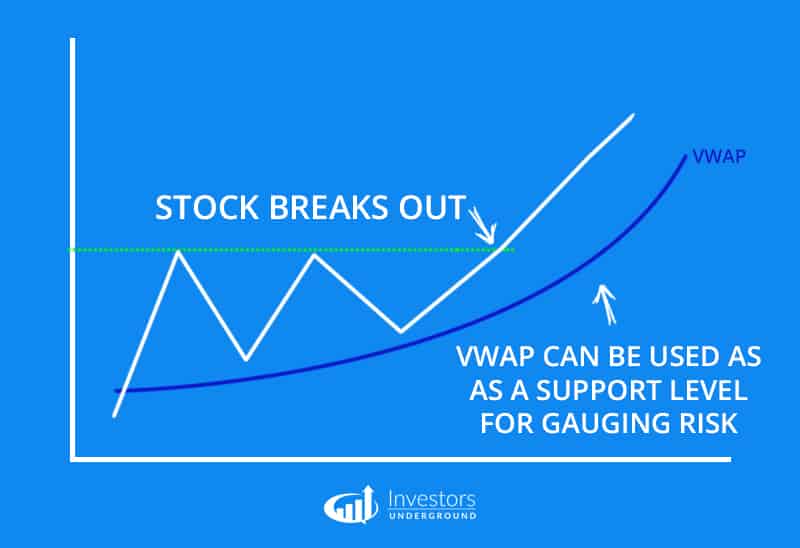

Use VWAP as a Guide

Volume weighted average price (VWAP) is a technical indicator that basically shows the average price a stock was purchased at for a given day. Unlike traditional moving averages, VWAP incorporates the stock’s volume. For example if a stock sold 1000 shares for the day, 400 at $10 and 600 at $12, VWAP would be $11.2 (Calculation: [(0.4)($10)]+[(0.6)($10)] ). You don’t need to do the math, as most trading softwares will include VWAP as a technical indicator.

VWAP serves 2 main purposes for day traders:

- Gauging a stock’s relative strength for the day

- Acting as a support/resistance level

If a stock is trading above VWAP, it may be considered bullish, and VWAP may act as support. If a stock is trading below VWAP, it may be considered bearish, and VWAP may act as resistance. So, how does this factor into risk mitigation?

First things first, you want to make sure you are on the right side of a trade. If you are building a short position while a stock is trending over VWAP, you are fighting the trend and may be on the wrong side of the trade.

You can also use VWAP as an area of support/resistance. For example, If a stock is up trending and you want to build a long position, you may consider buying on dips, basing your risk off of VWAP.

Avoid Random Trades

Many times, when a stock is experiencing abnormal price activity, traders want to guess which way it’s going to go next. Picture a stock running from $2/share to $5/share in an hour. Some traders are quick to form a thesis such as, “it’s up too much so I’m going to short.” At that point, you may as well flip a coin.

You are better off waiting for the stock to form a trend so you can be on the right side of the trade.

Good work.. Thanks

Thanks Nate…awesome work…as ALWAYS… ( and congrats for the baby boy )!!

Nate, it seems the OTC stocks are getting hot lately. I don’t have any experience trading OTC and would love to read your thoughts on how trading those differ from nasdaq?

thanks